As I noted in yesterday’s article, the market was bouncing strongly, but “we’re not out of the woods yet.”

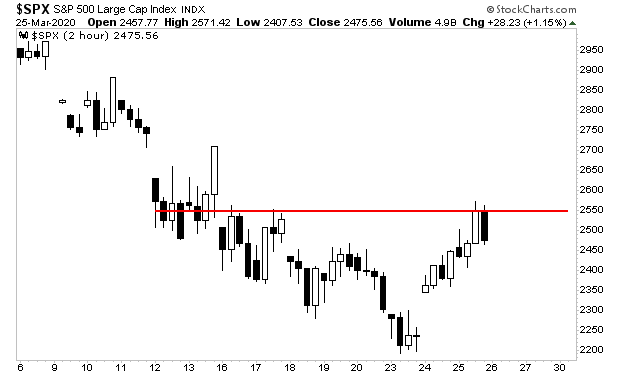

Stocks slammed into overhead resistance yesterday and then retraced half of the day’s gains. This is not a good look if this rally is going to have legs. Stocks should have at least taken out the first line of real resistance with little difficulty.

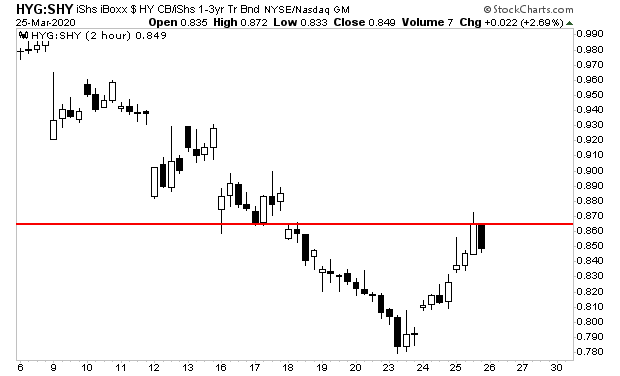

The story was identical for high yield credit: a rollover that retraced half of the day’s gains. Here again we should have a stronger rally given how oversold the markets are.

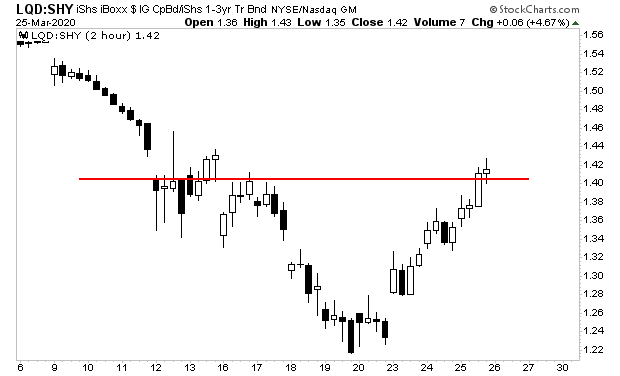

The one bright spot is investment grade credit, which managed to break through resistance. Given that this sector is being bought by the Fed for the first time ever… and that the Fed is buying it with “unlimited QE,” even this was not too outstanding. It is, however, one bright spot in what was overall a very lackluster day for risk yesterday.

I continue to believe stocks will retest the lows and possibly even break to new lows. Put another way, now is not the time to rush in and start buying.

My point with all of this is to NOT rush into stock right now. Do not worry about trying to catch a bottom or timing the exact low on the markets. You’re much better off waiting for clear signals that the market has DEFINITIVELY bottomed and THEN start buying.

My point with all of this is to NOT rush into stock right now. Do not worry about trying to catch a bottom or timing the exact low on the markets. You’re much better off waiting for clear signals that the market has DEFINITIVELY bottomed and THEN start buying.

Best Regards

Graham Summers

Chief Market Startegist

Phoenix Capital Research