QUESTION: Happy New Year;

Am I correct in noticing a global connection in the money supply, M1 & M2? You directed us to this long ago.

The global banks have found the turning point so this affects everything no? Even the US consumer is sliding to the cautious side of spending – fewer mortgages, cars, etc. The coffee shops are now worried about a market melt-down.

Martin, you’re starting to make my brain hurt. But it’s a good hurt.

Thank you;

RH

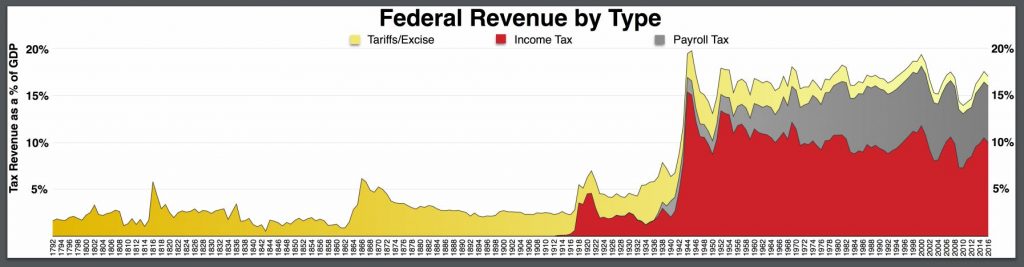

ANSWER: Yes, but there is another influence — rising taxes. The economy declines when taxes rise for the simple reason that when politicians raise taxes, they are reducing the net disposable income. Simply put, if I give you $100 and then demand you give $90 back, but the year before I gave you $80, you can point to the fact that your income rose. However, you can only spend what you have left in your pocket. Women may have won the independence they were protesting for in the 1960s, but now they have lost the right to stay home and raise the kids. What use to take one income to support a family BEFORE the payroll tax now requires two. Once the government began income taxes (DIRECT TAXATION) economic growth rates gradually declined. We have been in a protracted decline since World War II. Tax revenue in France is 46% of GDP as people leave to invest elsewhere.