via Zerohedge:

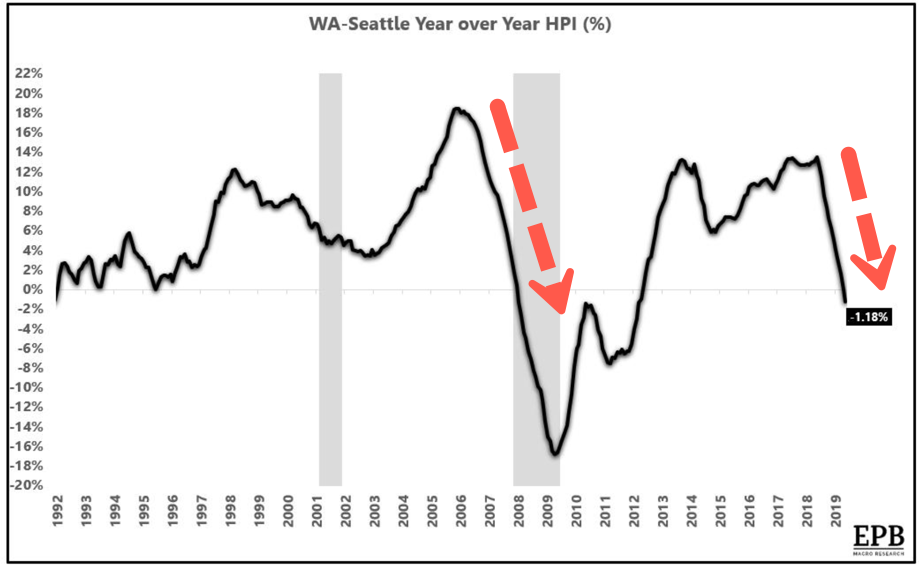

The nationwide housing bust is underway with the first cracks showing up in Seattle-area home prices.

The price of a Seattle single-family home in May fell 1.2% YoY, the first negative change in a major US city in this cycle, according to new data from S&P CoreLogic Case-Shiller.

“Whether negative YOY rates of change spread to other cities remains to be seen,” said S&P Dow Jones Indices Director and Global Head of Index Governance Philip Murphy, in a statement.

“For now, there is still substantial diversity in local trends.”

Eric Basmajian, Founder of EPB Macro Research, said an industrial slowdown has moved into real estate and is now affecting some areas in services, has the potential to create “negative wealth effect,” something that most Americans haven’t seen since the last recession. He warned if more cities experience negative home price growth YoY, like Seattle, this will undoubtedly put downward pressure on the domestic economy in the coming quarters.

“As the deceleration in economic activity becomes increasingly pervasive, spreading from manufacturing to housing and now some areas of the service sector, the potential for a negative wealth effect has reemerged – a dynamic not seen for most of this economic cycle.

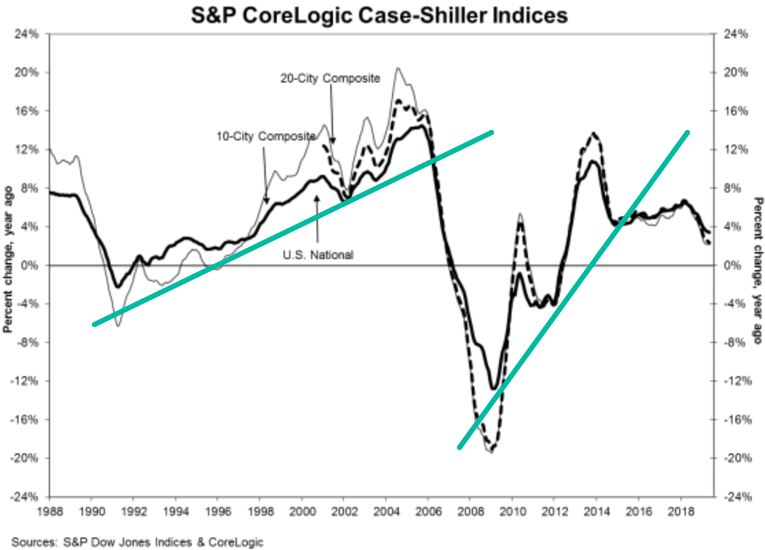

The growth rate in the national home price index has dropped to an 80 month low, falling below 3.5% year over year. While the national index continues to decelerate, holding above the zero bound, the latest data showed Seattle recording the first negative reading in year over year home price growth, falling 1.2% compared to the same month last year.

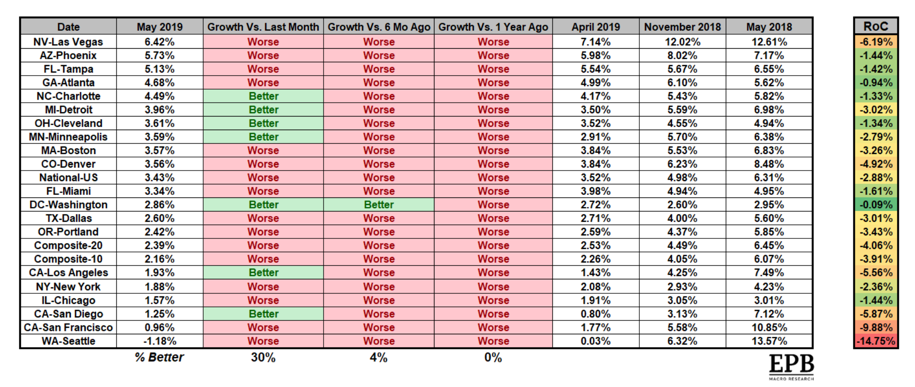

Of note is how broad-based the decline in home price appreciation has become with none of the major cities recording a rate of home price growth greater than one year ago and only one region posting a growth rate above the reading six months ago.

Should more cities continue on this path to negative home price growth, the potential for a negative wealth effect and downward pressure on forward consumption remains a strong possibility, adding to the already mounting headwinds facing the domestic economy.”

But digging into local-area price trends, north and south of Seattle remained vibrant. In Tacoma and Pierce County, median house prices increased 7.3% in June YoY, according to data from the Northwest Multiple Listing Service. And prices in Kitsap and Skagit County both recorded sizeable price gains.

The Case-Shiller index identified three tiers of home prices in Seattle: over $625,000, less than $400,000, and those in between. The lowest-priced homes in the Seattle metropolitan area did the best, increased in May by 2.74% YoY. But it’s the mid-tier to the luxury homes that have gone cold.

Nationwide, growth rates in home prices have been slowing in the last three quarters. Las Vegas, which passed Seattle as the nation’s hottest housing market last June, saw gains of 6.4%, still experiencing declining growth rates over the last year.

As Basmajian noted, a turning point in the domestic economy could be nearing if more major cities see negative home price growth YoY. Perhaps Seattle is a leading indicator of what’s to come for the national housing market.