via mybudget360:

Most Americans are familiar with Alice in Wonderland. The Red Queen’s race in the story highlights Alice running but remaining in the same spot. Many Americans can relate. They are working harder yet somehow feel stuck. Putting more and more energy just to stay in the same spot economically. And many are unable to keep up. The middle class is dramatically shrinking. Many in the United States understand this yet don’t know the exact reason why so they lash out at various culprits. While this is a multifaceted problem there is one issue we can pinpoint. Inflation and the culture of debt. All we need to do is look at is nearly 20 years of data and measure how the price of various goods and commodities are changing over time.

Why the middle class has been shrinking

Let us first talk about something that is rather obvious on the surface but is part of the root issue of our economic stagnation. First, our once robust manufacturing segment of our economy has faltered. After World War II, the U.S. was the economic engine of the world. We are no longer in that position. We are now the leader in knowledge workers but these are clustered in various large metro areas (e.g,. Bay Area, Seattle, Austin, etc.). Most of the country is simply not keeping up. And knowledge work tends to produce more outlier rewards for those in the sector – for example think of Bill Gates and the knowledge workers at Microsoft. While most use the product, you don’t need millions of people working for the company.

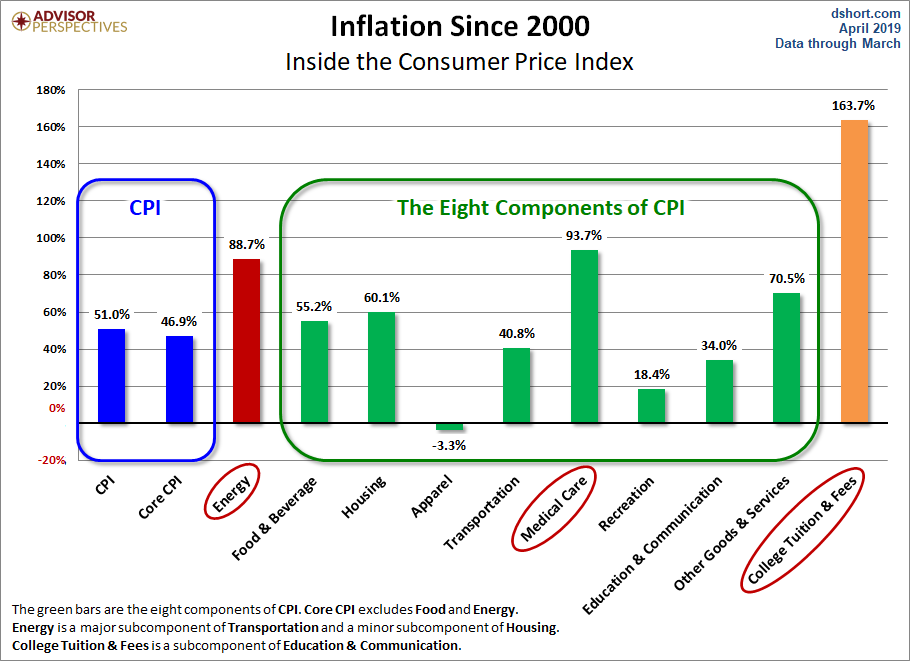

Many of the higher paying jobs in the U.S. require a college degree. Now look at the below chart and we will go through various categories:

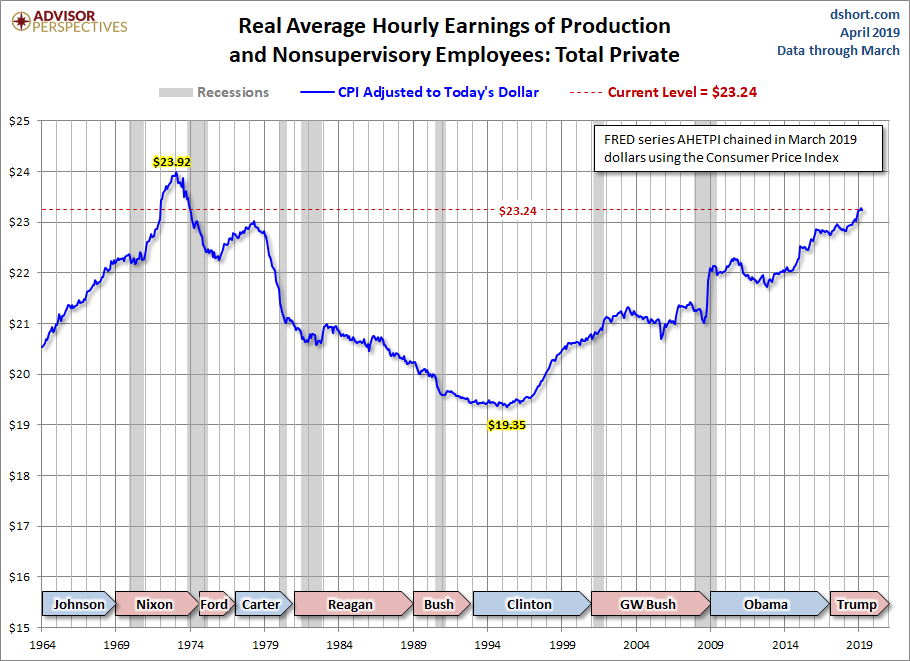

College tuition and fees are up a staggering 163% since 2000. The overall CPI is up only 51%. This is why we now have nearly $1.5 trillion in student debt and many politicians are using this as a major platform to motivate younger voters. This is a severe drag on our economy especially for our younger workers that are trying to make their way into a solid middle-class lifestyle. And if you don’t think this is the case just look at real hourly earnings:

Real hourly earnings started declining in the Nixon era to bottom out in the Clinton era. They have slowly crept up but they are still below the top which occurred with Nixon. Ironically this is the same time we went off the gold standard and essentially let the U.S. Dollar run wild.

Next you will find that medical care is up 93% since 2000. Most of our baby boomers are broke and are only able to survive thanks to Social Security and Medicare. If it weren’t for these two programs millions upon millions would be on the street and eating dog food to get by. With such a large group of Americans getting into old age, the rising cost of medical care has taken a bite out of their small disposable income.

Energy is another sector that is up dramatically. Energy is up 88% since 2000 and this is factoring the boom and bust of this sector. All Americans rely on energy for driving to work, heating their homes, and keeping the lights on.

These are all essential items. What I find interesting is that areas that are non-essential are down relative to the CPI: apparel, recreation, and education and communication (non-college education). So while we hear people slamming on Americans for being spenders just look at these areas. Many people have cut back on non-essentials. But areas that are essential are eating up a larger share of income. Many don’t have this savings so they are using student loans to fund college and credit cards to pay bills.

So how is inflation to blame? When you essentially “print” digital money you create a run on real world goods. Any products or goods serviced by debt are in bubble phases: think of housing (mortgages), cars (auto loans), and college (student debt). We already saw a bust in the mortgage market and we are now seeing problems with auto loans. Student debt is starting to look precarious. So part of the reason the middle class has shrunk is that we’ve allowed banking to essentially create long-term debt holders that now need to finance practically every major purchase in their lives. This is a recipe for bubbles and we’ve lived through a few already – expect more.