Sadly, as markets stall and crash, participants will still be in their seats thinking all is well.

The tragic 2009 crash of Air France Flight 447 offers an apt analogy for the global economy and central bank-driven false signals. Flight 447 entered an area of frigid turbulence over the Atlantic which caused the air-speed sensors (pitot tubes) to ice up. A few minutes later, the autopilot disengaged, and the co-pilot flying the aircraft over-corrected in the turbulence.

Deprived of accurate airspeed readings, the co-pilot misjudged the situation and attempted to climb, causing the aircraft to stall. Unable to recover, it crashed into the Atlantic, killing all on board.

The co-pilot’s last recorded words are haunting: “We’re going to crash! This can’t be true. But what’s happening?”

The Federal Reserve’s massive pimping of the stock market has frozen free-market feedback, generating wildly inaccurate readings which are leading participants to their doom. Stripped of price discovery and accurate readings of risk, participants are attempting to recover recent highs, a misreading of reality that will cause the stock market to stall and crash.

In effect, the Fed is jamming the equities market light on”green” when it should be flashing red and a stall alarm should be sounding. Participants in the current manic rally are looking at the indicator light–a steady green, indicating A-OK–when in reality the global economy has stalled out and is crashing.

Thanks to the Fed’s pimping, the indicators no longer reflect the realities of price discovery or risk, and so participants are making a fatal error: they are assuming that the indicator light is accurate and that the stock market is “safe” and “stable,” when in fact it is unstable and stalling.

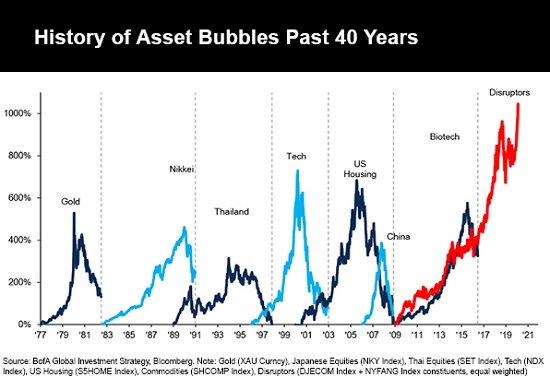

Having inflated a high-risk, unsustainable bubble from September 2019 to February 2020, the Fed’s response to the stock market stall in March has been to create false readings of stability, risk and altitude. While punters and money managers are acting on the panel of green lights (“The Fed has our backs, stocks will rise, there’s no risk”), the market is actually stalling out so severely that the warning sensors have shut down.

Sadly, as markets stall and crash, participants will still be in their seats thinking all is well because the Fed has jury-rigged all the readings to be bright green and disabled the stall alarm.