First, The Fed’s discount window soared to its highest level since … you guessed it … the previous financial crisis of 2008/2009.

Second, the 10-year Treasury yield declined -16 basis points this morning as investors flee to safety.

Bankrate’s 3-year mortgage rate rose to 7%, but with today’s decline in the 10-year Treasury yield we should see mortgage rates declining.

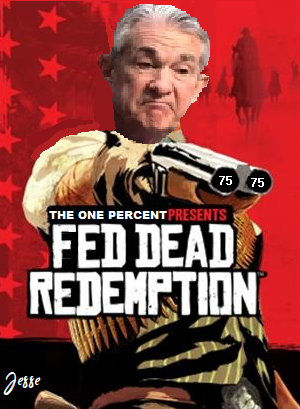

Yes, much of the blame belongs to The Fed’s leadership (Bernanke, Yellen, Powell) for leaving rates too low for too long, then suddenly try to lower inflation by raising rates. Now we have The Fed’s balance sheet INCREASING again as the use of The Fed’s discount window soars to highest level since Lehman Bros fiasco.