Feds Collect Record Income and Payroll Taxes Through March–Still Run $526,855,000,000 Deficit

The federal government collected record amounts of both individual income taxes and payroll taxes through the first six months of fiscal 2017 (Oct. 1, 2016 through the end of March), according to the Monthly Treasury Statement.

Through March, the federal government collected approximately $695,391,000,000 in individual income taxes. That is about $7,387,280,000 more than the $688,003,720,000 in individual income taxes (in constant 2017 dollars) that the federal government collected in the first six months of fiscal 2016.

The federal government also collected $547,491,000,000 in Social Security and other payroll taxes during the first six months of fiscal 2017. That is about $2,731,820,000 more than the $544,491,000,000 in Social Security and other payroll taxes (in constant 2017 dollars) that the government collected in the first six months of fiscal 2016.

Despite collecting record amounts of individual income taxes and payroll taxes, the Treasury still ran a deficit of $526,855,000,000 in the first six months of fiscal 2017.

Also, even with record revenues from individual income taxes and payroll taxes in the first six months of fiscal 2017, overall federal tax collections were slightly down.

In the first six months of fiscal 2016, the federal government collected $1,513,124,070,000 (in constant 2017 dollars) in total taxes. In the first six months of this fiscal year, total federal tax collections have dropped to $1,473,137,000,000—a decline of about $39,987,070,000 from total tax collections in the first six months of fiscal 2016.

http://www.cnsnews.com/news/article/terence-p-jeffrey/695391000000-feds-collect-record-income-taxes-through-march

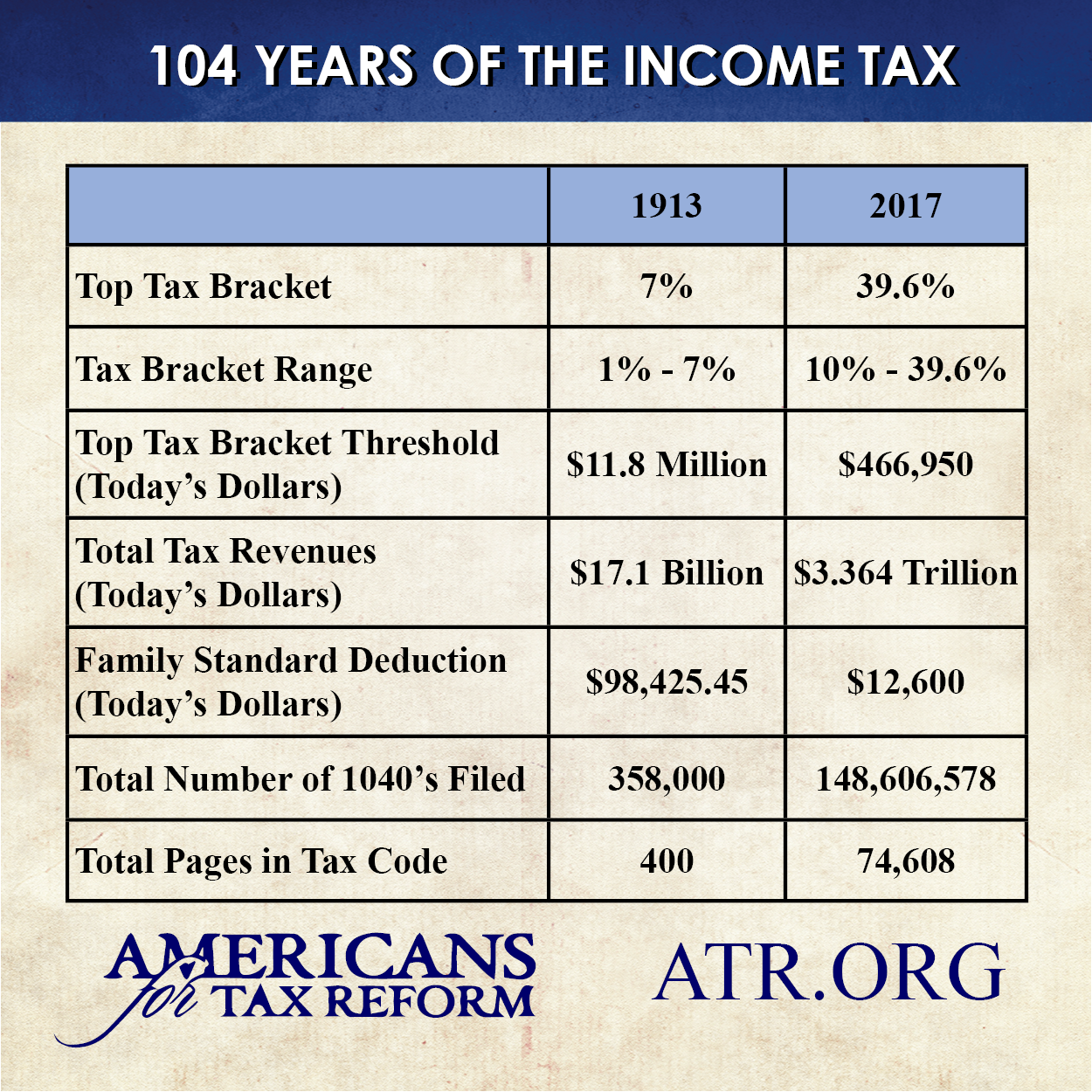

As Americans finish yet another tax filing season, let’s take a look at the 104-year history of the income tax:

- In 1913 the top marginal income tax bracket was 7% — today it is 39.6%.

- In 1913 the marginal income tax bracket range was 1% – 7%. Today the range is 10% – 39.6%.

- In 1913 there were 400 pages in the tax code. Today there are 74,608 pages in the code.

- In 1913 the family standard deduction was $98,425.45 in today’s dollars. The family standard deduction now is just $12,600.

- When the income tax started in 1913, only 358,000 Americans had to file a 1040. Today 148,606,578 Americans file 1040s.

No surprise here — war is expensive.

Let’s give John McHitler a $10 budget with which he can fight any war he’s dreaming of. That will solve both the excessive spending and the excessive warmongering, and the warmongers should still be happy, after all, their beloved McCain will be deciding just how to spend those $10.