by Amy S.

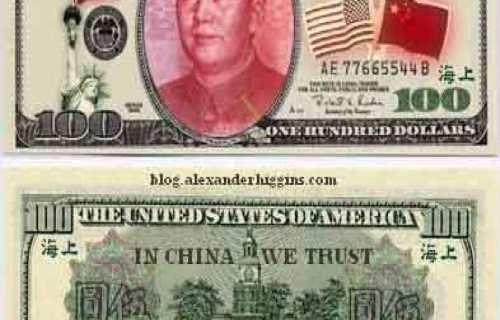

The Collapse Has Already Begun. Watch Out For China!

Despite constant reassurances from federal overseers, Americans are becoming increasingly aware of the economy’s frail nature.

While media pundits and analysts desperately push the failure of central planning and Keynesian economics, these five experts continue to be proven right on the dangers of reckless spending and debt.

Here are five renowned experts who warned of the now-present, slow-motion financial collapse. With currencies being rapidly devalued by their respective governments, the global economy in a slow-down, and tensions over resources heating up around the world, it’s time to start considering the endgame. If we all talk about the end game and a scenario of total collapse, I can see the governments telling everybody that your money is now worthless and the bonds you own are now worthless. You all have to take a haircut. The controlled media tells us that it is a symptom of corporate greed and an accidental occurrence. The truth is that recently released central bank cartel documents show that the entire global financial melt-down in a purposefully engineered consolidation. The following is a transcript of an interview with award-winning investigative journalist Greg Palast in which Palast blows the IMF World Bank program of slavery wide open.

AJ: Burrow into NM Rothschild, you’ll find it all there. Go through these four points. You’ve got the documents. The IMF/World Bank implosion, four points, how they bring down a country and destroy the resources of the people. The US government has run up trillions of dollars in debt, and given the recent debates over the country’s debt ceiling, we can rest assured that neither Congress or the President will act to curtail spending and balance the budget. We will continue adding trillions of dollars to the national debt clock until such time that our creditors no longer lend us money. Lindsey Williams prediction prepper total collapse coast to coast am sheep sheeple ghost town hyperinflationary environment developing major collapses in the bond and stock markets and possible sudden deflation (primarily of assets), followed by dramatic inflation, if not hyperinflation (primarily of commodities), followed by a crash of several major currencies, particularly the euro and the US dollar.

Travel Restrictions. This will begin with restrictions on foreign travel, including suspension/removal of passports Confiscation of wealth. The EU has instituted the confiscation of bank accounts, which can be expected to become an international form of governmental theft. Food Shortages Riots. These will likely happen spontaneously due to the above conditions, but if not, governments will create them to justify their desire for greater control of the masses. Martial Law. The US has already prepared for this, with the passing of the 2012 National Defense Authorization Act (NDAA)

long-term food supplies, barterable goods, monetary goods, self defense armaments and having a well thought out preparedness plan The United States and Germany are prepared to engineer a coup in Greece to keep the country operating as a strategic asset on NATO’s vulnerable southeast European flank. Greek Military is an Operation Gladio Asset The wild breakout in German yields is rocking global debt markets, and giving investors an early glimpse of the uneasy future for bonds in a world of higher interest rates.

Economic analyst GERALD CELENTE about the recent bank run in China on P2P lenders as countless people hit the streets. Chinese household debt has climbed 40% in the past year alone. To top off that problem, one of the most at risk financial sectors has reached its inevitable end.

These loans are usually done without collateral, putting the loans at risk of default with no recovery whatsoever. China’s peer to peer industry is far bigger than the rest of the world’s combined. It had risen 50% just last year alone, totally $215 billion! Interest rates are often as high as 37%. Investors have been pulling their funds from these P2P lenders for some time, but in recent weeks the volatility got far worse. Countless P2P lenders have closed their doors in the last few weeks. Over 200 since June. Investors have been pulling funds in massive numbers causing a bank run! 243 online lending platforms have recently gone bust! This piles on top of the growing centralization in China as debt weighs down on people’s shoulders.

The Chinese government has been encouraging people to buy gold so to stand as one of the most powerful dominoes to fall. China is going cashless, fast. The IMF has spoken about putting their headquarters in Beijing. China clearly wants to be the next world reserve currency as the US dollar inevitably falls alongside all other current fiat empires.

The Bank For International Settlements recent named China, Hong Kong and Canada as the economies most at risk of a banking crisis. The bubble worsens and the centralization applied to fix the problems of centralization will simply get to heavy to sustain. All fiat currencies have eventually reverted to their true value of zero. They always have, they always will, going back to 1024 AD in China interestingly enough. So as we see the markets and the economy inevitably crash, the only thing one can do is decentralized, protect their purchasing power and learn to be far more independent.

Financial education and responsibility are key. Individual responsibility is the hallmark of freedom itself after all. We hope individuals prepare themselves. It’s better to over prepare than under prepare.

China’s debt boom, or “credit boom” in more palatable terms – whose true extent remains purposefully obscure – and what it might do to the Chinese economy and by extension to the global economy is starting to worry.

The annual growth in the People’s Bank of China’s measure of “total social financing” – which includes bank loans, off-balance-sheet financing, trust loans, and net corporate debt issuance – is now around 12% (about half of what it had been during the blistering surge after the Financial Crisis). That’s the official figure.

But with the muni bonds swapped for bank loans added into the equation, annual credit growth would be above 15%.

The blowout in credit initially came at the local-authority level, with provincial and municipal officials overseeing an explosion in the local government financing vehicles that became a poster child for China’s lack of transparency. Much of the money flowed into real estate, sparking a boom in prices, especially in the largest cities. Wary about affordability and potential social unrest, Beijing has periodically moved to rein in its property industry, only to relax again when economic-growth targets came under threat.

China and Japan are the biggest owners of the U.S. debt. But they have no incentive to create a collapse. The United States is their largest market. If it fails, so do their economies. Furthermore, China is not selling all of its dollar holdings. It has remained above $1 trillion since 2016. For more, see U.S. Debt to China.

If anything, the dollar would slowly decline instead of collapse. It fell 40 percent between 2002 and 2008. It has gotten stronger since then because of the financial crisis. Investors flock to ultra-safe U.S. Treasurys and the U.S. dollar as a safe haven.

1. The dollar won’t be replaced as the world’s global currency. The doomsayers point to gold, the euro, or Bitcoin as a replacement for the dollar. China has said it would like the yuan to replace the dollar. It’s true that the dollar’s value is supported by its role. But none of these other alternatives have enough circulation to replace the dollar.

2. The Fed’s quantitative easing program and low fed funds rate won’t cause hyperinflation. If anything, these programs have created a liquidity trap. That’s when people, businesses, and banks hoard the extra cash instead of spending or lending it. The real cause of hyperinflation has been debt repayments to fund wars.

3. The stock market hit new highs in 2016 and 2019. Stock prices are based on corporate earnings, so that’s a sign of business prosperity.

4. Consumer confidence hit a nine-year high in 2019. Consumer spending drives almost 70 percent of the economy.

5. Economic growth is slow but stable. Since the Great Recession, the economy has grown between 1.5 – 2.7 percent per year. According to business cycle theory, a bust only occurs after a boom. That’s when GDP is more than 3 percent. It hasn’t been that high since 2005 according to a review of GDP by year.

What It Means to You

Before you run out to buy gold or stock up on canned goods, do two things. First, read the articles linked in the 10 points above. They will give you the facts the naysayers ignore. Or read “How the U.S. Economy Works.”

Second, understand what a real economic collapse looks like. On September 17, 2008, the U.S. economy almost collapsed. That’s when companies pulled out trillions of dollars from money market accounts. It would have created a severe cash crunch had it continued. The nation’s trucking industry would have ground to a halt. Gas stations would have gone dry. Grocery stores shelves would have gone empty. But those things didn’t happen because the Federal Reserve prevented the collapse. It guaranteed money market accounts and restored confidence.

Iceland’s economy collapsed in 2008. Its banks had defaulted on $62 billion of foreign debt. They had used the debt to finance foreign acquisitions. But Iceland’s entire gross domestic product was only $14 billion. When the banks defaulted, foreign investors fled. Within a week, the krona lost half its value. The stock market dropped 95 percent. That’s when almost every business in Iceland went bankrupt.

Although the Great Depression wasn’t a collapse, it was close. GDP fell by half. Global trade dropped almost two-thirds. Unemployment was 25 percent. What caused it? Government actions turned a recession into a depression. First, the Fed used contractionary monetary policy like raising the fed funds rate to protect the gold standard. Congress cut back on spending as soon as the New Deal got the economy back on its feet. That contractionary fiscal policy brought back the depression in 1937. It didn’t end until the military build-up to World War II.