Authored by Laura Frost via BondVigilantes.com,

Financial markets can be a scary place for investors. The US economy is now in its longest expansion on record, the world is seeing record level of total debt and now even some corporate bonds have negative yields.

If you’ve carved a pumpkin, got your Halloween costume and been to see the latest scary movie, there’s only one thing left to do: take a look at the Bond Vigilantes team’s 2019 Scary Charts.

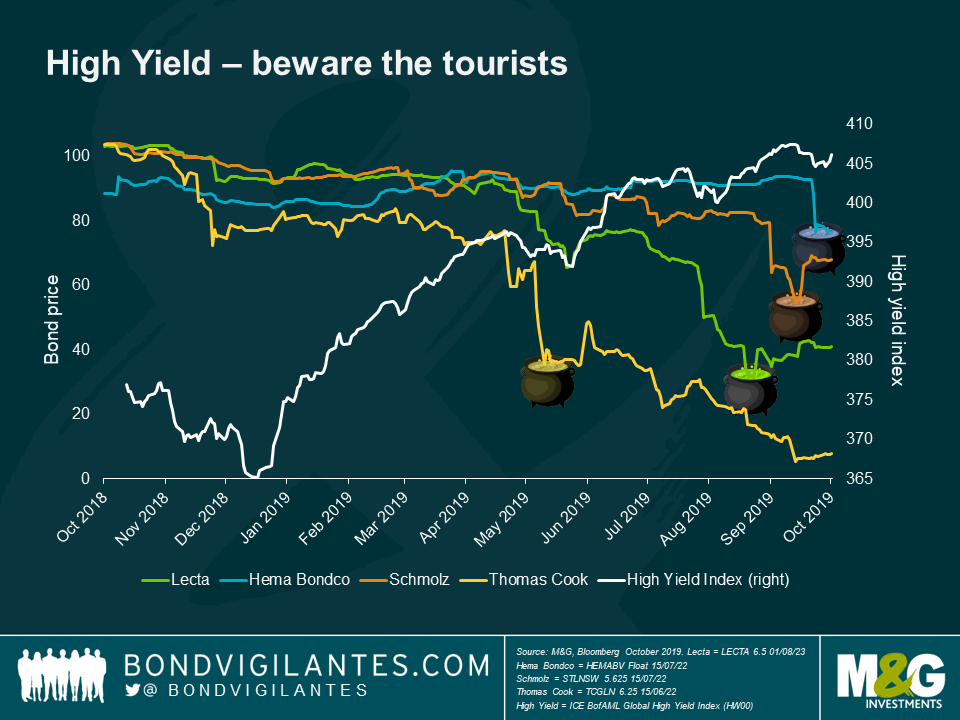

If you’re searching for some decent yield right now, high yield must be a good place to start, right? Year-to-date, investors have seen double-digit returns in high yield: around 12% and 9% in the US and EU index respectively. In our yield-deprived time, many who would normally be holding investment grade bonds have been willing to sacrifice credit quality and take a trip into high yield.

But watch out: when there has been the slightest sign of trouble in some large household names this year, these high yield tourists have wanted out at any price. Some high yield bonds have taken a plunge this year, even where the bonds have not defaulted.

So if you’re dipping your toes into high yield, make sure it’s based on a deep understanding of issuers and that there’s nothing lurking in the depths…

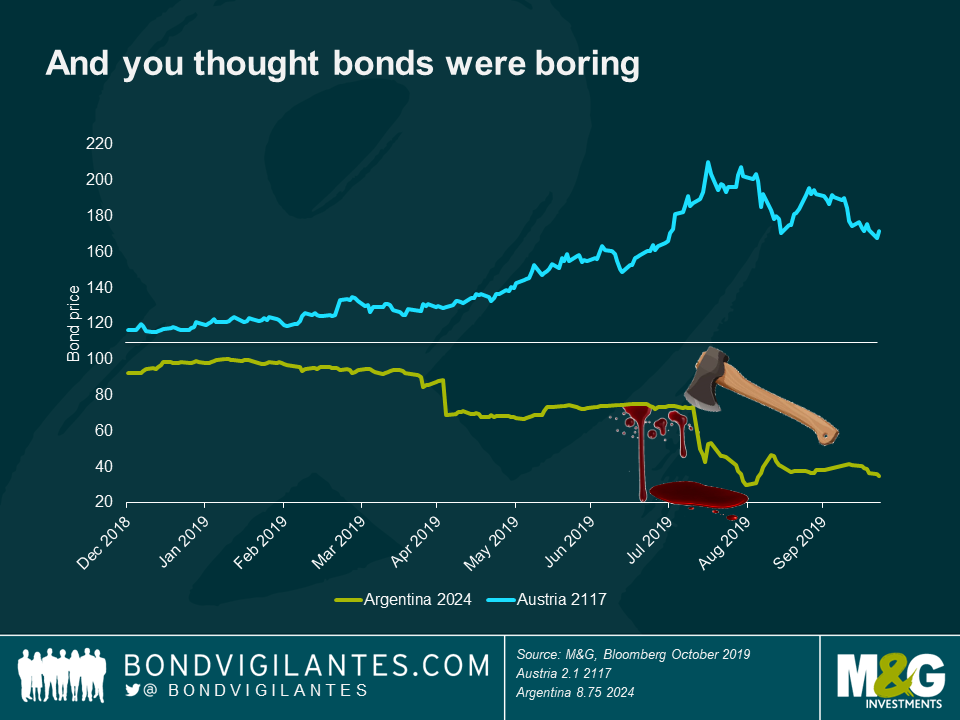

If you thought that bonds were the safe and boring part of your portfolio, think again. Take a look at these two bonds, the Argentina 8.75% 2024 and Austria 2.1% 2117.

After Argentina’s relatively market-friendly President Macri was trounced in the primary elections by populist Fernandez, Argentinian bonds were decapitated, with more than half their value chopped off. They now trade at around $40 per $100 par value.

Meanwhile, investors in Austria’s AA-rated 2117 bond this year will be patting themselves on the back for the trade of a lifetime. With a duration of over 50 years, downward pressure on bond yields this year saw the bond almost double in value.

Looking at European and US IG credit, trade wars clearly scared markets earlier this year. But the sell offs are getting smaller. It looks like the market may be suffering from trade war fatigue after so many headlines and tweets over the past few months. But might trade wars come back to spook the markets even further?

According to political hearsay, Democrat front-runner Elizabeth Warren is even more ferocious on trade than Donald Trump. She has also been called “the monopolist’s worst nightmare” due to her criticism of big tech companies, a large constituent of the US IG index. Although the 2020 elections seem a long way off, success for the Democrats may cause some ripples for markets.

While current IMF figures estimate that the US-China trade war has shaved 0.8% from global growth, with 0.5% added back by global monetary easing, could even more protectionism and larger potential tariffs in the future leave investors wishing for the days of Trump?

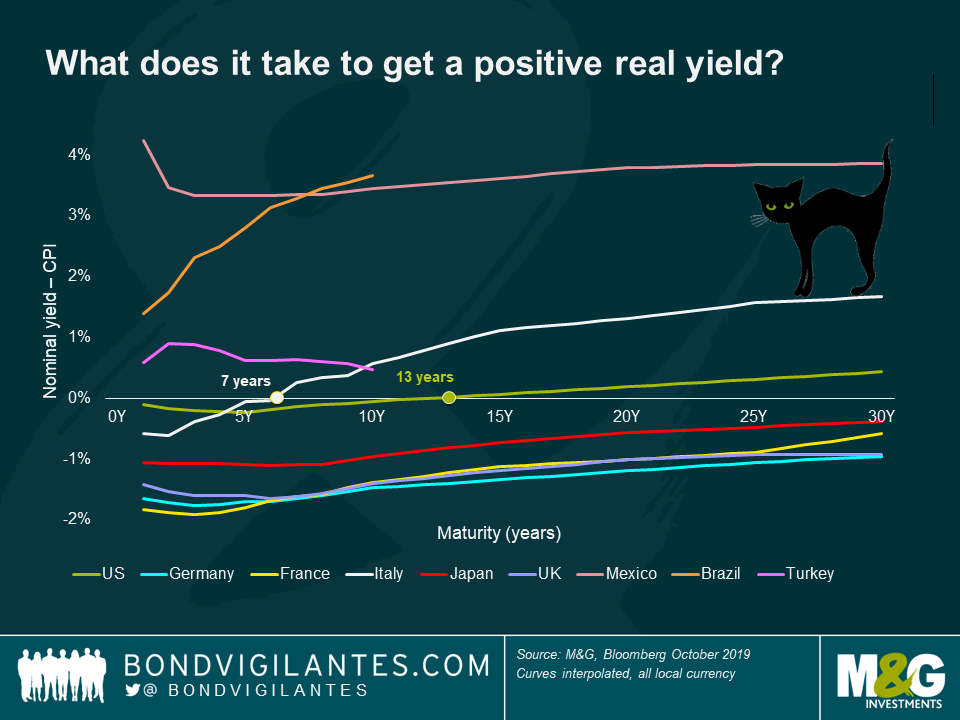

Equities are for growth and bonds for income, right? Not in Germany, France, Japan and the UK, where real yields are negative even up to 30 years. In Italy you need to invest for seven years to get a positive real yield.

No wonder investors are looking to emerging market debt in search of yield. Brazil and Mexico provide positive real yields, as does Turkey – but beware an upside surprise to inflation.

This is a scary measure of how far investors are being pushed just to get a positive yield.

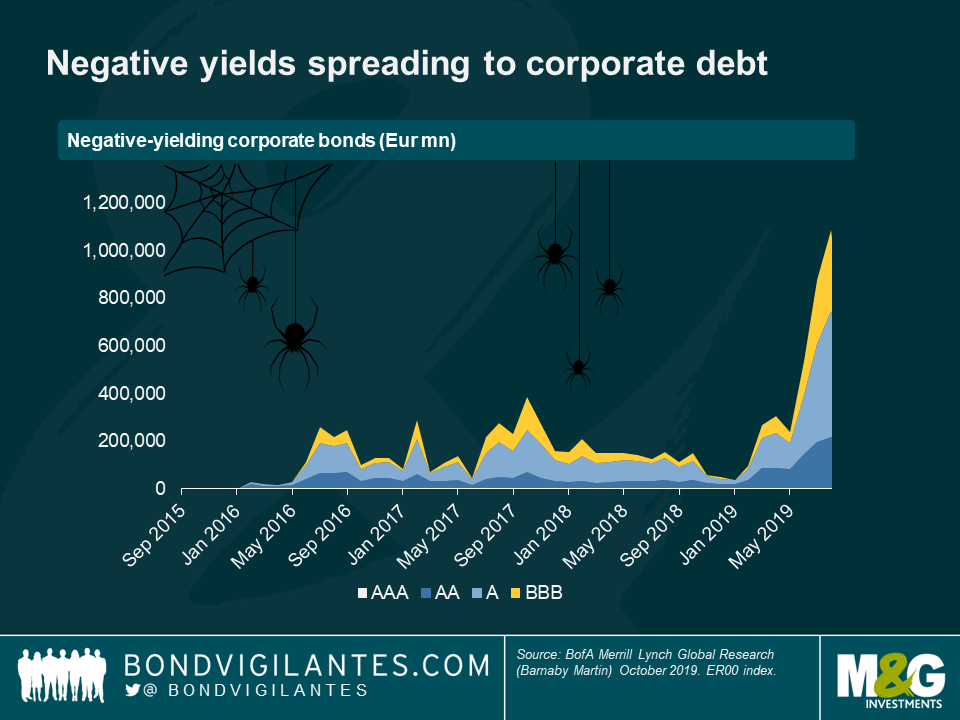

If you’ve seen enough negative-yielding government debt by now not to be spooked by it, take a look at this next chart.

Even many corporate bonds are now negative yielding. This chart shows the face value of negative-yielding debt in the ICE BofAML Euro Corporate index: now as high as €1 trillion!

Most of this negative-yielding corporate debt is actually in the lower end of investment grade, namely A and BBB.

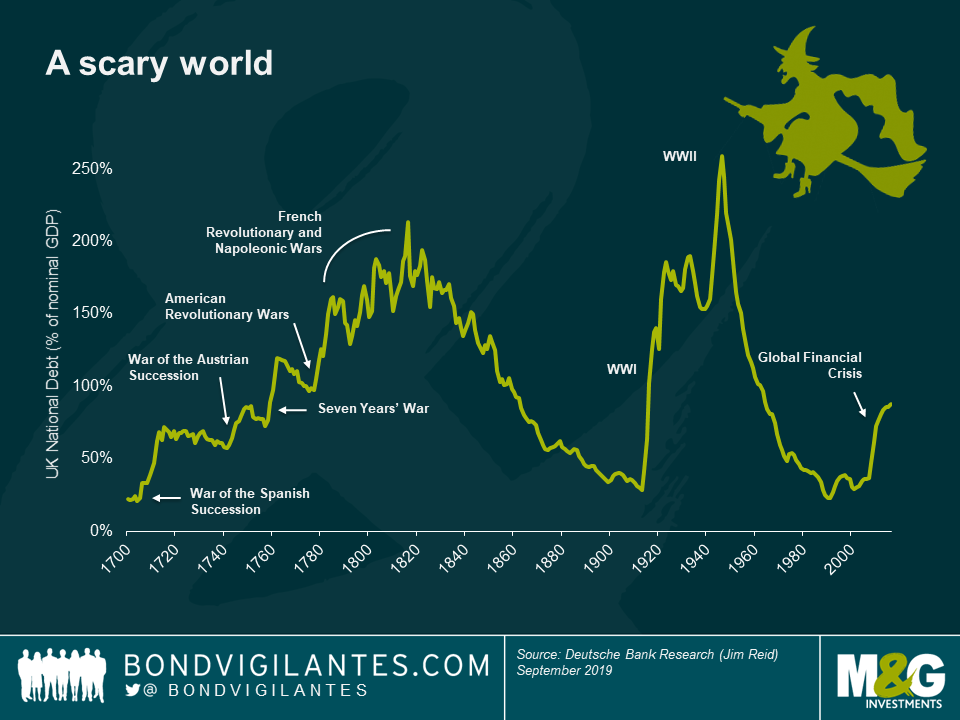

Here’s a scary statistic: total (public + private) debt in the world has never been higher. And looking at public debt alone, while its peak could be seen during and after the Second World War, government borrowing is at its highest peacetime level.

Taking UK debt as an example, a spike in borrowings can be seen since the 1700s whenever financing was required for a war or conflict. So what is going on now to explain the spike in government borrowing?

One answer may be the greater power of democracy in the world. In order to pay down its debt, a country must maintain a primary surplus. Put simply, it must raise more revenues through taxation than it spends on citizens. While governments in the past had the power to do this, who would vote to be subject to such an environment for long? We have seen the rise of populism in countries like Italy which have tried to move from deficit to surplus.

Governments and central banks have a scary problem in trying to keep public debt under control in this new world.