Vaccine Stocks During a Pandemic

It’s often said that with every crisis comes great opportunity.

While such catastrophes do create upheaval and uncertainty in financial markets, they can also lead to new opportunities for investors, as asset classes react to different environments.

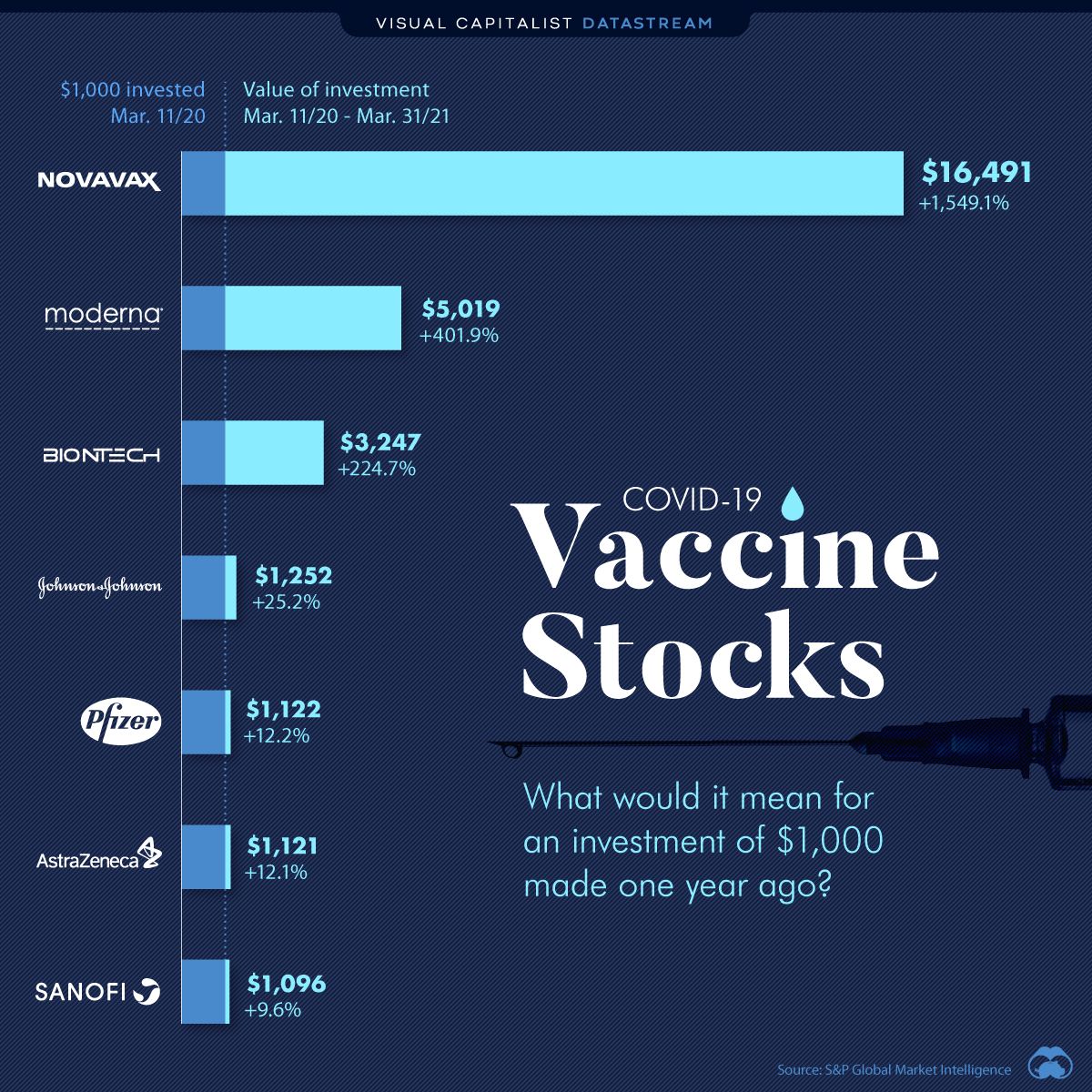

Since the World Health Organization (WHO) declared COVID-19 to be a pandemic on March 11, 2020, the performance of vaccine stocks have been varied—but with some notable winners that notched triple or quadruple digit returns.

Here’s how much a $1,000 investment would be worth as of March 31, 2021, if you had put money into each vaccine stock at the start of the pandemic:

The Business of Vaccines

The returns on vaccine stocks have varied greatly. They are staggering in the case of Novavax and Moderna, but also seem quite underwhelming, when considering the likes of Sanofi, AstraZeneca, and Pfizer.

One factor for the discrepancy in stock price performance is the revenue potential from vaccine sales relative to the rest of the existing business, as vaccine sales will have a much greater impact on the fundamentals of smaller companies.

For example, before the pandemic, Novavax had revenues of just $18.7 million—this meant that capturing any portion of global vaccine sales would create massive value for shareholders. On the flipside, vaccine sales are much less likely to impact the fundamentals of Sanofi’s business, since the company already is generating $40.5 billion in revenue.

To put it into perspective, analysts are expecting total sales from COVID-19 vaccines to be around $100 billion, with $40 billion in post-tax profits.

Vaccine Stocks vs the S&P 500

Even in a booming and valuable industry, it’s difficult to identify the long-term leaders. For example, in the mobile phone market, there was a time where the likes of Motorola, Nokia, and Blackberry appeared untouchable, but eventually lost out.

Similarly, with the limited information available at the start of the pandemic, few, if any, could have separated the winners and losers from this group with accuracy.

In the past year, the S&P 500 grew 44.9%—meaning that only three of the seven vaccine stocks have seen their share prices outperform the market.

Nobody said helping solve a global pandemic guarantees a pay off.

Where does this data come from?

Source: S&P Global Market Intelligence

Notes: Investment growth is calculated between March 11, 2020-March 31, 2021. All market capitalization values are as of March 31, 2021.