As Coinbase prepares to go public with a direct listing on the Nasdaq, the company has released its S-1 filing detailing just about every aspect of their business.

Along with surging users and crypto prices, Coinbase’s trading volume has also increased exponentially, with institutions leading the way.

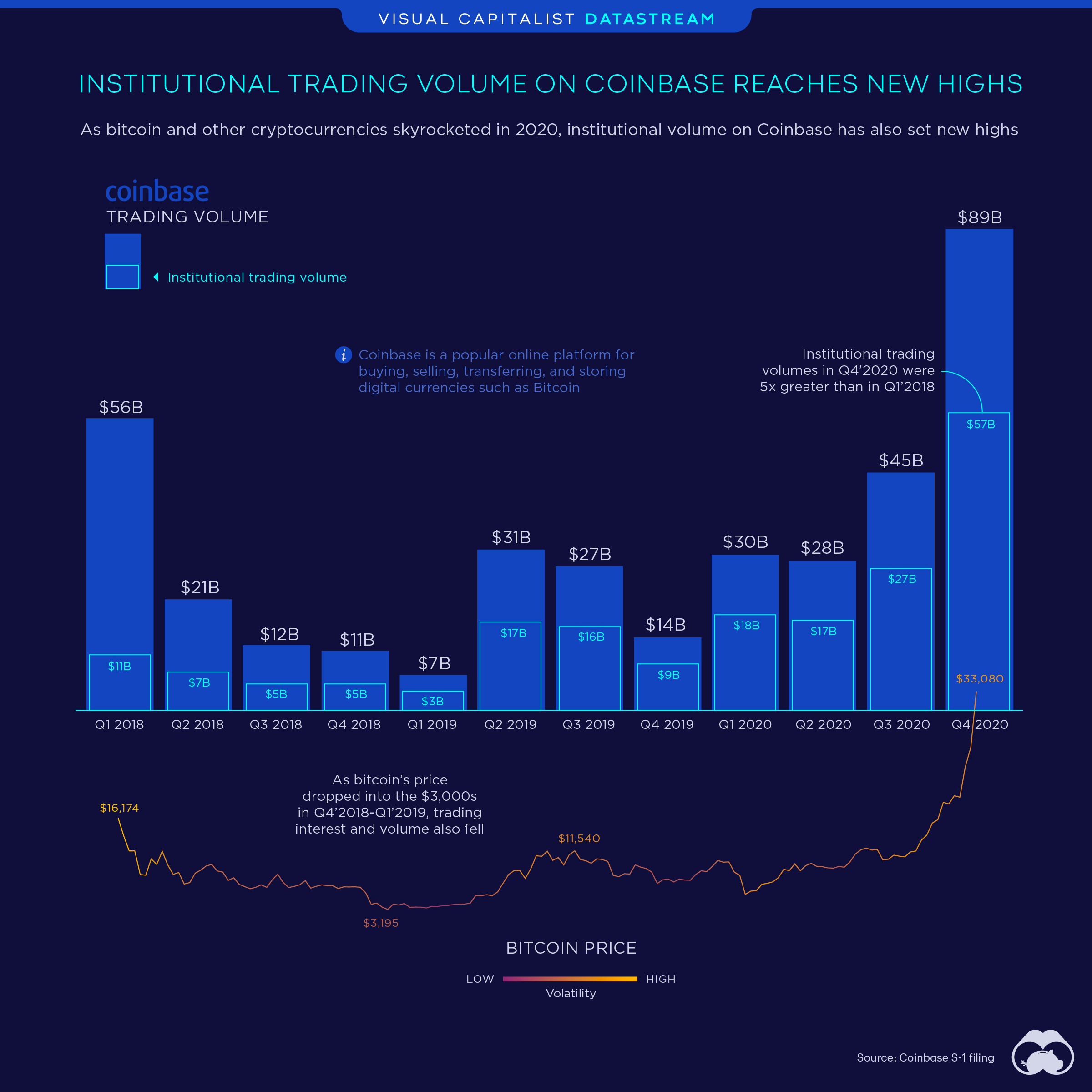

This graphic looks at the return of rising institutional and retail trading volumes on Coinbase over the past two years alongside bitcoin’s price.

Coinbase’s Volume and Active Users are Rising

Crypto trading volume on Coinbase set record highs in Q4’2020 with $89B in volume, with institutions making up $57B. While recent institutional volume is more than five times Q1’2018 volume, retail trading volume is still below Q1’2018 levels despite bitcoin making new all-time highs.

Overall, trading volumes on Coinbase’s platform are far greater today than they were at the peak of the last bitcoin bull run. However, monthly transacting users on the exchange in Q4’2020 just barely surpassed the numbers of Q1’2018.

Coinbase’s Monthly Transacting Users per Quarter

| Date | Monthly Transacting Users (millions) |

|---|---|

| Q1’2018 | 2.7M |

| Q2’2018 | 1.2M |

| Q3’2018 | 0.9M |

| Q4’2018 | 0.9M |

| Q1’2019 | 0.8M |

| Q2’2019 | 1.3M |

| Q3’2019 | 1.2M |

| Q4’2019 | 1.0M |

| Q1’2020 | 1.3M |

| Q2’2020 | 1.5M |

| Q3’2020 | 2.1M |

| Q4’2020 | 2.8M |

Along with Coinbase’s volume figures showing a greater increase in institutional volume compared to retail, it’s clear that institutions have bought into the bull run while retail investors have returned to transacting crypto more slowly.

The Institutions Buying into the Bitcoin Bull Run

It began with Michael Saylor’s company MicroStrategy purchasing $250M worth of bitcoin in August of 2020, before eventually investing a total of $2.2B in the cryptocurrency. These aggressive bitcoin purchases were followed up by Jack Dorsey’s Square and Elon Musk’s Tesla investing $220M and $1.5B respectively, with Tesla also revealing plans to accept bitcoin payments in the future.

Along with these companies betting on bitcoin, banks have renewed their interest in cryptocurrency as well. Earlier this month the Bank of New York Mellon set up a digital assets unit to help customers manage their cryptocurrencies, and Goldman Sachs just announced the return of its cryptocurrency trading desk.

While it’s rumored that Goldman Sachs could even pursue listing a bitcoin-focused ETF, the Chicago Board Options Exchange has already filed a request with the SEC to list VanEck’s bitcoin ETF, which would be the first of its kind in the United States.

>>Like this? Then you might like this article comparing bitcoin’s market cap to other cryptocurrencies