by UPFINA

Throughout this recession we have been looking at the high frequency consumer spending data. Typically, it’s not as important because it can meander away from retail sales which is what matters. However, in normal situations, the accuracy level needs to be higher because vacillations are small. The difference between 2% growth and 4% growth is a huge deal. In this situation, the data is so wild, we are using the latest data to just understand trends. For the most part, trends have been positive since March/April.

For Visa, from April to May U.S. payments volume growth went from -18% to -5% which is a huge improvement. In the week ending May 28th, Mastercard switched volume growth was -1% in America and -13% in the rest of the world. In that week, growth improved 2 points in America and 1 point in the rest of the world. The situation continues to improve. Cross border volume growth is still weak which is bad for the payment processors, but doesn’t matter for macro investors unless you’re looking for increased international travel.

Speaking of travel, there has been a huge spike in bookings growth as there is pent up demand. Starting in mid-May, yearly growth went positive. It’s now at 50%. The chart below shows the yearly growth in travel by time horizon. As you can see, the growth is in near term travel with massive growth in travel that’s less than a month in advance. Arrivals in 60 days or more are flat which is a big improvement from March and April. That being said, trip cancelations are still running higher than last year.

That said, the recovery is all people booking near term/short term vacations, which probably makes this recovery/growth fragile pic.twitter.com/eCL9zrBn0N

— OswaldValue (@OswaldValue) June 8, 2020

According to OpenTable, on June 7th restaurant bookings growth in America was down 74%. Growth went negative again in Germany after being positive for 2 days about a week ago. For restaurants that are taking reservations, bookings growth is 58%. It’s obvious growth would be strong because there is pent up demand. Plus, these is more limited supply. Higher demand and lower supply mean much more growth than normal.

Stocks Are Expensive

The latest bearish thesis on equities is that the more stocks rally while the economy is weak, the more likely corporations are to be regulated and taxed more. Envision a scenario where Joe Biden becomes president, the stock market is up year to date, and the unemployment rate is in the high single digits. That looks bad. It gives added political momentum to those who want to raise the corporate tax rate. As you can see from the chart below, tax reform can lower 2021 EPS by $20 to $150. This is different from COVID-19 as this is a permanent decline in earnings. Corporate tax rates could always come back down after they are raised. However, conservative investors should assume they stay high after they are raised.

"Presumptive Democratic nominee and former Vice President Joe Biden has proposed partially reversing the 2017 TCJA. If enacted, this tax reform would reduce our S&P 500 earnings estimate for 2021 by roughly $20 per share, from $170 to $150." https://t.co/ItlwnseKS1 pic.twitter.com/ozl4OdloPq

— Jesse Felder (@jessefelder) June 8, 2020

The stock market is completely ignoring the potential for higher taxes because it’s trading at 21.5 times 2021 earnings (if EPS is $150). That’s a high multiple for an economy coming out of a recession, facing political risk, another potential wave of COVID-19, and a harsher trade war. Both Joe Biden and President Trump are running on being tough on China. The trade war could get worse in the next few years. If the S&P 500 trades at 17 times $150 in EPS, the market will fall 21%.

Wednesday Fed Meeting

The Fed obviously isn’t going to hike rates at its June meeting. The Fed also won’t cut rates below zero. There’s some media speculation about the Fed going below zero, but the Fed has given no indication it will. We believe the Fed because it’s not saying negative rates aren’t needed. It’s saying they won’t be effective. The market always understands, when the economy changes the Fed needs to react. However, it’s tough to go from saying something won’t work to saying it will. In this instance, we agree with the Fed.

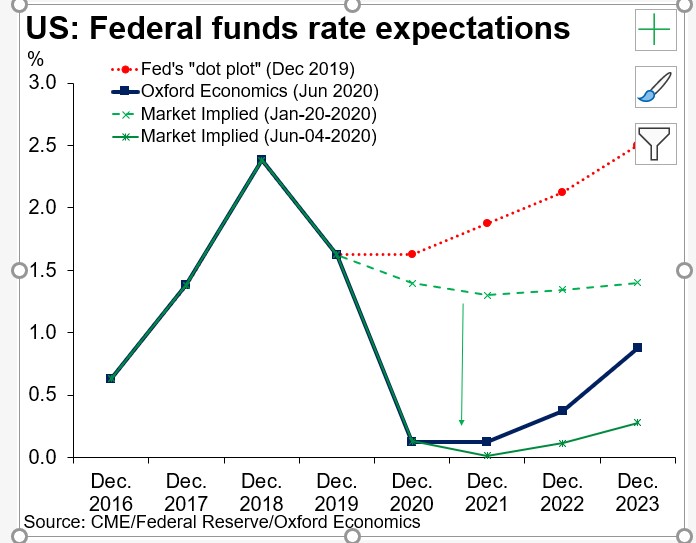

The next few Fed meetings are exclusively about guidance and the new lending programs the Fed has in place to stabilize the economy. As you can see from the chart below, the market sees rates staying near zero for the next 3 years, while Oxford Economics sees them getting back to 1% in 2023. Rates won’t be a concern until next year at the earliest.

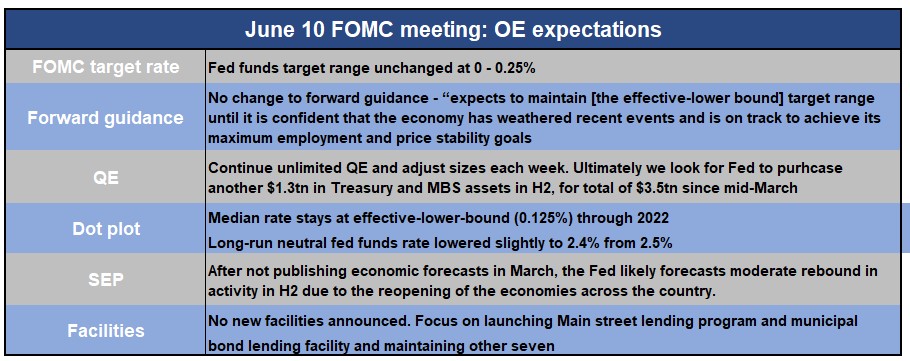

The Fed just altered the Main Street lending program. Fed meetings haven’t mattered as much this year because the news has broken in between meetings as the Fed has worked to support the economy. On Monday the Fed lowered the minimum loan size from $500,000 to $250,000 and raised the maximum to $300 million. It also lengthened the loan terms from 4 to 5 years. Stretching out the payments should encourage more firms to participate. It also delayed the initial principal payment for 2 years instead of 1. The Fed wants loans to be made to small and medium sized firms immediately once they register with the Fed. Banks are now assuming 5% of the loans with the Fed doing the rest. It had been 15% for some loans. The Fed is pretty much doing whatever it takes to save the economy. The table below shows predicted Fed guidance on Wednesday.

Keep in mind that the Fed limiting the damage small and medium sized firms incur doesn’t mean stocks can’t fall. Euphoric traders justify their optimism by saying the Fed has their back. The Fed isn’t directly supporting the stock market.

Conclusion

Consumer spending is improving. That makes sense because income growth was strong due to unemployment benefits and the stimulus checks. Plus, people are being allowed to spend more money as the country opens up. There is pent up demand and consumers have the savings to spend. The stock market might not be a good value, especially if the corporate tax rate is raised. The Fed won’t cut rates below zero, at least that’s what it seems to be indicating currently. It’s working on refining the Main Street lending program. The Fed has done a great job at limiting the damage of this recession which could have turned into a depression if officials didn’t act. This also doesn’t mean that moral hazard isn’t being created in the long-term. Just because the Fed helped limit the damage doesn’t mean Powell has the stock market’s back. The stock market can easily fall into a correction.