by Dana Lyons

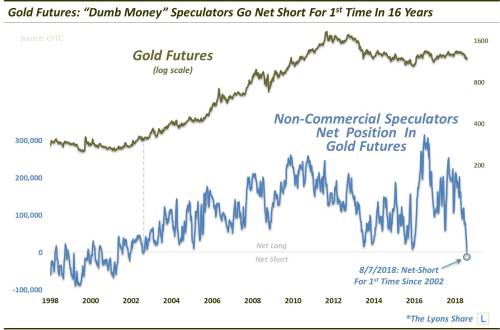

Gold speculators have gone net-short for the first time since near the beginning of the last bull market.

If rallies are born on skepticism, we may be about to see a gold rush. At least, that is an inference some are drawing from recent figures from the CFTC on trader positioning in gold futures. That’s because, as of 2 weeks ago, Non-Commercial Speculators adopted their first net-short position in 16 years.

The last time Speculators were net-short was exactly 16 years, in August 2002. Of course, that was also around the time that the last bull market in gold was getting kick-started. Over the subsequent 10 years, the metal would go on to jump 500% from those levels.