A major bank just went under… contagion is dragging down other similar firms… the Fed is introducing emergency measures to bailout the system.

Is it 2008 all over again?

Yes and no.

“Yes” in the sense that the Fed created a massive bubble in risk assets. Also “yes” in the sense that banks made stupid decisions, violating central tenets of risk management by lending money to clients that could never pay it back (this time tech startups instead of high risk mortgage borrowers). And finally “yes” in the sense that the guilty players get bailed out by the tax-payer and the wealthy are made “whole” with preferential treatment due to their connections to DC.

However, that’s where the similarities end… because the issues the financial system faces today are far greater and systemic that the ones it faced in 2008.

The 2008 crisis was triggered by a crisis in housing… which became a banking crisis courtesy of Wall Street’s toxic derivatives trades,

This crisis (2023) is a crisis in Treasuries… which are the bedrock of our current financial system, the senior-most asset class in existences. And once again Wall Street has gone bananas with derivatives based on an asset class.

In 2008, the derivatives were “credit default swaps” and the market for them was roughly $50-$60 trillion in size.

Today, the derivatives are based on “interest rates/ bond yields” and the market for them is $500+ trillion. And as we just discovered with Silicon Valley Bank and Signature Bank… the banks weren’t particularly clever in how they managed their risks this time either.

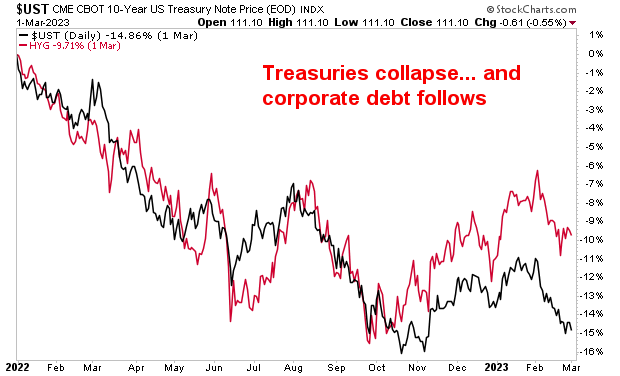

Over the last year as the Fed raised interest rates from 0.25% to 4.75%, the Treasury market has collapsed. Remember, when bond yields RISE, bond prices FALL.

Other debt securities followed suit including mortgage-backed securities, corporate bonds and the like. Because remember, the yield on Treasuries represents the “risk free” rate of return against which all risk assets are priced. So when Treasuries fell, ALL other debt instruments had to be repriced accordingly.

As a result of this, U.S. banks are currently sitting on $640 BILLION in unrealized losses on their longer duration bond/debt portfolios. This is what precipitated the collapse of Silicon Valley Bank… and if you think that’s the last shoe to fall in this mess, I’ve got a bridge to sell you in Brooklyn.

So enjoy the bounce we are seeing in risk assets now. It won’t last… just as the market rally triggered by Bear Stearns’ shotgun wedding to JP Morgan in March 2008 didn’t last either.

Indeed, from a BIG PICTURE perspective my proprietary Crash Trigger is now on the first confirmed “Sell” signal since 2008.

This signal has only registered THREE times in the last 25 years: in 2000, 2008 and today.

If you’ve yet to take steps to prepare for what’s coming, we just published a new exclusive special report How to Invest During This Bear Market.

It details the #1 investment to own during the bear market as well as how to invest to potentially generate life changing wealth when it ends.

To pick up your FREE copy, swing by:

phoenixcapitalmarketing.com/BM.html

PS. Our new investing podcast Bulls, Bears & BS is officially live and available on every major podcast application (Apple, Spotify, etc.)

To download or listen, swing by:

bullsbearsandbs.buzzsprout.com/