by jessefelder

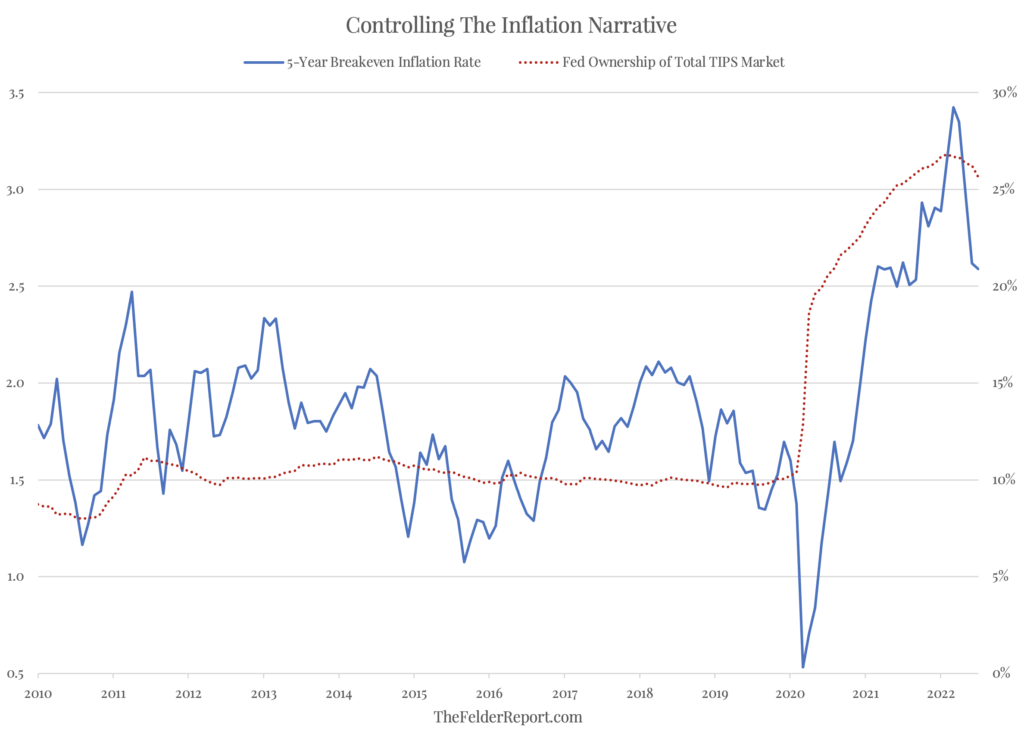

Today, the Fed is set to announce another rate hike of 75 basis points, taking the funds rate to 2.25-2.5%. And while inflation running over 9% appears to indicate that the debate over whether inflation will prove “transitory” has seemingly been won by the “not” crowd, markets are still pricing in a rapid decline in inflation. Some point to these “market-based” indicators of inflation expectations, derived from the yields of Treasury Inflation-Protected Securities (TIPS), as evidence the Fed is on top of the inflation situation.

However, there is a major problem with using TIPS-implied inflation expectations as a report card for Fed policy and that is the fact that the Fed, after buying up more than a quarter of the total outstanding, is now the single most dominant force in the market for TIPS! To some degree then the Fed, in managing its TIPS portfolio via QE and QT, is able to write its own report card. And this at least creates the temptation to try to manage inflation more by controlling the narrative than by actually addressing it directly.