by howmuch

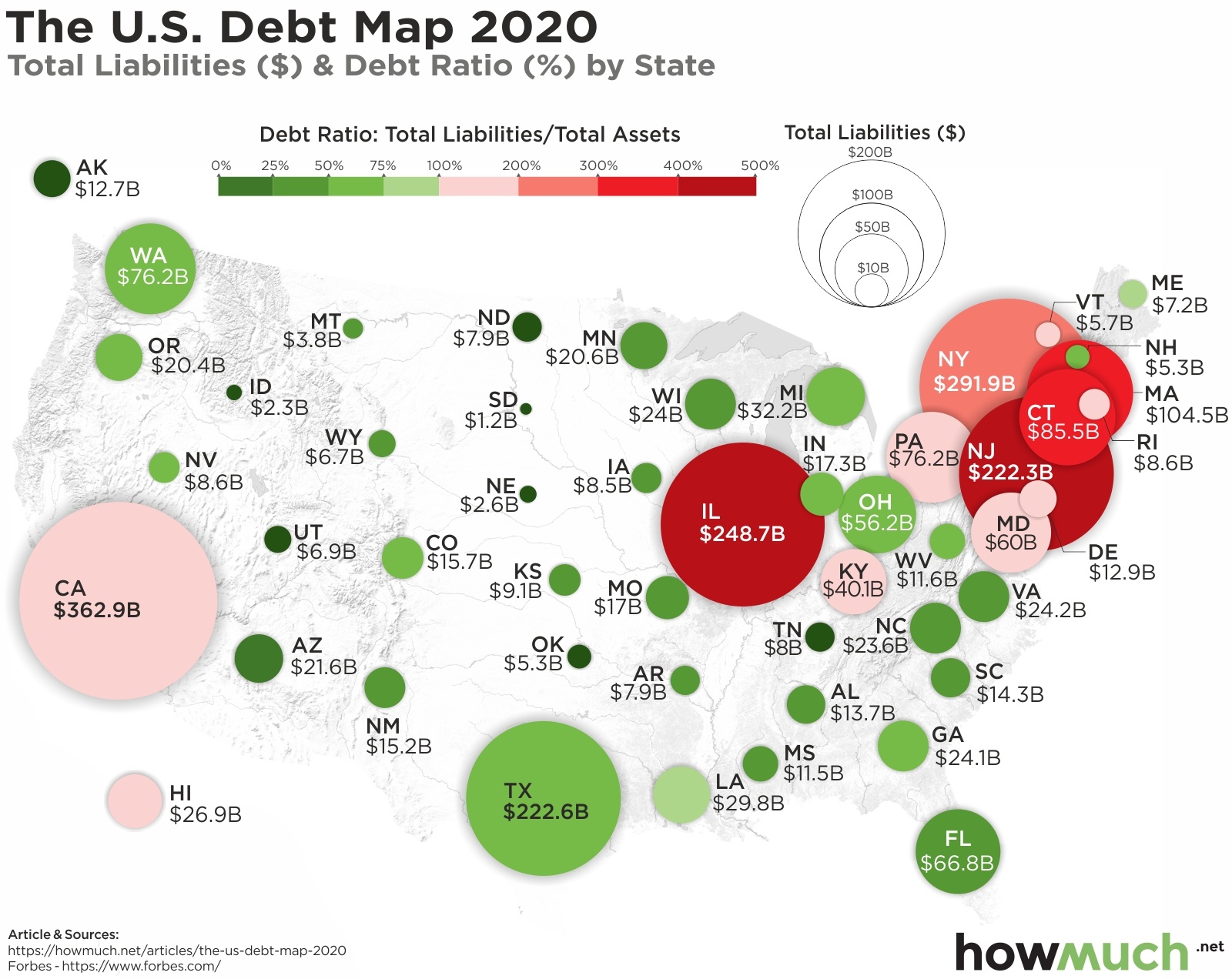

Is there a state debt problem in the U.S.? A major part of President Biden’s $1.9T economic stimulus package is $350B in direct aid to states. The idea is that states need additional revenue to deal with the pandemic and supplement their reserves. Critics point out that states tax revenues in 2020 were roughly flat compared to the previous year. But nonetheless there is a massive state debt problem, as our latest visualization of debt by state makes clear.

- California has the highest overall total debt liability of any state at $362.9B, representing 120.5% of total assets.

- The most leveraged state is Illinois, where $248.7B of debt equals an astonishing 468.7% of assets.

- 13 states have debt loads topping 100% or more of assets, with a concentration of heavily indebted states in the Northeast.

- The vast majority of states across the country have manageable total debt levels. Alaska (14.2%), South Dakota (15.1%) and Nebraska (15.1%) have the healthiest balance sheets.

Forbes originally collected and published the data for our visualization. We first created a bubble corresponding in size to the overall debt load for each state, which highlights the places with the highest and lowest debt totals. Then, we added a sliding color scheme to illustrate the relative size of debt compared to state-owned assets. It makes sense for California and New York to have higher overall debt levels than South Dakota and Alaska. However, our approach indicates the places with potentially enormous debt problems.

Top 10 States With the Highest Debt Ratio

| State | Total Liabilities ($) | Debt Ratio (%) |

|---|---|---|

| 1. Illinois | $248.7B | 468.7% |

| 2. New Jersey | $222.3B | 441.7% |

| 3. Connecticut | $85.5B | 334.9% |

| 4. Massachusetts | $104.5B | 305.5% |

| 5. New York | $291.9B | 273.8% |

| 6. Delaware | $12.9B | 174.2% |

| 7. Maryland | $60B | 123.9% |

| 8. Kentucky | $40.B | 121.4% |

| 9. California | $362.9B | 120.5% |

| 10. Hawaii | $26.9B | 118.4% |

The most obvious takeaway from our map is that there are lots of states with tens of billions in debt. The state with by far the most debt in the country is California at $362.9B, topping some 120.5% of the state’s assets. Five other states also crack $100B in debt, including New York ($291.9B), Illinois ($248.7B), Texas ($222.6B), New Jersey ($222.3B) and Massachusetts ($104.5B). Clearly these states have been spending a lot more money than they’ve been collecting in tax revenues for several years.

But just because some states carry a lot of debt doesn’t necessarily mean they are on an unsustainable path. After all, Jeff Bezos is one of the richest men in the world, and he could easily afford a million-dollar credit card bill. Taking a look at debt ratios provides a fuller picture because it divides total debt by total assets. Some of the states with the highest debt loads also have extremely high debt ratios, like Illinois (468.7%) and New Jersey (441.7%). And there are a lot of states with a lot less overall debt, but which are still at unsustainable levels. Connecticut only carries $85.5B in debt, but that’s the third highest ratio in the country at 334.9%. All these states have a real problem spending more money than they actually have.

On the flip side, Texas has one of the highest total debt levels, but is middle-of-the-pack with its debt ratio at just 62.5%. In fact, the vast majority of states have very little debt both overall and as a ratio. Alaska only carries debt levels of 14.2%. This is why federal aid for states is such a controversial and political issue. Politicians from states with high debt ratios believe they need federal help to manage through the COVID pandemic. But others from places with manageable levels see a bailout in response to a long-term problem with spending.

If you are in debt, it might be worth consolidating different loans into a single payment. Our personal loan for debt consolidation cost guide is a great place to get started.