In his latest report, commodities analyst Marin Katusa lays out the case for a sea change in gold’s relationship to the overall market. Here’s hoping he’s right:

Gold Just Had Its Biggest One Day Influx EVER

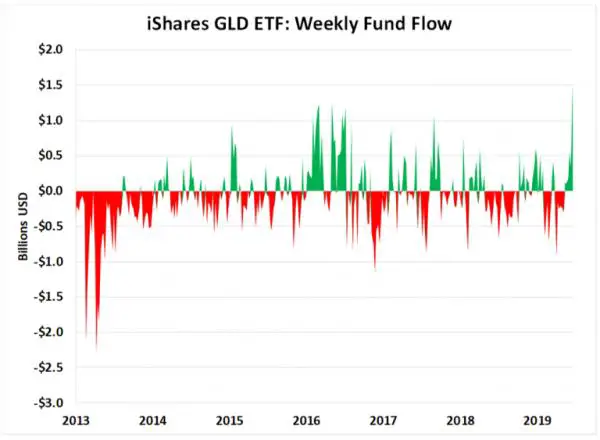

On Friday June 21st, the largest gold focused Exchange Traded Fund (GLD) saw over $1.5 billion flood into the ETF.

The inflow that day was over 10% higher than the 2nd largest ever inflow. That happened on July 11, 2008.

Last week, we witnessed the single largest inflow day ever in the ETF’s history, which was created just before the 2008 financial crisis.

And this will have massive implications for gold investors.

So pay attention…

Below is a chart which shows the weekly inflows and outflows of the GLD ETF since 2013.

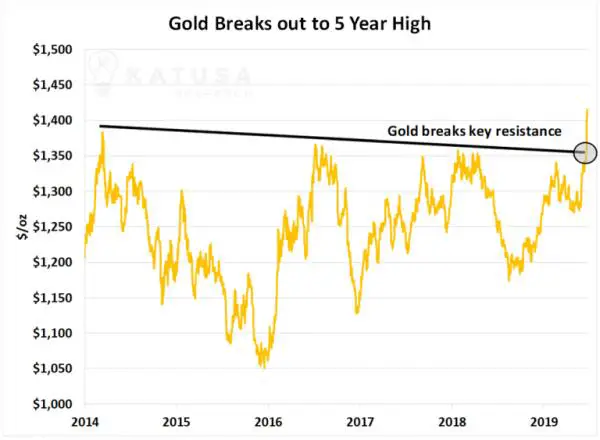

It’s no wonder that Gold is at a 5 year high and recently broke a 5 year resistance line…

Gold Rush – Follow the Fund$ Flow

A metric we follow very carefully is this:

• Which sectors are “passive” funds directing their capital into?

It’s been many years since the passive funds have paid attention to gold.

More importantly, the passive funds have just started their influx of capital into the gold sector.

And if you understand how the algorithms work (which us math nerds do), the algo’s and passive funds chase gains and liquidity.

The gold sector is tiny compared to other sectors like the financial sector or bio tech sector. Thus…

It doesn’t take a lot of new capital to send the share prices soaring. Let me explain…

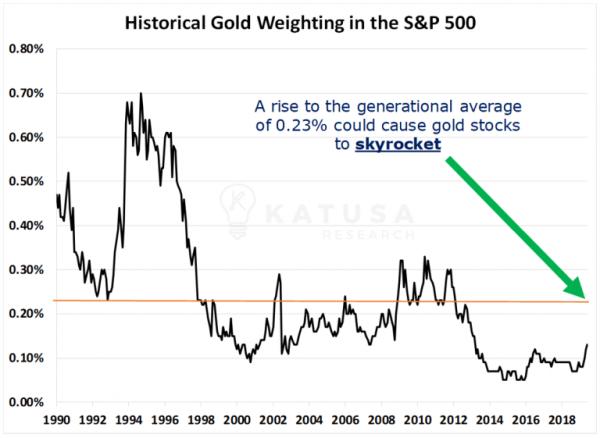

Below is a chart which shows the weighting of gold stocks in the S&P 500.

The reduction from 0.30% to 0.07% sent the gold market into the worst bear market in history.

That is what the opportunity is in the gold sector.

As you’ll see in the chart, the weighting has recently spiked back above 0.10%.

The 30 year weighting average is 0.234%

If the gold weighting doubles from here…

Which would still be less than the 30 year average…

The gold sector will be one of the hottest markets in the world.

And we will see multiple ten baggers in short order.

The great thing about the niche sectors is it takes a long time for the passive, generalist fund manager to rotate their capital into gold stocks. A savvy investor can get in front of the herd and make a killing.

How You Can Make Money in This Cycle

History shows that resource stocks move in cycles. Especially gold stocks.There’s a reason why gold bugs go nuts…

There’s no rush quite like a gold rush.

And throughout the last fifty years there have been many major (and some minor) gold rushes where the gold stocks went absolutely ballistic.