Normally, we see the US Treasury yield curve slope rise dramatically after a recession. Except for after the shortest recession (2 months) in US history. Why?

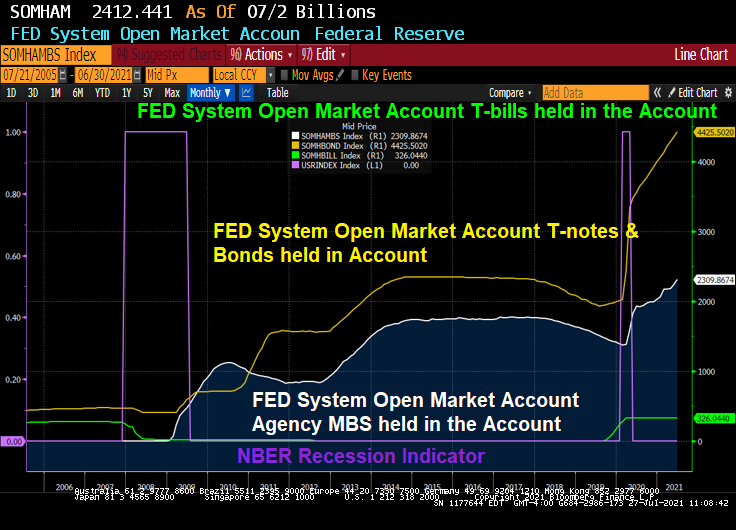

With the Covid outbreak in early 2020, The Fed chose to repress interest rates with a vengeance by lowering their target rate to 25 basis points (yellow line) and massively expanding their Treasury and Agency MBS purchases (orange dotted line). As a result, the US Treasury yield curve slope had an anemic post-recession surge and has declined again to 103.39.

Oddly, The Federal Reserve overstimulated their balance sheet for the Covid epidemic which created the shortest recession in US history. .

But the stimulus remains. As does inflation and home price growth and rents.

This is indeed monetary Stimulypto.

Will this be acknowledged at The KC Fed’s Jackson Hole Monetary conference?