via Zerohedge:

Just hours after China, as a gesture of goodwill, waived tariffs on 16 types of US goods in a clear attempt to get on Trump’s good side and “sweeten” trade talks, a move which clearly was not lost on the US president, moments ago Trump said he was delaying a 5% increase in tariffs on Chinese goods by two weeks, supposedly out of respect for the celebration of the 70th anniversary of the revolution that brought the communist government to power.

“At the request of the Vice Premier of China, Liu He, and due to the fact that the People’s Republic of China will be celebrating their 70th Anniversary on October 1st, we have agreed, as a gesture of good will, to move the increased Tariffs on 250 Billion Dollars worth of goods (25% to 30%), from October 1st to October 15th,” Trump tweeted at7;17pm.

….on October 1st, we have agreed, as a gesture of good will, to move the increased Tariffs on 250 Billion Dollars worth of goods (25% to 30%), from October 1st to October 15th.

— Donald J. Trump (@realDonaldTrump) September 11, 2019

While Trump claimed that the move was out of respect for the Chinese National Day holiday, it is far more likely an in kind response to China’s announcement that a range of U.S. goods would be exempted from 25% extra tariffs put in place last year.

The delay comes into place just 11 days after a new round of tariffs kicked into place, and followed an escalation of the U.S.-China trade war in August when Trump announced an increase in the tariffs on $250 billion in Chinese goods to 30% from 25% starting Oct. 1.

The nations are scheduled to hold two rounds of face-to-face negotiations in Washington in coming weeks with the first this month and the second in early October with a visit from He.

The news sent S&P Emini futures surging by 0.6%, or up 17 points, to 3,020, just 7 points away from the July 26 all time high, and the Dow up over 140 points…

… sending the Dow back to where it was when Trump suffered his tariff tantrum at the end of July…

… with the Nasdaq…

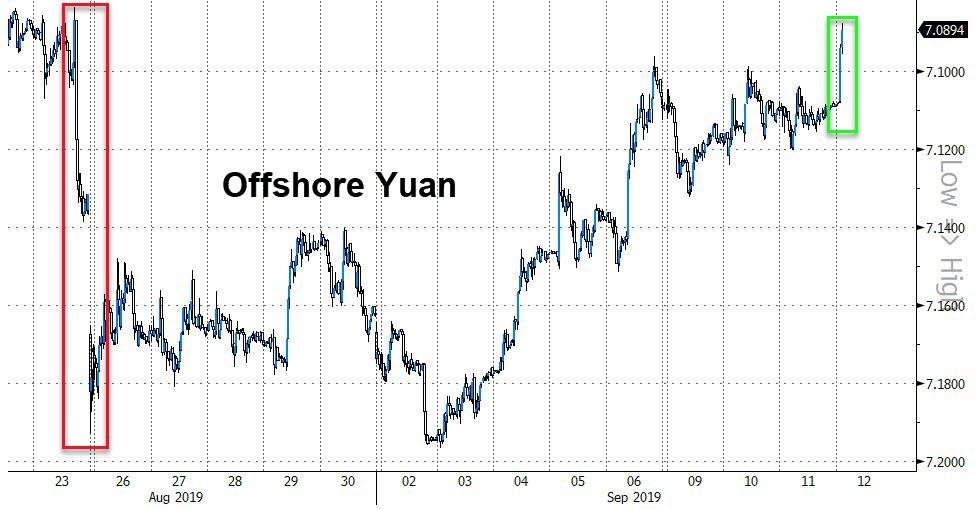

… and the Yuan also sharply higher.

Source: Bloomberg

In the process roundtripping back to where the yuan was before China announced its retaliation to the latest round of US sanctions.

Source: Bloomberg

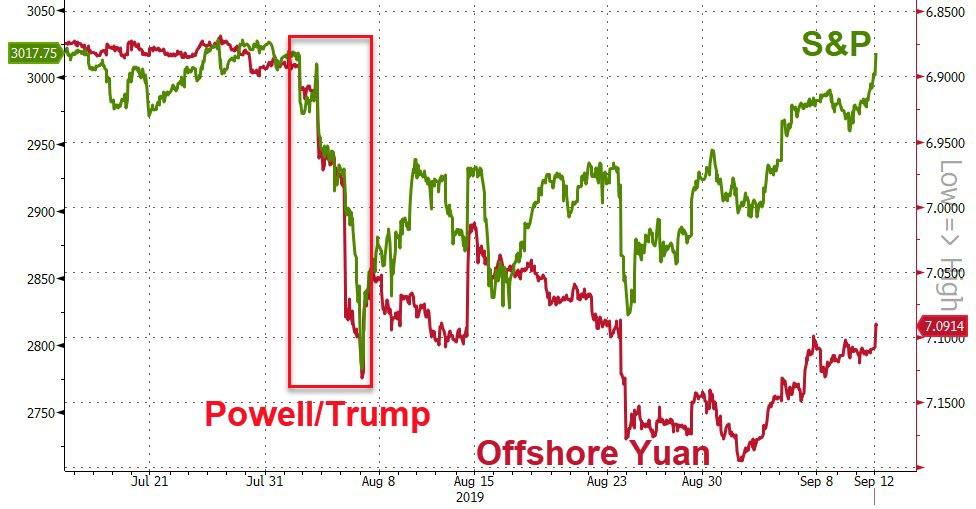

But yuan remains dramatically decoupled from US stocks.

Source: Bloomberg

At this rate, the S&P will be at its all time highs by the open tomorrow, which means that next Thursday the Fed will cut rates by 25 bps with the US stock market at fresh all time highs…. unless of course, the Fed sees today’s de-escalation as a key transition in the trade war and decides to delay rate cuts. Which, however, it won’t as otherwise – with the ECB set to cut tomorrow and restart QE – Trump will show up at the Marriner Eccles building with a flamethrower and burn the whole place down.