by Money Metals

According to newly uncovered information in the gold market, it provides additional evidence of why the Fed, Central Banks and the IMF were forced to RIG the gold market. Not only was the dropping of the Gold-Dollar peg going to release a great deal of pressure on the manipulated gold price, but forecasts of a massive increase in gold demand was going to totally overwhelm supply.

Thus, this new information provides clear evidence that the gold market was being assaulted on “two fronts.” Not only was the gold market suffering from a decades of price suppression schemes via the Fed and Central Banks, but also that surging gold demand in the jewelry and industrial sectors was going to lead to severe shortages in the gold market.

Which means, the gold market was experiencing a great deal more stress than complications stemming from the debasement of the U.S. Dollar due to massive money printing. Actually, looking at this new information, I had no idea of the amount of Fed, Central Bank and IMF gold market intervention until I put all the pieces together.

Now, when I say “new information”, it pertains to new information and data that I dug up from older official documents. While most of the folks in the precious metals community realize that the Fed and Central Banks have sold gold into the market to depress the price, this new evidence puts the gold market it in an entirely DIFFERENT LIGHT.

Furthermore, additional data points to a “Gold Supply & Demand” situation that would have gone completely out of control, if the Fed, Central Banks and IMF did not step in.

To preface this subject matter, the Central Banks dumped a lot of gold into the market during the 1960’s to maintain (suppress) the official gold price. This was known as the “London Gold Pool” where an estimated 78 million oz (Moz) of gold were dumped into the market between 1961 and 1968. I explained this in my THE GOLD REPORT- Investment Flows.

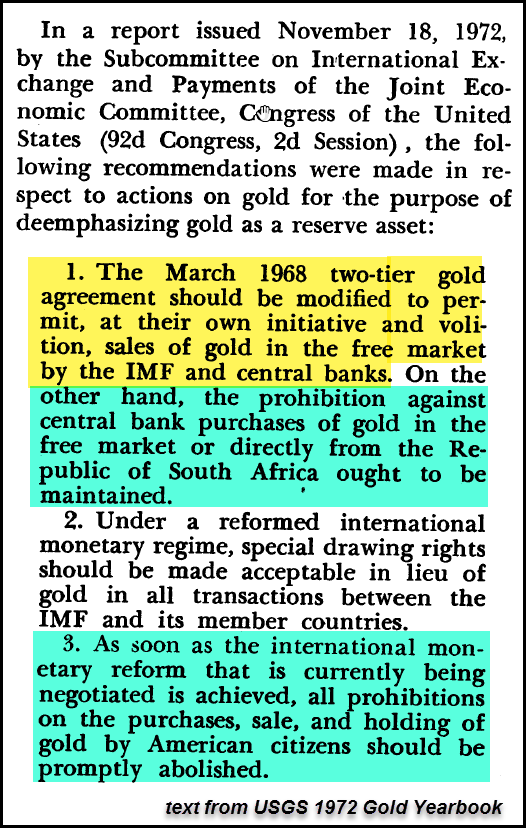

However, when Nixon dropped the Dollar-Gold Peg on August 15, 1971, the problems with the global monetary system were just beginning. In a report published in November, 1972, by the U.S. Congress and Subcommittee on International Payments of the Joint Economic Committee for the purpose of “De-emphasizing gold as a reserve asset”,it stated the following:

Not only did the committee suggest and permit the “voluntary” sale of official gold into the market, but also to “prohibit” against Central bank purchases. Which meant the committee was proposing a plan to only allow the DUMPING of gold into the market, but forbid any OFFICIAL BUYING. This of course was supporting the “FREE MARKET” fundamentals for proper gold price discovery… LOL.

At the bottom of that quote, the committee went on to state that when the international monetary reform had been achieved (to an IMF SDR basket), all prohibitions of gold (investment) purchases by American citizens would be promptly abolished.

So, the wonderful folks up in government had an ingenious method to their madness. According to their assessment, it would have not been prudent to allow Americans to start purchasing and hoarding gold until the completion of the new fiat monetary system was achieved.

Again, most of us in the precious metals community understand that the Central banks dumped a lot of gold into the market during the 1960’s London Gold Pool to maintain the official gold price. However, new uncovered gold supply and demand data suggests there was another FACTOR that forced even more dumping of official gold during the 1970’s.

Forecast Of Massive Gold Supply & Demand Imbalance

The reason that Nixon dropped the Gold-Dollar Peg in August 1971 was to keep U.S. gold from flowing overseas as the U.S. Government had been printing a great deal of paper money. Thus, countries such as France were exchanging Dollars for real gold. This forced Nixon to drop the convertibility of Dollars into gold so the United States could hold onto its remaining gold reserves.

But, and here is a BIG BUT… converting Dollars into physical gold was only one part of the monumental problem facing the gold market and industry. Up until now, this was the only real problem that I was aware of as it pertained to the gold market in the 1970’s. However, forecasts of future Gold Supply & Demand factors were going to totally disrupt the market unless the Fed and Central banks stepped in.

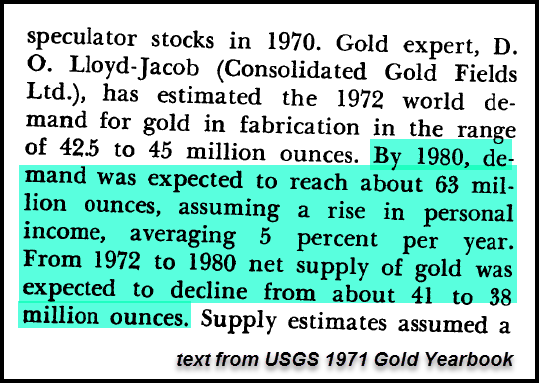

This next quote comes from the USGS 1971 Gold Yearbook. The highlighted area shows just how bad the gold supply and demand situation was going to be at the end of the decade:

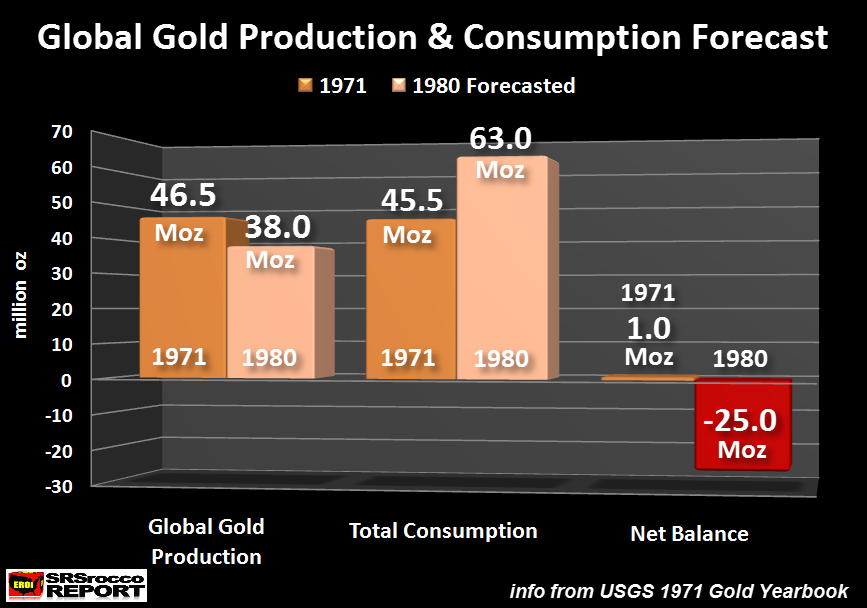

According to a gold expert at Consolidated Gold Fields Ltd., global gold demand was forecasted to reach 63 million oz (Moz) by 1980, up from 42.5-45 Moz in 1972. You see… this was a BIG PROBLEM. Why? Because gold mine supply was also forecasted to decline to 38-41 Moz in 1980. This would have resulted in a huge net deficit.

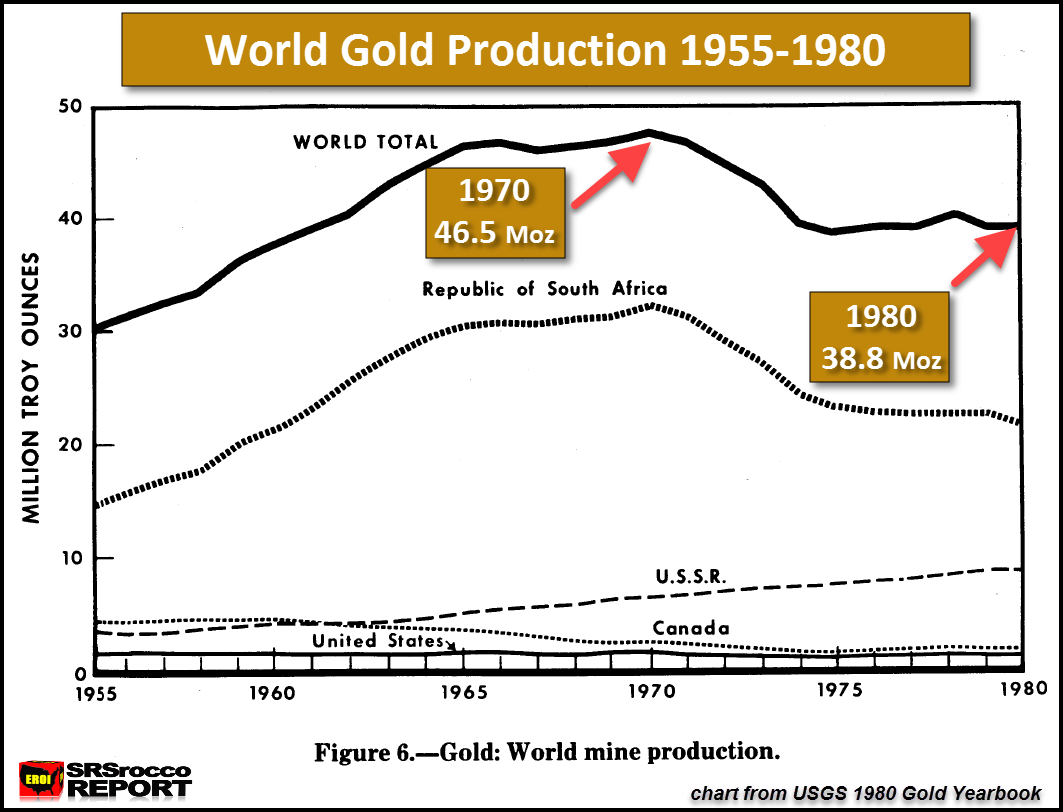

So, how well did the Consolidated Gold Fields Ltd., forecast turn out? Let’s look at the chart below:

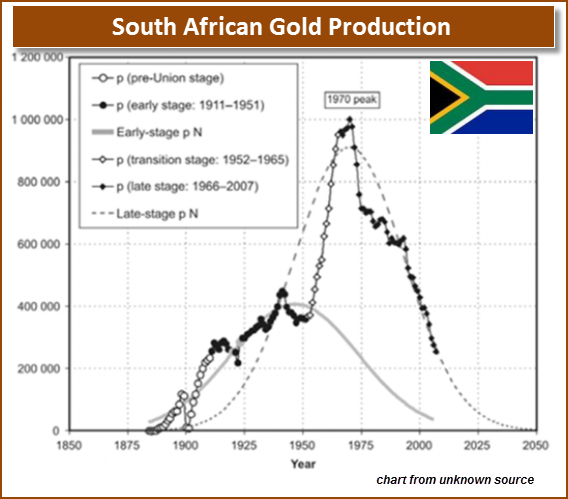

Actually, it turned out pretty darn accurate. Global gold production declined from its peak of 46.5 Moz in 1970, to 38.8 Moz in 1980. This was mainly due to the peak and decline of South African gold production. I would imagine very few individuals in the precious metals community realize just how much gold South Africa produced.

No other country has come anywhere near the record annual gold production achieved by South Africa at its peak in 1970:

South Africa produced an amazing 1,000 metric tons of gold in 1970… 32 Moz. Here are the annual peak production figures from three leading gold producing countries:

- China = 478 mt (15.4 Moz) 2014

- USA = 366 mt (11.8 Moz) 1998

- Australia = 276 mt (8.9 Moz) 2015

China holds the second highest annual gold production record at 478 mt (15.4 Moz) set in 2014. However, this is still less than half of the 1,000 mt that South Africa produced in 1970. According to GFMS 2016 Gold Survey, South Africa’s gold production was 151 mt (4.8 Moz) in 2015. The once mighty South African gold production has declined 85% from its peak in 1970.

Now, taking the 1980 forecasted supply and demand data by Consolidated Gold Fields Ltd. above, here is the result:

If the forecast of a 63 Moz gold demand figure was true, then the market would have suffered a 25 Moz deficit in 1980. So, not only did U.S. President Nixon stop the bleeding of gold flows out of the U.S. Treasury, but in addition, public demand for gold that decade was going to explode.

This just could not fly. Which is why the Congress and the Subcommittee on International Exchange and Payments (listed above) were highly motivated to promote “Official Gold Sales” while prohibiting “Official Gold Buying.” This was a “ONE-WAY PLAN” for gold… and that was the dumping of a massive amount of the yellow metal into the market.

The Fed, IMF and Official Government Gold Sales During the 1970’s

It’s hard to tell how much gold was dumped into the gold market during the 1970’s decade. I have plans on putting together a more comprehensive report on the details of what took place in the gold market from the 1960’s to present. This will include more detailed data on Official gold sales.

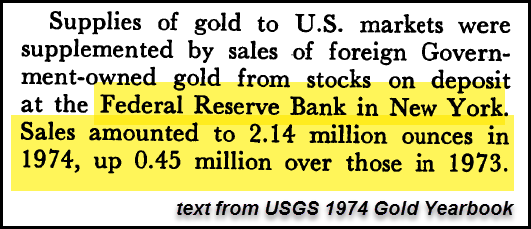

However, we have some clues in the text from different USGS Gold Yearbooks. First, we have foreign gold at the Federal Reserve sold into the market in 1973 and 1974:

As we can see, 2.14 Moz of foreign held gold at the Fed were dumped into the market in 1974 and 1.69 Moz in 1973. Unfortunately, official sales of gold into the market did not deter the rising gold price. The gold price jumped from an average $65 in January 1973 to a high of $200 at the end of 1974.

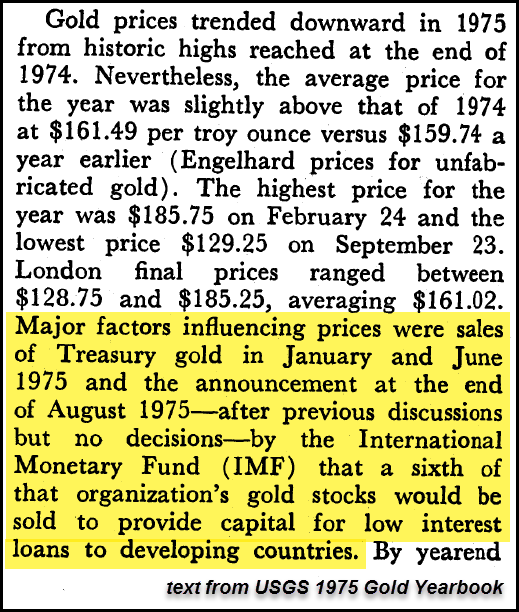

Well, the Central banks could not let this exploding gold price to continue. Which is why the IMF made this official statement in August, 1975:

The IMF – International Monetary Fund, announced in August, 1975 to sell one-sixth of its gold stocks. At the time, the IMF held 153.4 Moz of gold. Thus, it planned to sell 25.5 Moz over the next several years to supposedly provide capital for low-interest loans to developing countries. I wonder why the IMF did not make this statement back in 1973 or 1974? And why would the IMF have to sell gold to provide capital for developing countries?? Wasn’t there a new FIAT MONETARY REGIME??

Wasn’t gold now a “Barbarous Relic?”

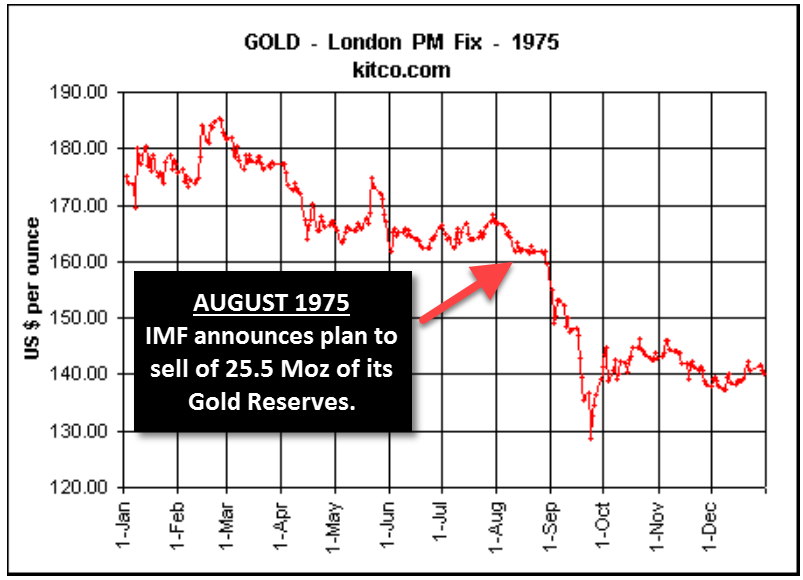

With the IMF “strategic”announcement that it would sell 25.5 Moz of gold into the market, it had a profound impact on the gold price in 1975:

After the IMF gold sale announcement, the gold price plummeted 21% in just one month from $165, down to a low of $130. Before I came across this information, I just believed that the gold price was due for a correction… stated by several websites, such as by analysts on King World News. However, this wasn’t a typical market correction. Rather… this was a MARKET INTERVENTION FORCED CORRECTION. Big difference.

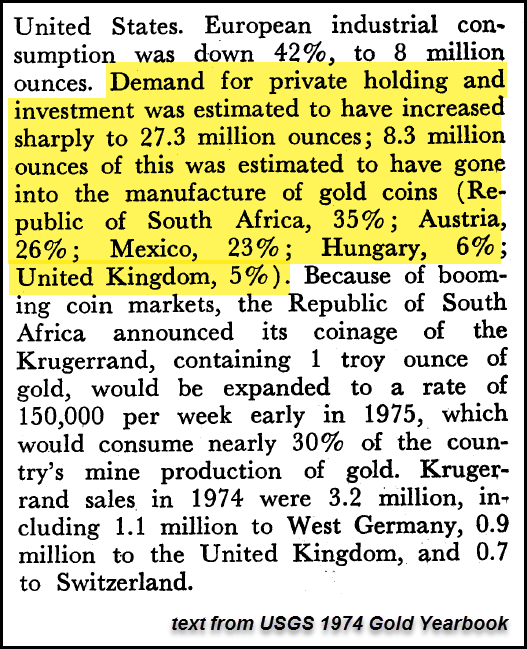

So, why the IMF gold sale announcement? Was it due to a response to the rapidly rising price.. or did rising demand play a part. If we look at this next quote taken from the USGS 1974 Gold Yearbook, we find our answer:

According to the data, private gold holdings and investment surged 5-fold in 1974 to 27.3 Moz. The report also stated that total gold jewelry and industrial demand was 23 Moz in 1974. Thus, total gold demand exceeded 50 Moz in 1974.

I would imagine if private gold investment didn’t jump 5-fold from the previous year, the IMF would have not considered it necessary to announce the sale of 25.5 Moz of its gold reserves in 1975.

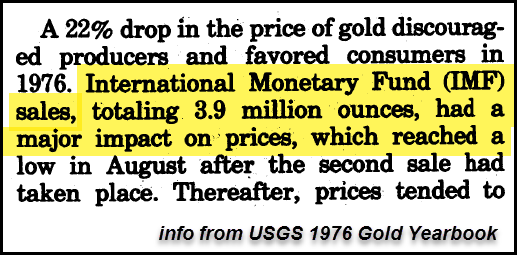

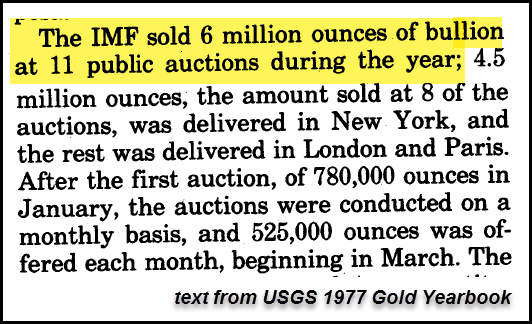

In order to make good on its promise, the IMF did sell 3.9 Moz of gold in 1976 and another 6 Moz in 1977 into the market:

In just the first two years after its proposed 25.5 Moz gold sale in August 1975, the IMF sold 9.9 Moz, or nearly 40% of its planned amount. If we read the first quoted text above (1976), the gold price reached a low in August 1976 after the second IMF gold sale.

Oh, did I forget to mention that another 2.14 Moz of foreign held gold at the Federal Reserve was dumped into the market in 1976?? So, between these two official institutions, over 6 Moz of gold were sold into the market in 1976 alone to guarantee there was a FREE MARKET PRICING mechanism for gold.

I have to make a comment here. I spend a lot of time at energy and precious metals blogs. I am completely surprised at the lack of intelligence by individuals who are supposedly very “BRIGHT” in their respective industries. When I hear comments that gold is nothing more than a “13th Century Middle Ages Relic”, and that digit currency is the new monetary system… the Good Lord Almighty must be enjoying one hell of a BELLY-ACHING LAUGH.

These folks who seem to understand the ramifications of falling cheap energy production upon the global markets still cling to a FIAT MONETARY SYSTEM that needs an ever-increasing supply of cheap oil to survive. How on earth are they unable to CONNECT THE FRICKEN DOTS is beyond me.

Regardless, the Fed, Central banks and IMF have been rigging the gold market for quite some time… and continue to do so.

During the 1960’s Gold Pool it was more a physical market intervention as they dumped 78 Moz of gold to maintain the official gold price of $35 an ounce. Then when Nixon dropped the Gold-Dollar Peg in 1971, these official institutions combined “Physical gold dumping” along with the “Creation of a Paper Gold Futures Market in 1975” to rig the gold market during the wild 1970 decade.

I don’t have a lot of data on the paper futures market in this article (will be in future Paid Report), but here is a tidbit on some of the trading volume:

Global Paper GOLD EXCHANGE Annual Trading Volume

- 1975 = 84 Moz

- 1977 = 190 Moz

- 1979 = 1,027 Moz

From the beginning of paper gold trading on the Global Exchanges, it increased from 84 Moz in 1975 to an astonishing 1,027 Moz (1.03 billion oz) in 1979. The tremendous trading of paper gold contracts (later on including options) sucked in a massive amount of funds. Thus, paper gold trading funneled a great deal of money away from physical gold and into worthless paper gold.

As I mentioned, I don’t have a full reporting of all the official gold that was dumped into the market from 1971-1980. That will be included in an upcoming report. However, it was stated in the USGS 1980 Gold Yearbook, that the IMF did complete its final gold auction in May 1980. This was their final gold sale that equaled a total of 25.5 Moz from 1976 to 1980.

If we include this amount with the sales of foreign gold at the Federal Reserve and other official gold sales, the amount of gold sold during the 1970 decade was quite an impressive amount… probably something north of 50 Moz.

Again, this was all done to guarantee a FREE MARKET price discovery for gold. Today, most Americans and citizens around the world have no idea just how undervalued gold is. No idea whatsoever.

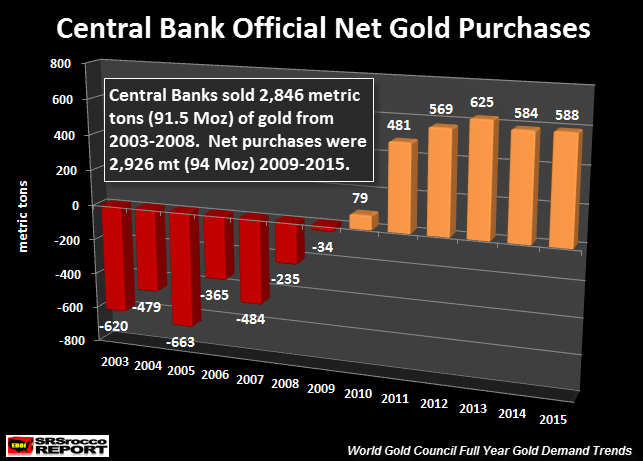

Since the peak of the gold price in 1980, the Fed and Central Banks continued to dump physical gold into the markets at various times up until 2009. However, “Official gold sales” turned into net “Official purchases” in 2010. This put a severe KINK in the Western Central Bank plan of gold market rigging. Just seems like those problematic Chinese and Russians have a much different idea about REAL MONEY than the West.

To continue rigging the gold market in the 1990’s and onwards, the West had to introduce “Gold Leasing” and more exotic “Gold Derivatives” to keep the gold price from going completely BONKERS. Again, this has been done while the public remains completely in the dark.

In conclusion, the Fed and Central banks were in serious trouble in 1971. Not only was the dropping of the Gold-Dollar Peg in 1971 a sign that things were about to get very interesting with the gold price, but the forecast of exploding gold demand would have resulted in a 25 Moz deficit by 1980. This forced the Fed, IMF and Central banks to dump a massive amount of gold into the market to meet the insatiable demand.

Which means, gold became too valuable to be used as money in the U.S. and Global economy. Yes, that sounds strange… but that is the truth. I mentioned this in a previous article on why silver was removed from U.S. coinage. It was due to the same reason.

When I say, “too valuable to be used as money”, I mean it in the way that money has degraded to. There are no real banks in the world. A bank should hold stored “ECONOMIC ENERGY” as stated by Mike Maloney. When someone deposits gold at a bank, that is REAL MONEY. A bank is supposed to store real money. Instead, banks store DIGITAL IOU balances, or worse yet, highly leveraged loans.

Since Nixon dropped the Dollar-Gold Peg in 1971, the amount of debt in the world has skyrocketed. The Central Banks designed a two-tiered system to remove gold as a reserve asset:

- Dump physical gold into the market to suppress or maintain price. Then add a Paper Futures Market to funnel funds away from a limited supply of physical gold and into an unlimited supply of paper gold contracts.

- Increase world debt to such massive levels, that interest rates had to fall towards zero.. or negative. Thus creating a 30+ year artificial Bond Market Rally. If interest rates rise… the entire system BLOWS UP.

While the ultimate revaluation of gold and silver has taken more time than most of us in the precious metals community anticipated, THAT DAY IS COMING.

As I have mentioned in several articles and interviews, the timing of this event will be known by what takes place in the energy markets as they are the drivers of our economy… and the highly leverage Fiat Monetary System.

Investors should not try to time the markets by selling Stocks, Bonds or Real Estate before the crash comes and then move into physical gold and silver. Rather, that should be done on an ongoing basis as the TIMING of the event is impossible to predict.

However, it is much wiser to do be in the metals a DAY EARLY than a DAY LATE.