via JOHN RUBINO:

It’s disconcertingly quiet out there. The local/regional bank near-death experience is firmly in the rearview mirror. Most Americans still have jobs. And the debt limit pseudo crisis is in its final inning and — if history is any guide — will be resolved soon.

So why does it seem like we’re tipping into a recession, or something much worse? The general answer is that behind the headlines a lot of disturbing trends are moving into territory that in the past have preceded serious downturns. Here are 10 worth watching:

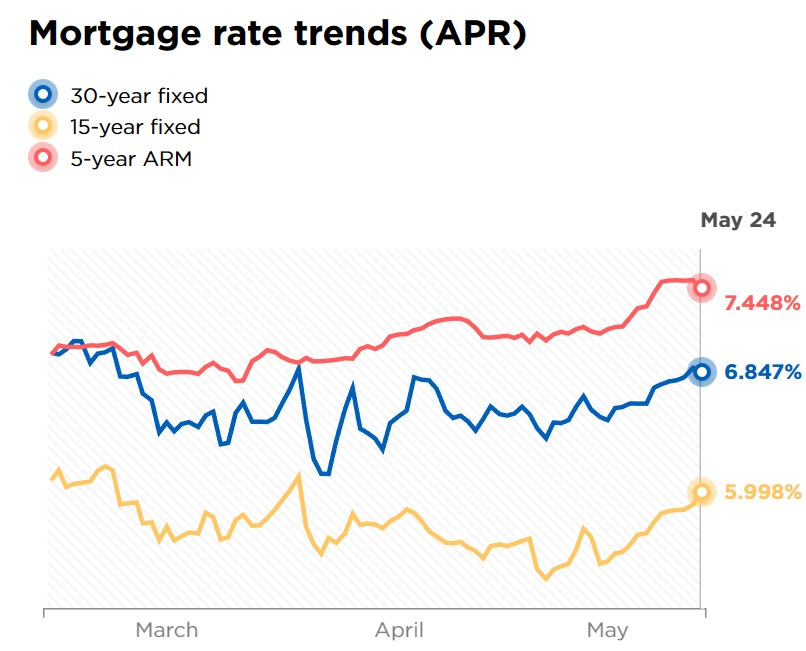

Mortgage rates are rising again. This chart is a few days old; the current average 30-year fixed is now 7%.

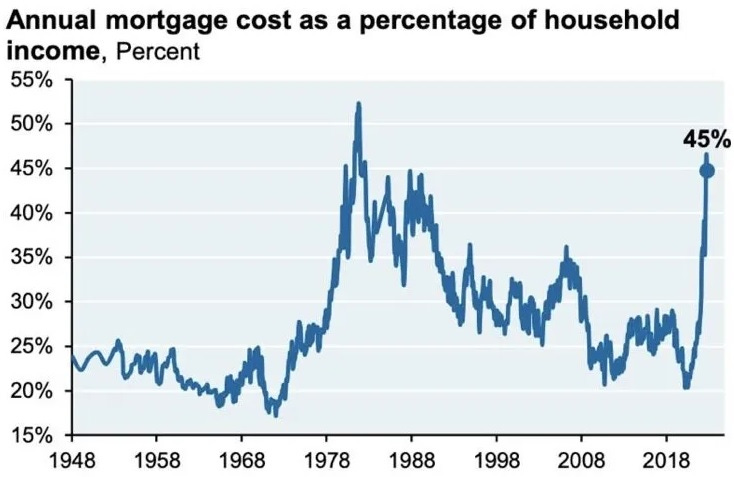

Houses bought with these new high-rate mortgages are debilitatingly expensive for the average home buyer.

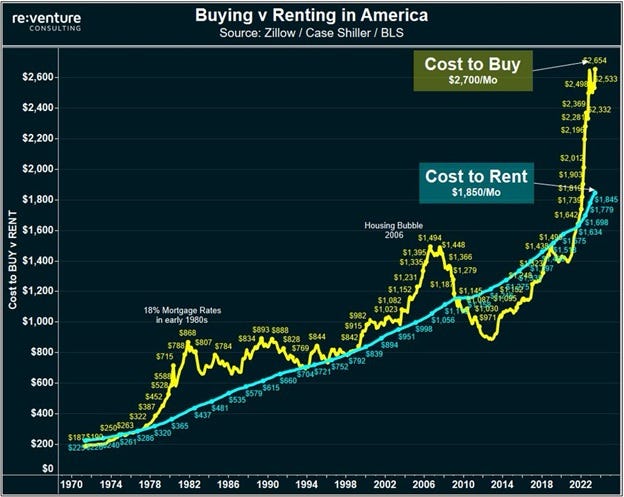

Viewed through a different lens, the cost of buying a house has soared beyond the (also steadily rising) cost of renting.

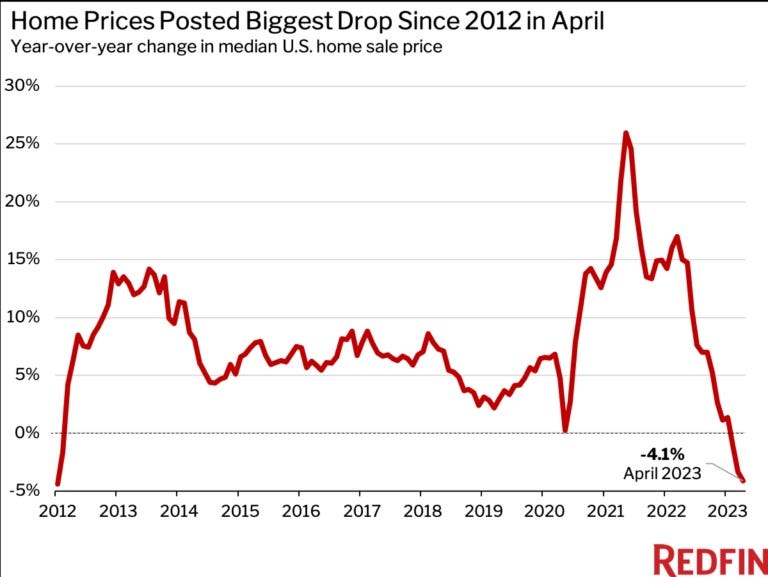

The housing market, as a result, is starting to roll over. Existing home sales in April fell by 3.4% from March and were down 23.2% versus April 2022.

Home prices, after spiking during the pandemic, are headed back down. April’s 4.1% year-over-year drop was the first negative read since 2012.

But it’s not just housing

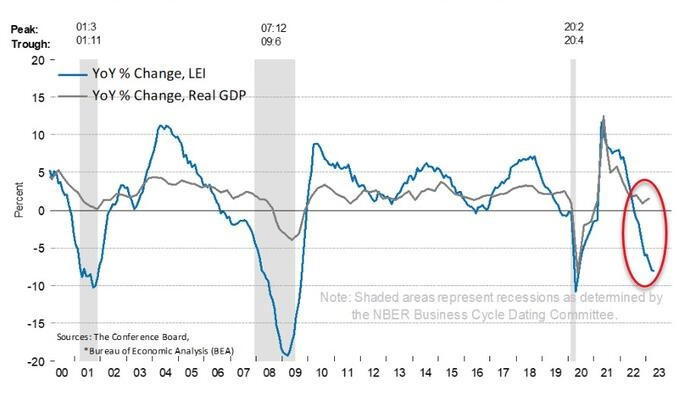

The Index of Leading Economic Indicators (LEI) is a compilation of stats that tend to foreshadow future economic activity. Hours worked, for instance, predicts changes in incomes and spending in the coming quarter, while new manufacturing orders predict corporate sales and profit growth. There’s a lot more like that, making LEI a good predictor of recessions in the past. Today it’s flashing red.

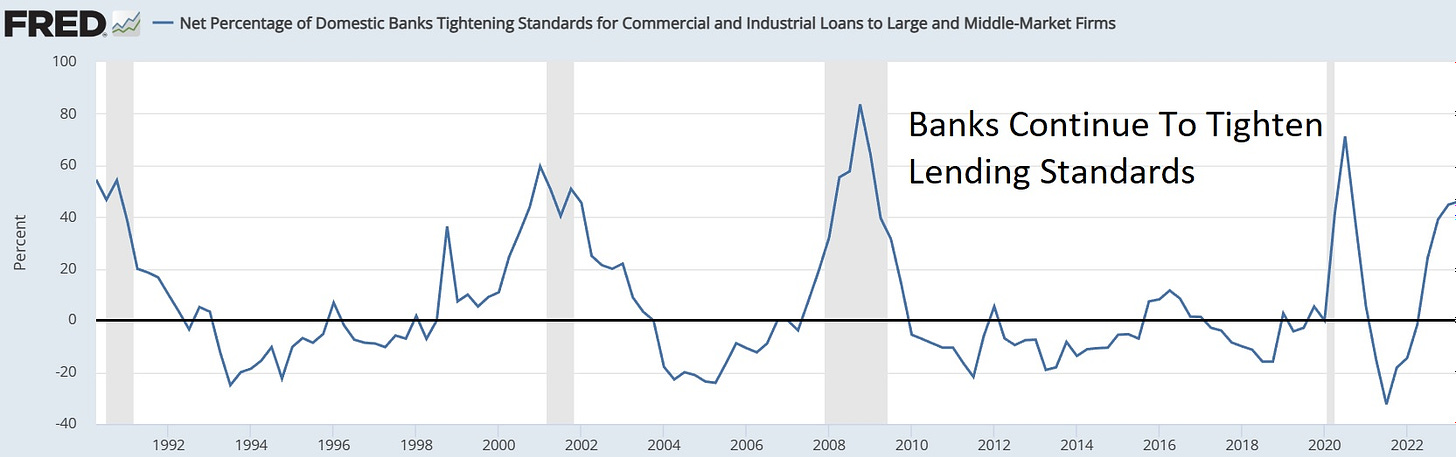

Banks have been spooked by the damage higher interest rates are doing to their bond and real estate portfolios. So they’re now lending to only the most creditworthy customers. Junk financing is drying up, leaving a country full of debt zombies to fend for themselves.

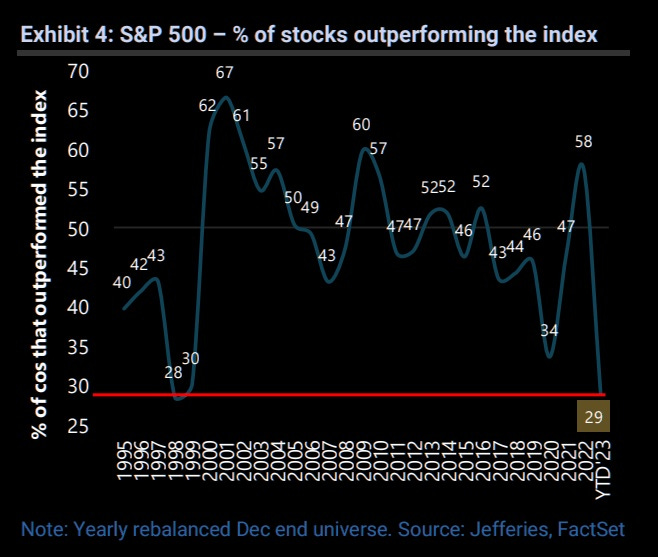

Stock market breadth keeps deteriorating, meaning that fewer and fewer stocks are supporting the broad indexes, and by implication the broader economy.

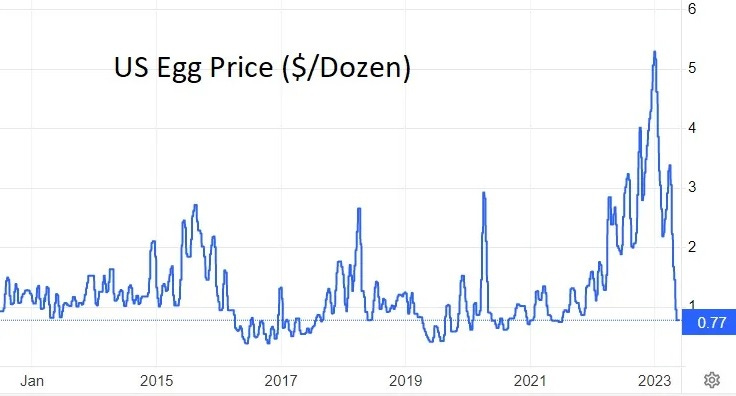

As for specific commodities, remember the egg shortage?

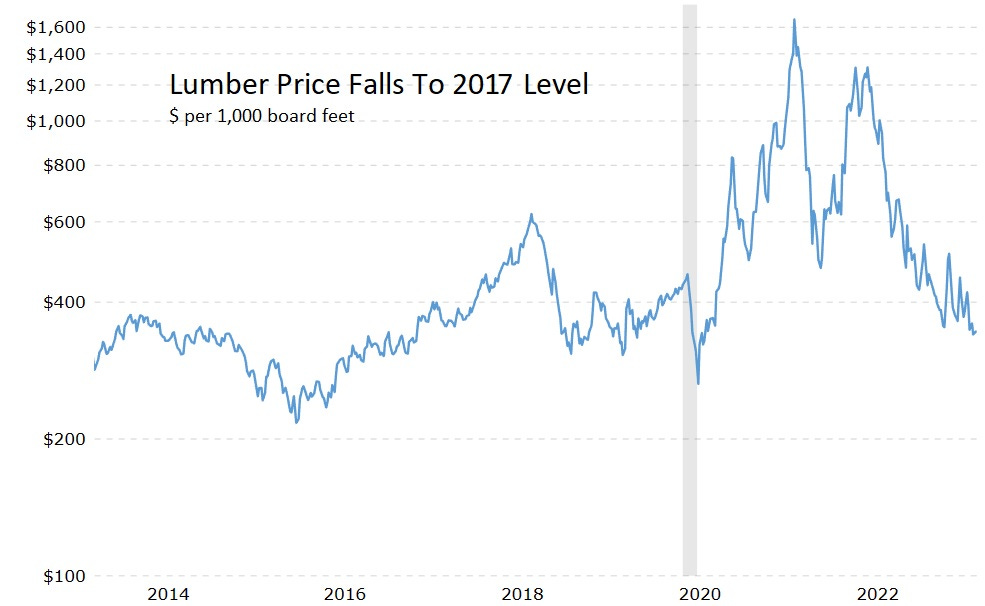

And the lumber price spike that caused so many people to cancel their home-building plans?

So why aren’t we already in recession?

One plausible theory is that during the pandemic the Fed created a truly insane amount of currency and dumped it into the system. That cash continues to work its way through, causing prices to keep rising and consumers to keep spending.

But the credit spigot is now turned off, so when the last of the pandemic funny-money dribbles through the economy, the trends highlighted here will become the dominant drivers of future activity. And we’ll finally fall off that cliff. Prepare for an ugly year.