Posted on Reddit

I’ve been posting since 2018 when technical conditions have seemed to reach manic extremes.

In January 2018 I posted at that exact top and shortly before the “Vixpocalpse” – The Evidence for the Greatest Top in History.

In November 2019 – Things are about to get Fun and Scary was posted shortly after the top and before the plunge into year end.

A couple of months before the March 2020 crash I posted Closing in on the Greatest Crash in History.

So here we are again looking at mania level extremes in sentiment. A sentiment extreme is a psychological condition — investors have to FEEL it.

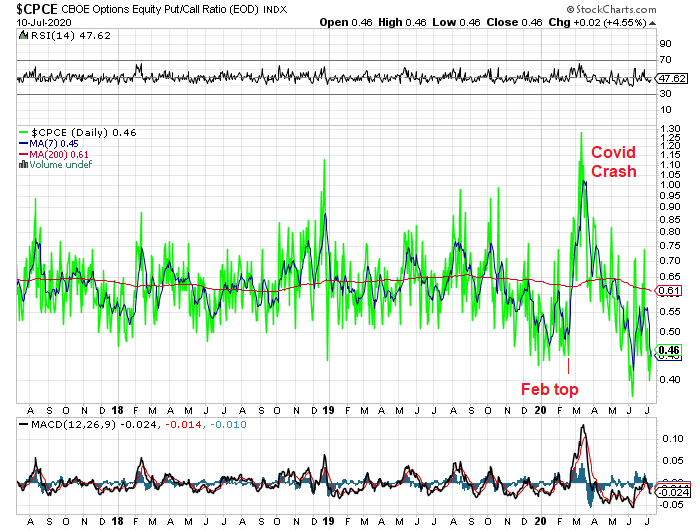

The put/call ratio has been even lower than in February.

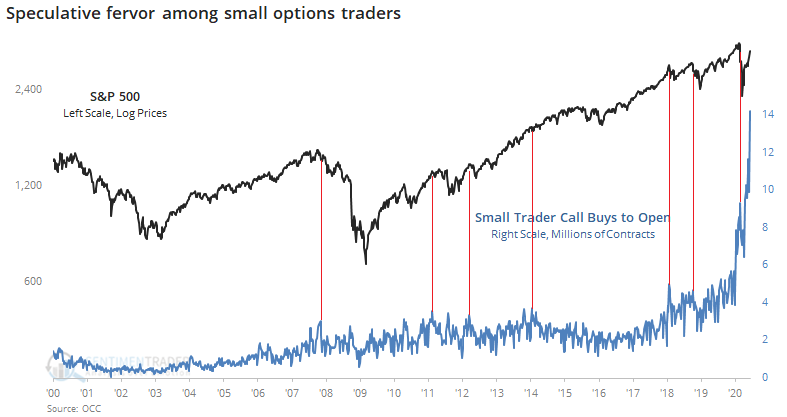

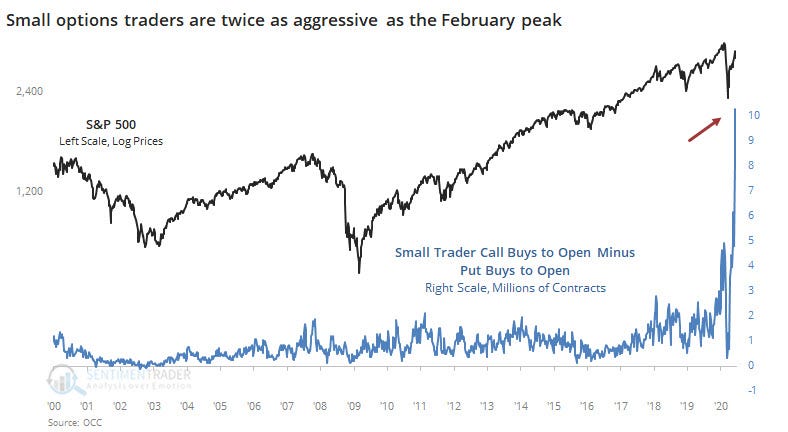

Small options traders have been big call buyers. (These next couple of charts are about a month old).

But they’re not buying puts either…

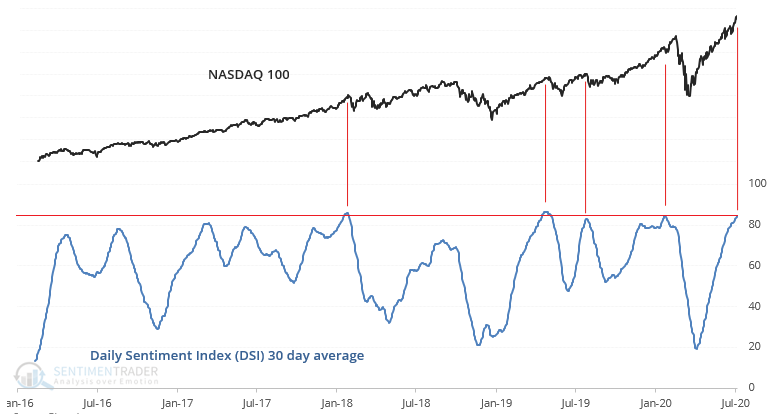

Tech has been the focal point of the buying — now even more than ever. The daily sentiment index is about as extreme as it gets and has reached 93% on at least a couple of occasions. The 30 day average is also extreme.

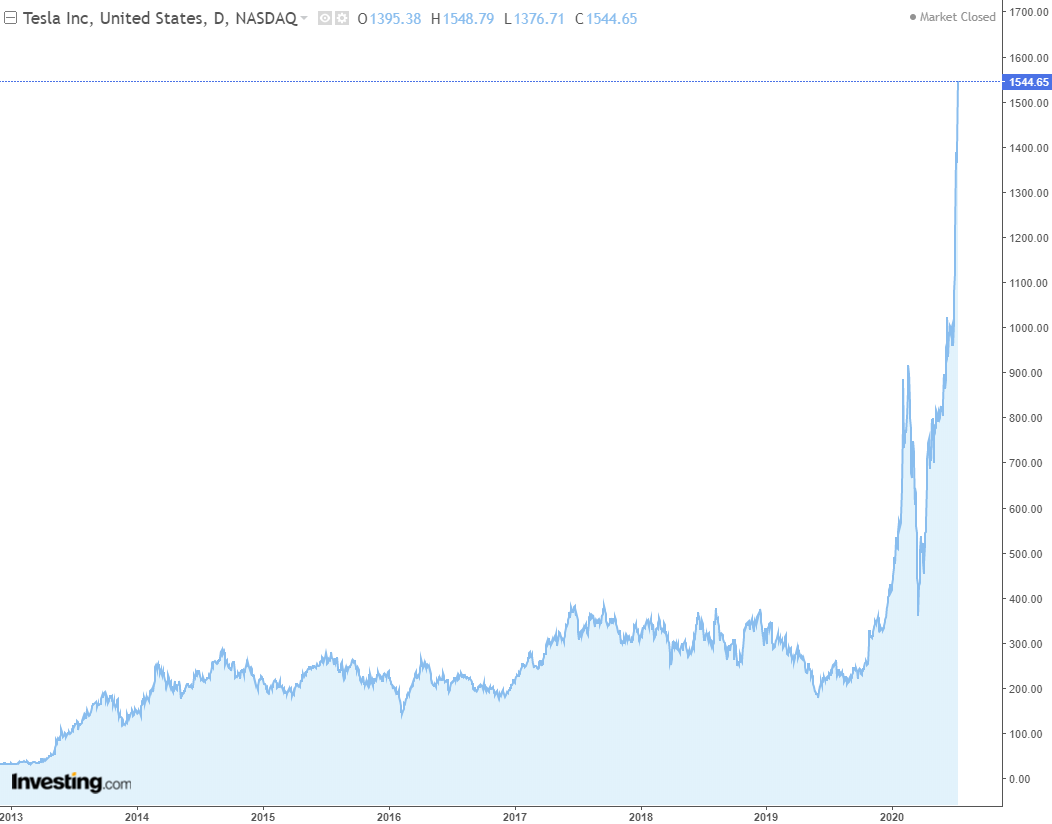

Financial manias typically have stocks that do something insane. The level of stupidity has been so intense that even bankrupt stocks such as Hertz, Chesapeake and JCPenny got bid up. Apart from bankrupt stocks surging in price we also have Tesla, now the most valuable automaker in the world! Also more valuable than many of the worlds great automakers put together.

One of the indicators that this bubble era is coming to an end (well apart from the economic depression) is the narrowed focus on tech and certain stocks within tech.

This chart is of the ratio between the S&P500 and S&P500 equal weight. When it declines there is a bigger focus on larger cap stocks.

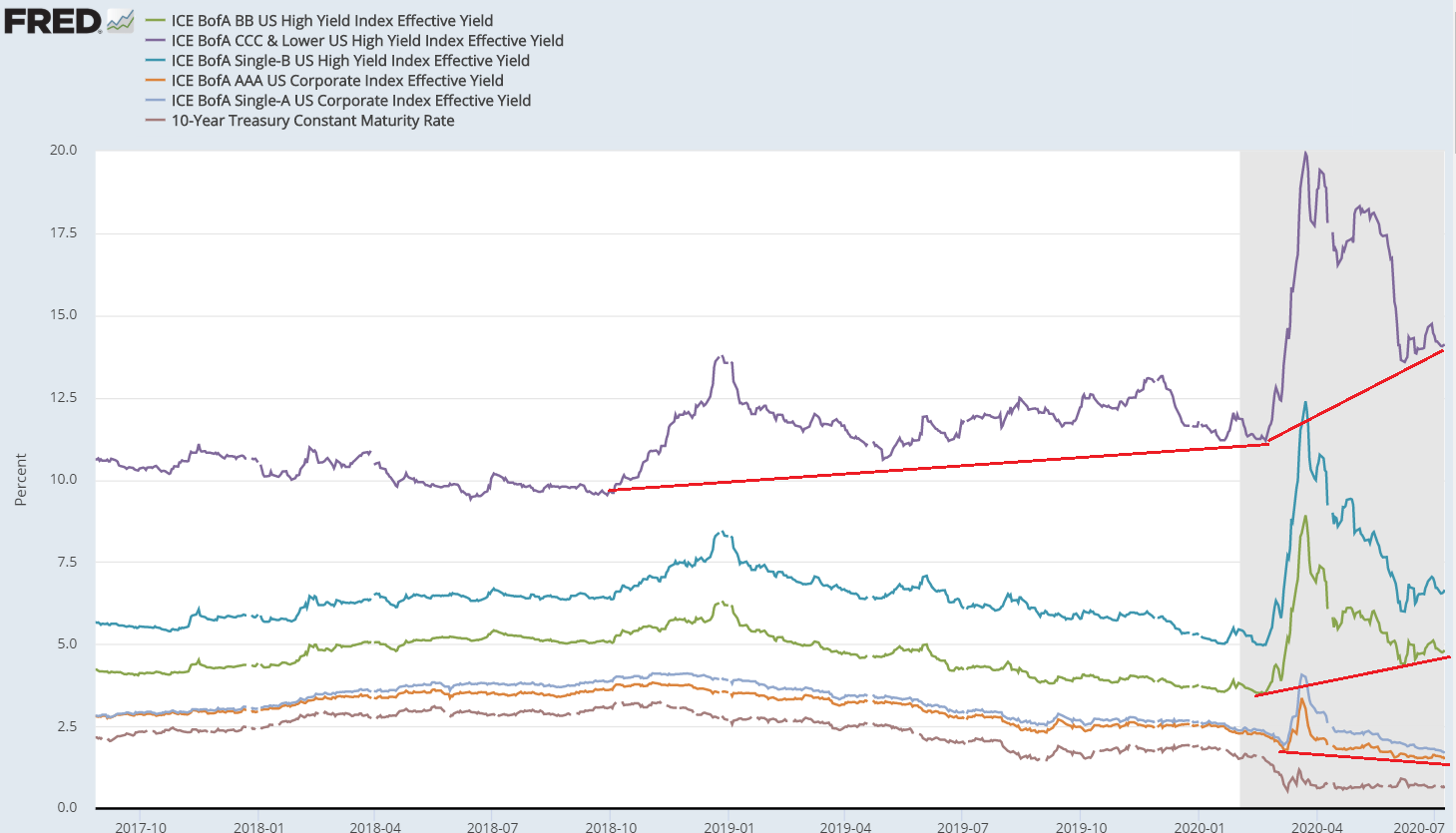

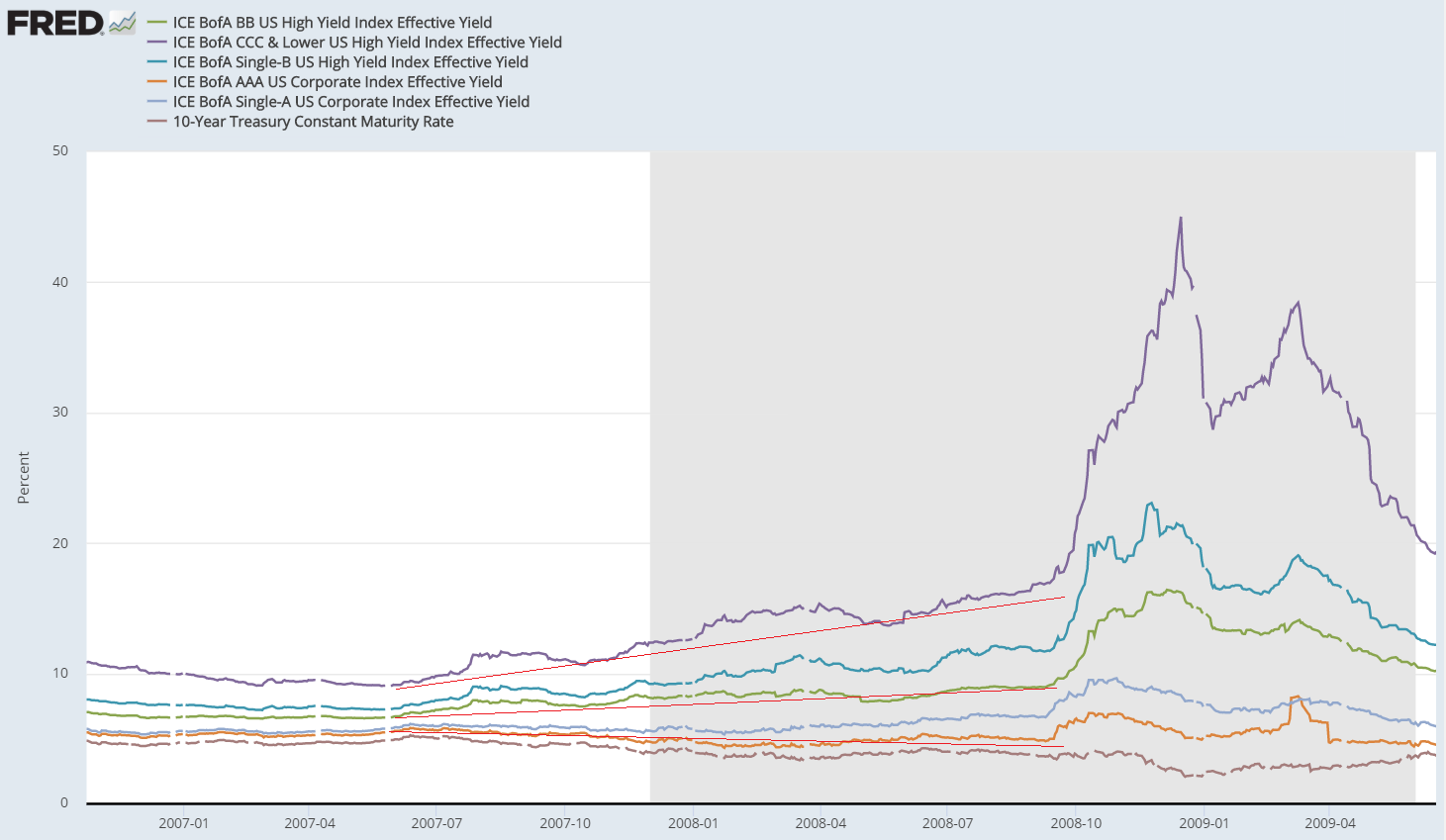

We also see a divergence in corporate credit yields. A sign of emerging risk aversion.

This sort of divergence also occurred leading up to the 2008 crash.

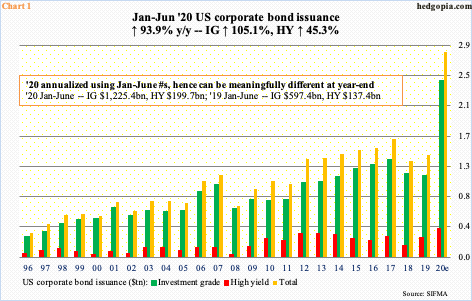

Despite this divergence in bond yields investors are still throwing money at corporations. Corporate debt issuance is at a record pace despite concern about insolvency. Note that it is investment grade borrowing that has really blasted off into the stratosphere.

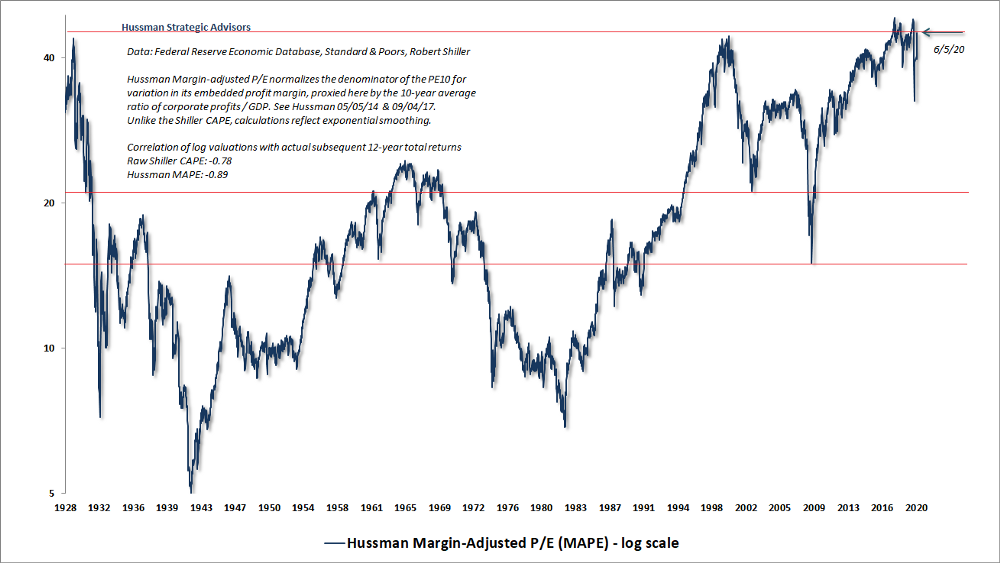

And of course stock valuations are still at some of the most extreme levels in history.

It might seem strange to have a financial mania in an economic depression but its the financial markets that tend to lead the economy if anything, as they did in March.

We’re also approaching the September/October period where historically such panics as the 1929 crash, 1987 crash and the epicenter of the 2008 crisis occurred. Whether a panic occurs during this time frame remains to be seen but it is something to watch out for as seasonally this period can be negative.