by Sven Carlin

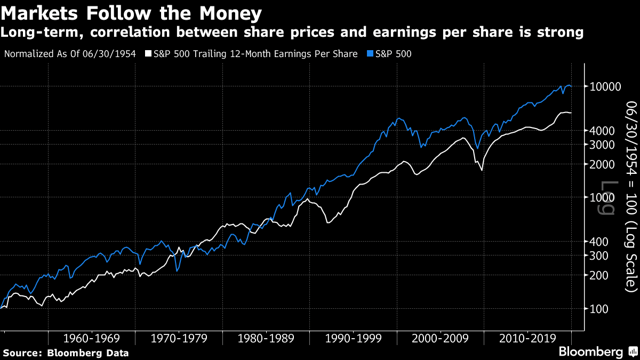

Historically, investment returns have been almost perfectly correlated to the underlying earnings the respective securities deliver.

Currently, S&P 500 earnings are in a Goldilocks period; margins and buybacks are at record highs, taxes have been lowered and debt is cheap.

However, by adjusting earnings for financial engineering, we see that corporate America hasn’t been doing great at all for the past decade.

By looking at fundamentals, valuations, margins, buybacks and taxes, it is likely things will eventually revert to the mean. This suggests the outlook is really ugly.

It is not difficult to determine one’s long-term investing returns. Those will be perfectly correlated to the underlying earnings the investment produces. The correlation between the S&P 500 (SPY) and respective earnings is very strong with shorter term term deviations from the trend that usually revert to the mean.

Therefore, to estimate the expected investment returns from investing in the SPY now, we have to take a fundamental look at earnings. A look that includes margins, the current trend in earnings growth, GDP based earnings versus accounting earnings, the impact of buybacks and valuations.

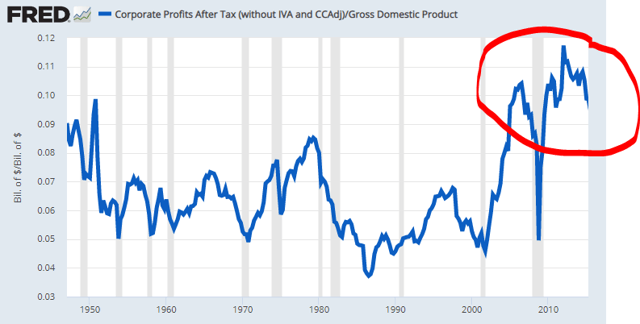

Margins are at historical highs and those are most likely to revert to the historical mean. It is really unlikely that corporate profits continue to make more than 10% of GDP for a longer period of time. It is also possible that we see higher corporate taxes in the future given the high budget deficits and low wage growth for half the population.

Source: FRED – Corporate profits

Source: FRED – Corporate profits

Further, thanks to all the buybacks, accounting earnings are diverging from GDP linked earnings. Therefore, one should ask whether there is a point to the current record high buybacks except for financial engineering. Given that businesses aren’t focusing on organic growth, but only on engineered growth, the outlook isn’t a good one.

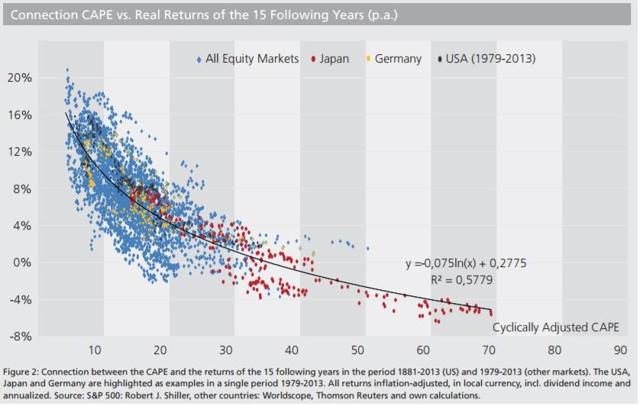

On top of the above, valuations are also at historical highs and consequently one should expect returns close to historical lows. The S&P 500 CAPE ratio, that takes into account 10-years of average earnings to calculate the price earnings ratio, is at 30. Given the chart below, it is most likely for investment returns to be between 0% and 4% per year over the next 15 years. Source: Star Capital

Source: Star Capital

All in all, the outlook is grim for SPY investors. If you wish to dig deeper into my reasoning for the above, enjoy the below video.

Video content:

1:03 The importance of earnings

2:33 Historical perspective on margins

4:21 Current earnings are in a recession

6:04 GDP and engineered earnings

9:00 Valuations

12:14 Investing outlook

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.