The world we live in:

5 quarters up in a row, 6 months up in a row, 6 consecutive new highs in a row and the Fed is printing like it’s 2008 with valuations north of 205% market cap to GDP while billionaires are celebrating launching themselves into space.

— Sven Henrich (@NorthmanTrader) July 2, 2021

If drugs aren't allowed in sports why are they allowed in the stock market?

— Sven Henrich (@NorthmanTrader) July 2, 2021

Jobs up, unemployment rate up.

Goldilocks take:

Higher jobs means the economy keeps improving beyond expectations.

Higher unemployment rate gives the Fed the excuse to keep printing.

— Sven Henrich (@NorthmanTrader) July 2, 2021

There is no such thing as the stock market. Even in bubbly times like 2000 or today there are sectors/equities which are reasonably priced and will do well when the bubbles burst. Ht @johnauthers pic.twitter.com/gSU3QhNyAy

— M. Arouet (@MichaelaArouet) July 2, 2021

the FED 500 stock market

h/t @ThinkTankCharts pic.twitter.com/ThnJHSZC1S

— 🅰🅻🅴🆂🆂🅸🅾 (@AlessioUrban) July 2, 2021

Party’s Over: Bank of America Sees Stagflationary Mess Slamming Markets In Second Half

In short, a stagflationary mess is about to unfold.

The Fed Can’t Tighten

“The Fed will be forced into a state of more or less permanent ease, almost regardless of the reported inflation rate”…

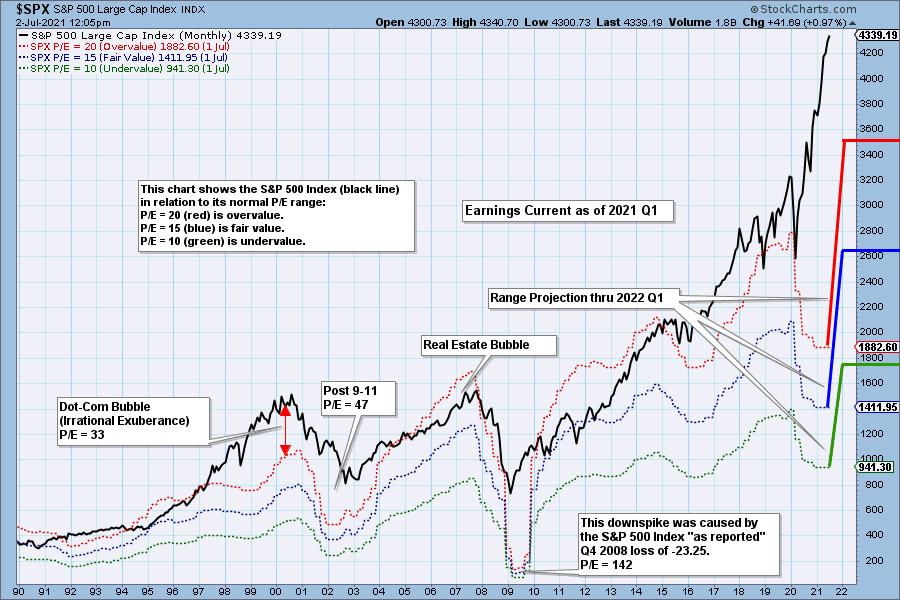

2021 Q1 Earnings Results: Still Massively Overvalued and Who Cares?: DecisionPoint

The normal P/E range for the S&P 500 is 10 (undervalued) to 20 (overvalued), but the P/E spike in 2009 nearly pushed that range into oblivion. The current P/E of 45.89 is the third highest in history, but it is the highest ever reached during a market advance. (The P/E peaks in 2002 and 2009 were reached after major market crashes.)