The Santa rally has finally hit.

It is highly likely fund managers/ the few remaining traders on Wall Street will gun the markets higher to end 2021 on the highest possible note.

But by all looks, 2022 will be the year of the next major crisis.

The Fed is beginning to tighten monetary policy. Sure, it’s highly unlikely the Fed will even be able to normalize monetary conditions completely, but the markets will no longer be receiving $1.4 TRILLION in liquidity from the Fed in 2022.

Additionally, the days of massive fiscal spending are over. It’s possible the Biden administration will be able to pass a watered-down Build Back Better bill of $1.8 trillion in 2022… but the days of $3-$5+ trillion in stimulus spending we experienced in 2020 and 2021 are over.

So that’s another $3+ trillion in free money the system won’t be receiving.

Add it all up, and you’re talking about the market no longer receiving $5 trillion or so in free money/ liquidity in 2022.

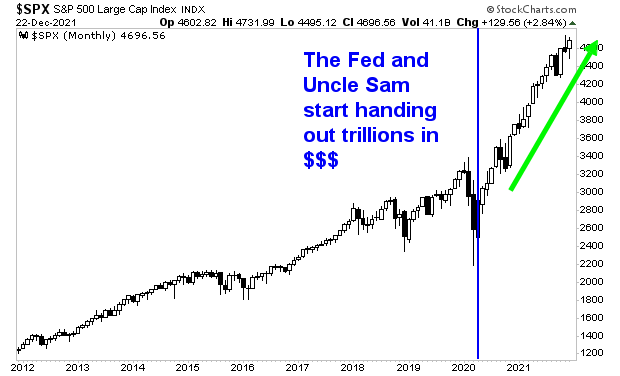

If you think this won’t have an impact, you’re mistaken. It is not coincidence that stocks went into BUBBLE MODE when the Fed and Uncle Sam started throwing around trillions of dollars in response to the C-O-V-I-D 19 pandemic.

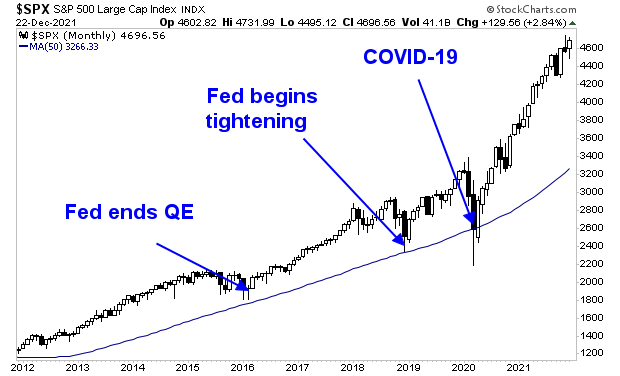

Every time the Fed or Uncle Sam have withdrawn easy money conditions, stocks have visited their 50-month moving average. Every. Single. Time.

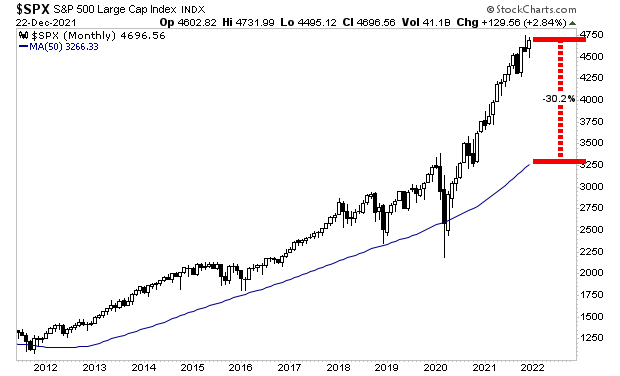

As I write this, the 50-MMA is at 3,200. That’s a full 30% lower than where stocks are trading today.

Moreover, it’s quite possible the markets will be entering a prolonged BEAR MARKET in 2022… a time in which stocks lose 50% or more over the course of months.

The coming bust is going to be life-changing for many people. Most will lose much if not everything. But a small number of investors will generate LITERAL FORTUNES.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guidecan show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,