By Graham Summers, MBA

Let’s cut through the narratives and media “BS.”

The Fed is trapped.

Inflation is soaring. And the Fed has signaled that it is shifting its focus from growth (employment) to inflation. Specifically, after 20 months of claiming inflation is “transitory” and not a problem, Fed Chair Jerome Powell has publicly stated that he no longer believes inflation is “transitory” and that the Fed can consider wrapping up its taper “a few months sooner.”

This means the Fed will be tapering QE and hiking interest rates sooner than expected.

There’s just one small problem.

As Lawrence McDonald recently noted, there is over $30 TRILLION more in debt trading at yields lower than 2% than there was the last time the Fed attempted to raise rates.

For bonds with yields this low, every time the Fed raises rates, there is a dramatic impact. Remember, the yield on U.S. Treasuries are the “risk free” rate of return against which the entire financial system is valued.

So, when the Fed raises rates, all debt, including that $30+ trillion must adjust accordingly. This means those bond prices FALL and their yields RISE. And if they rise enough, the investors begin to default.

Put another way, this time around, there is a $30 TRILLION+ ticking bomb sitting there. And the Fed is going to start playing with matches right next to it… hoping the fuse doesn’t light by mistake.

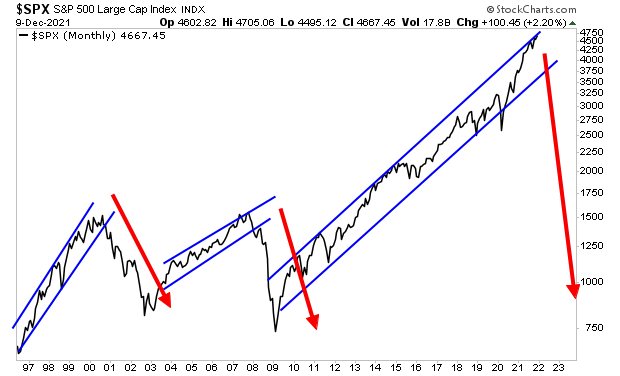

Given that Fed’s attempt in dealing with the Tech Bubble and the Housing Bubble resulted in full-scale crises…what are the odds the Fed can successfully deflate this current Everything Bubble… which is exponentially larger than the first two?

Look at the below chart and you tell me.

It is HIGHLY likely another bloodbath is coming to the markets.

It’s quite possible the markets will be entering a prolonged BEAR MARKET… a time in which stocks lose 50% or more over the course of months.

The coming bust is going to be life-changing for many people. Most will lose much if not everything. But a small number of investors will generate LITERAL FORTUNES.

Let me be blunt here, if you’re not taking steps to prepare for what’s coming, NOW is the time to do so.

For those looking to prepare and profit from this mess, our Stock Market Crash Survival Guidecan show you how.

Within its 21 pages we outline which investments will perform best during a market meltdown as well as how to take out “Crash insurance” on your portfolio (these instruments returned TRIPLE digit gains during 2008).

To pick up your copy of this report, FREE, swing by:

https://phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards,