As I first noted in my best-selling book The Everything Bubble: The Endgame For Central Bank Policy, “politicians make promises, but bond markets deliver.”

What I meant by this is that our entire political system is now consists of government overspending which is ultimately financed by the bond markets. As long as the bond markets remain stable, politicians will continue to spend and spend and spend.

And that is precisely what happened with the debt ceiling “resolution.”

We now live in a “one party” system that consists of Democrats, who like to spend trillions and trillions of dollars, and Republicans who like to sign off on 98% of Democrat spending, while arguing that doing so is a “win” for conservatives because the Democrats didn’t get 100% of what they proposed.

The latest Debt Ceiling “deal” is the latest example of this dynamic.

The Debt Ceiling deal features little if any spending cuts. Total federal spending will be reduced by about 0.2% of GDP in 2024. However, total spending then jumps 1% the next year (2025). And the debt ceiling is now suspended until 2025, which means we’ll likely tack on another $4 TRILLION in debt by then.

Inflation was already proving extremely sticky in some areas of the economy. We’re 15 months into one of the most aggressive monetary tightening cycles in history and CPI remains at 4.9% while Core PCE (the Fed’s favorite inflation measure) is at 4.7% and has been stuck there for FOUR MONTHS.

The fact the government will be permitted to continue running $1+ trillion deficits for the next 18 months will only make inflation even more embedded in the economy. The bond market knows this which is why bond yields are rising again.

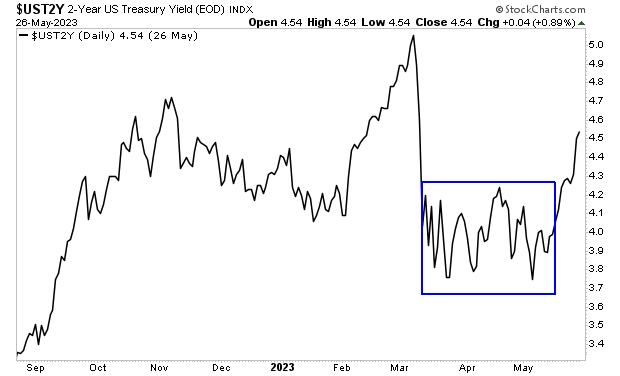

The yield on the 2-Year U.S Treasury has broken out to the upside after a three-month consolidation period. As I write this, it’s rapidly approaching its former highs.