It’s been a while since Wall Street banks recommended anything to do with either gold or gold stocks, but in a surprising reversal, last week one of Wall Street’s biggest bulls Credit Suisse said that the time has come to use gold stocks as a risk off diversifier, while seeing material upside for the precious metal.

Here is why CS’ global equity strategist Andrew Garthwaite, believes that it is now time to buy gold:

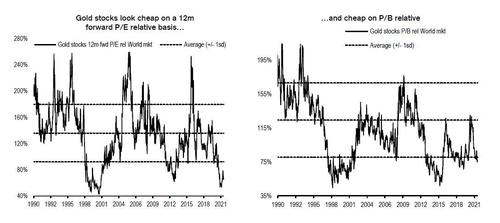

- First, according to Garthwaite, the valuation of gold stocks is abnormally cheap on both P/E – trading at a 25% discount to the broader market vs a 30% premium normally, and also cheap on a price-to-book basis relative to the market

- Looking at individual stocks, Credit Suisse writes that its “outperform”-rated stocks which screen cheap and have positive earnings revisions are: Newcrest Mining, Newmont, Endeavour Mining, Perseus, Regis Resources, St Barbara, Agnico Eagle Mines, Barrick Gold, Kinross Gold, Yamana Gold

As for the metal itself, the Swiss bank notes that gold is also at the bottom end of its 10-year range against silver or industrial commodities and 20% below its 2011 peak in real terms.