https://twitter.com/globalprotrader/status/994969292880924673?s=11

I’d say it’s a problem NOW and when we get a stock market crash and recession later this year, Fed Tax Receipts will dry up and those deficits turn from $1tln to 2 to 3… there’s a breaking point in confidence imho.

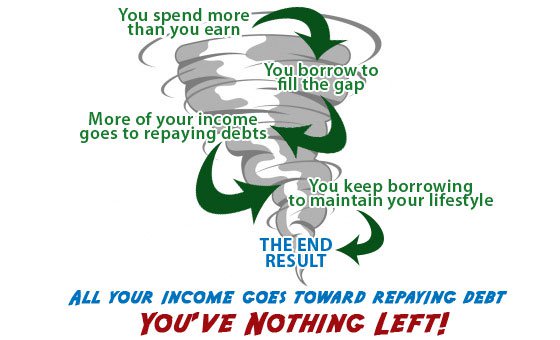

Trapped in a Debt Spiral, Americans Unprepared for Perhaps Sudden End

We have reached a point where there is near-unanimous agreement that our current rate of government debt spending is unsustainable.

But what does that actually mean? When debt ceilings come and go and even the temporary shutdown of the government becomes a semi-regular occurrence that doesn’t seem to impact anything, who can be blamed for seeing our financial quandary as one for which the bill, the one that must be paid now with no delay, will never come?

That bill will arrive. Nobody knows when. Making peace with the fact that the timing is unknowable, but still preparing for its inevitability, is the essence of sound preparation and investment.

The economy’s growth, which slowed in 2018’s first quarter, is not brisk; it still is not even the 3 percent that is the low end of presidential boasting. At the end of this month, the economy will amble into the tenth year of the expansion that began in June 2009. This month is its 108th, making it almost twice as long as the average expansion (58 months) since 1945.

Subprime Auto-Default Rates Top 2008 Level and Lenders Cut Back

Borrowers in the U.S. are defaulting on subprime auto loans at a higher rate than during the financial crisis, according to Fitch Ratings.

h/t David Brady