The Dangerous Season Begins Now

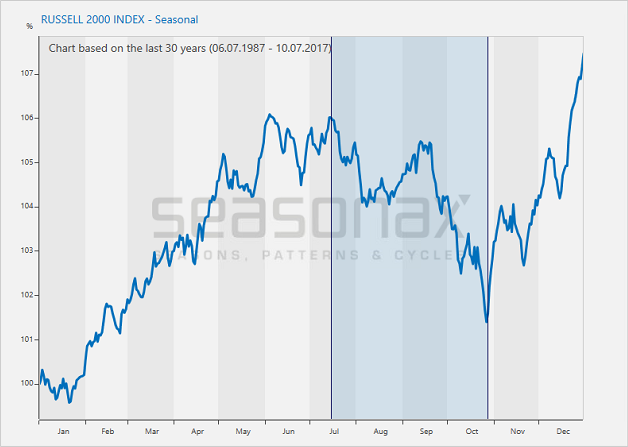

Russell 2000: 30-Year Seasonal Pattern

The Russell 2000 enters a period of seasonal weakness in mid July. Source: Seasonax

As you can see, the Russell 2000 does indeed typically decline between May and October. However, there is one last surge into a mid July interim peak before it actually begins to fall quite noticeably. This underscores the importance of analyzing seasonal trends with precision.

The period of seasonal weakness in the Russell 2000 Index is highlighted in dark blue on the chart. It begins on July 15 and ends on October 27.

The Russell 2000 declined in 17 of 30 cases in the weak seasonal phase.

But what were the returns of the index in individual years? The following bar chart shows the return the Russell 2000 generated between July 15 and October 27 in every year since 1987. Green bars indicate rising prices, red bars declines.

CREDIT SUISSE: The UK is ‘flirting with recession’ and it could begin by the end of the year

Britain is “flirting with recession” and could see its economy start to contract within six months, according to a new note from Swiss banking giant Credit Suisse circulated to clients on Wednesday.

Analysts Sonali Punhani, Peter Foley, and Neville Hill argue that while a recession is not hugely likely and does not represent the bank’s central scenario, there is as much as a 38% chance that a technical recession could be on the cards.

Britain’s economy grew just 0.2% in the first quarter of the year, and most current forecasts are for growth to be around that level in the second quarter as well.

That, Credit Suisse’s team says, is a troubling sign.

Bill Gross Warns: Central Banks Could Lead Us into a Global Recession

In the U.S. alone, households have $14.9 trillion in debt while businesses owe $13.7 trillion, according to the Federal Reserve.

- Bond expert Bill Gross says the Fed and other central banks should use caution when raising interest rates.

- The Janus Henderson fund manager has warned against stocks and bonds this year, though his fund is underperforming.

- Growth in China’s shadow banking is slowing amid coordinated government action to contain systemic financial risks, Moody’s said in a note Tuesday

Growth in shadow banking in China is slowing due to coordinated government action to contain systemic financial risks, a development that will benefit banks, although it will also bring adjustment risks, Moody’s Investors Service said in a report Tuesday.

The ratings agency’s analysis showed the effectiveness of coordinated measures by authorities by the central bank, the banking and securities regulators “to slow runaway growth in shadow banking.”

Actions included the central bank changing its monetary policy setting in the last quarter of 2016 to “moderate neutral” from “moderate,” which raised market funding costs and refinancing risks for banks, reducing the return from supporting long-term investments with short-term market funds, said Moody’s.

In March and April, the China Banking Regulatory Commission also requested banks test whether their interbank liabilities would exceed the regulatory ceiling at one-third of total liabilities.

As the Greek crisis continues to spiral downward, the housing market gets hit and value of homes decline dramatically. Rental growth declines, following a similar pattern in 2007 going into the 2008 recession. Philly Fed slumps. Corporate media reports that to many Americans are purchasing homes they can’t afford, it begins. ECB is ready to push stimulus if the economy starts to decline and falter. The central banks know that the collapse is headed our way, this is why they are prepared with stimulus. The Fed, like they have done in the past has fooled the American people, they will be rising rates, to bring down the economy.

Bonus:

Social Security is running out of money and time

Chicago Tribune–18 hours ago

But barring action between now and then to reduce costs or increase … familiar to every Illinoisan who knows about the state’s debt-bedraggled pension system.

State, municipalities face higher borrowing costs from falling credit …

KTOO–11 hours ago

Alaska’s credit was downgraded by two rating agencies in the past week. The state … Those estimates are by Deven Mitchell, the state’s debt manager. He’s in …

Connecticut Sinks Deeper in Debt

Bloomberg–6 minutes ago

The state’s $17 billion teachers pension returned an average of 3.2 percentage point less than its 8.5 percent assumed annual rate of return between fiscal 2001 …

CDC: Half of Americans have diabetes or are at risk for it

Dayton Daily News–20 hours ago

$AMZN C R U S H E D pic.twitter.com/acGeGTTyu8

— Alastair Williamson (@StockBoardAsset) July 20, 2017

The once arrogant UK has transpired in to a basket case,and where homelessness is ubiquitous .