The US economy is now forecast to grow at a rate of 8.33% following the massive Covid lockdown. And the US Treasury 10Y-3M curve fell along with GDP forecast growth.

Over a longer period, you can see that the 3M Treasury yield virtually evaporated after The Fed went to near zero short-term rates following the Covid outbreak so that the 10Y-3M curve is really just the 10Y curve.

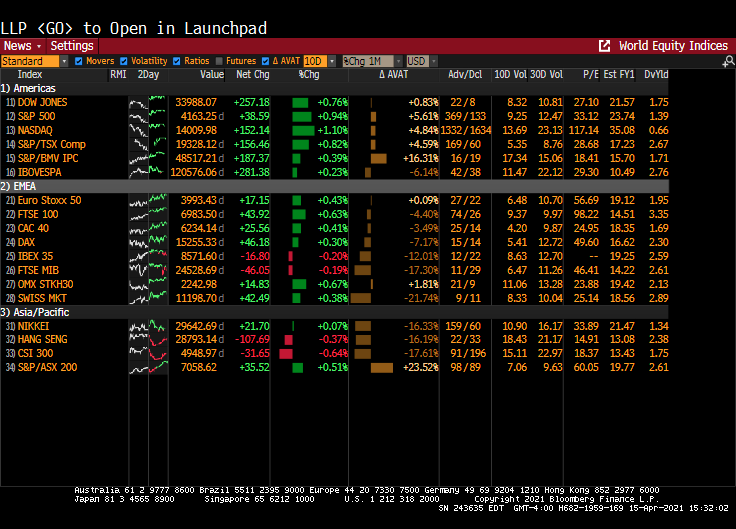

The stock market reacted positively to today’s good economic news. The markets are feeling hot, hot, hot.

Since GDP growth is 8.33%, why won’t The Fed return the short-end of the curve to “normal” levels, like in early 2019.

One reason why The Fed keeps short-term rates at near zero is the funding of the $28 TRILLION In US debt.

Are The Fed and Treasury pushing too hard??

Better that video than this one!