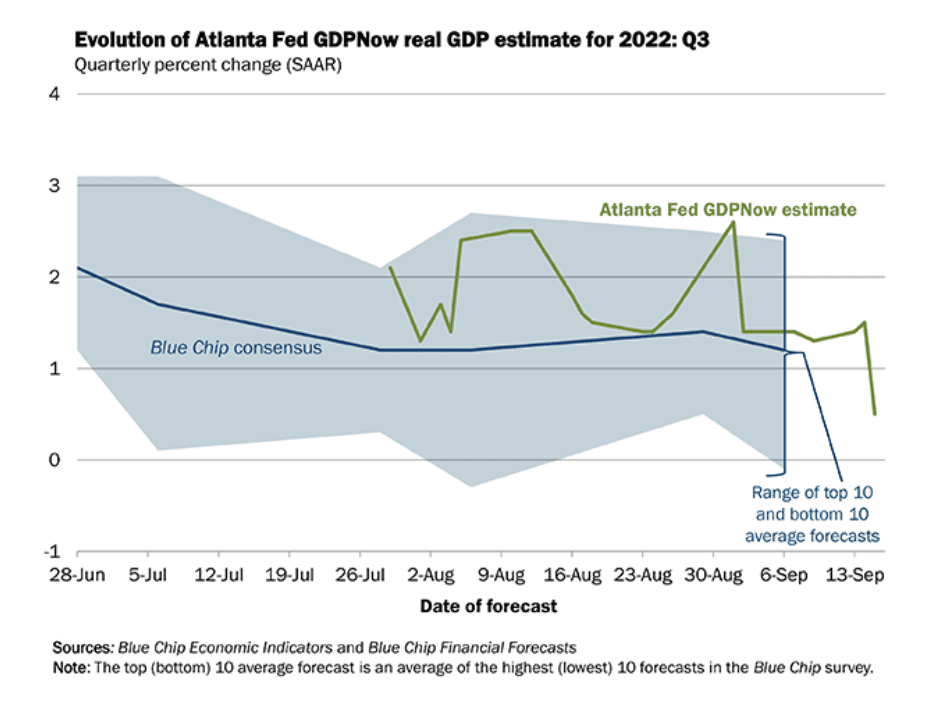

Estimated GDP by Atlanta Fed CRASHES 1 FULL POINT This Week!

Both the Atlanta Fed and the Blue Chip Consensus have taken deep dives in the past several days.

And in an unusual turn, the Blue Chip Consensus has been running below the Atlanta Fed all quarter; in previous quarters, it was usually higher than the Atlanta Fed.

Via the Atlanta Fed:

“Redfin” Predicts Housing Market Crash

If you’re looking to buy a home soon, you’re in luck. After two years of record high sales, data shows the housing market is starting to cool down, but there is a catch.

For the first time since March 2021, the average home is selling for less than its list price, but high mortgage rates are still impacting what people can afford.

Mortgage rates are the highest they’ve been in 14 years, reaching nearly 6%, according to the real estate company Redfin.

“This is the sharpest turn in the housing market since the housing market crash in 2008,” said Daryl Fairweather, Redfin’s Chief Economist.

Retail, Manufacturing Suggest Slowing U.S. Economy

Retail sales unexpectedly rose by 0.3 percent in August, topping the market estimate of zero percent growth, according to the U.S. Census Bureau’s advance estimates (pdf). This is up from the downward revised 0.4 percent drop in July, which was the first decline in seven months.

In total, consumers spent $683.3 billion, up by 9.1 percent from August 2021. This reflected that consumers are paying higher prices for goods and services. At the same time, the savings may have been accrued from lower gasoline prices as gasoline station sales tumbled by 4.2 percent. This potentially enabled shoppers to spend more on building materials and garden equipment (1.1 percent), general merchandise stores (0.5 percent), and apparel (0.4 percent).