Yesterday’s action sure seemed to come out of nowhere, didn’t it?

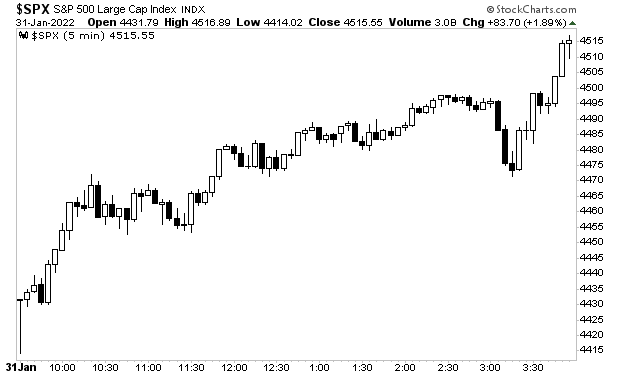

The market came roaring out of the gate yesterday morning and didn’t look back. Every period of weakness was bought aggressively by the bulls. And stocks finished the day up near 100 points on the S&P 500.

What happened here? Is the danger over and it’s time to buy?

Not so fast!

The financial media likes to act as if every market move is driven by fundamentals. But sometimes the market moves 100% based on manipulation. For those who aren’t aware of this, moves like yesterday’s can be quite tricky.

Let’s break this down together.

Fund managers must report their performance results every month. Yesterday was the last day of January. And going into that trading session, January had been a terrible month for most funds.

In simple terms, yesterday represented the last opportunity investment funds had to push stocks higher to ensure the month ended with the best possible results. So, they did what most people would do in that situation… they gamed performance by pushing stocks higher.

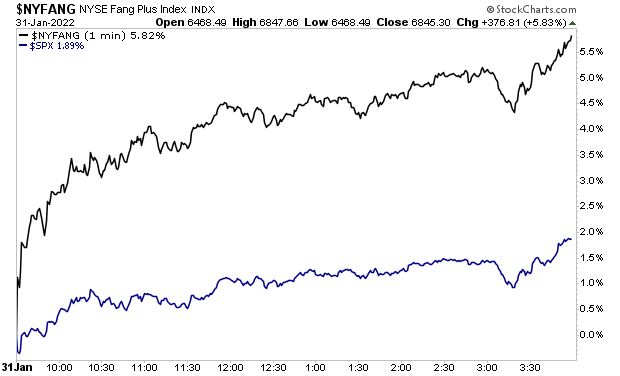

You can see this clearly in the Big Tech stocks (Microsoft, Apple, Alphabet, Facebook/ Meta).

These are the most over-owned companies on the market. Practically every fund on the planet owns them to the point that they’re often referred to as “hedge fund hotels.”

These companies exploded higher yesterday, dramatically outperforming the broader market. The FANG Plus Index which made up of large tech companies I just mentioned, rose over 5.8% while the S&P 500 was up just 1.89%.

What rational thinking investor bought shares of Apple or Alphabet or Microsoft in an absolute panic yesterday?

Again, these are the most owned companies on the planet. So where did the demand come from to force these companies to spike higher?

It was manipulation by the same funds that already owned these companies… and who were about to report awful performance numbers for the month of January.

This is what makes markets so tricky: if you’re not aware of what’s happening “behind the scenes” it’s easy to mistake these kinds of games for a real bull run.

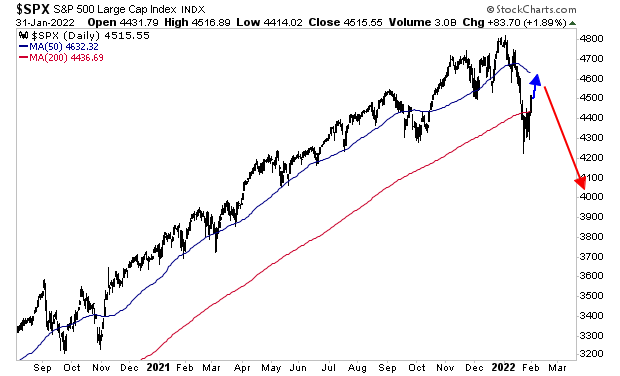

For those of us who know how the game is played, the most likely path for stocks going forward is this: