The Briefing

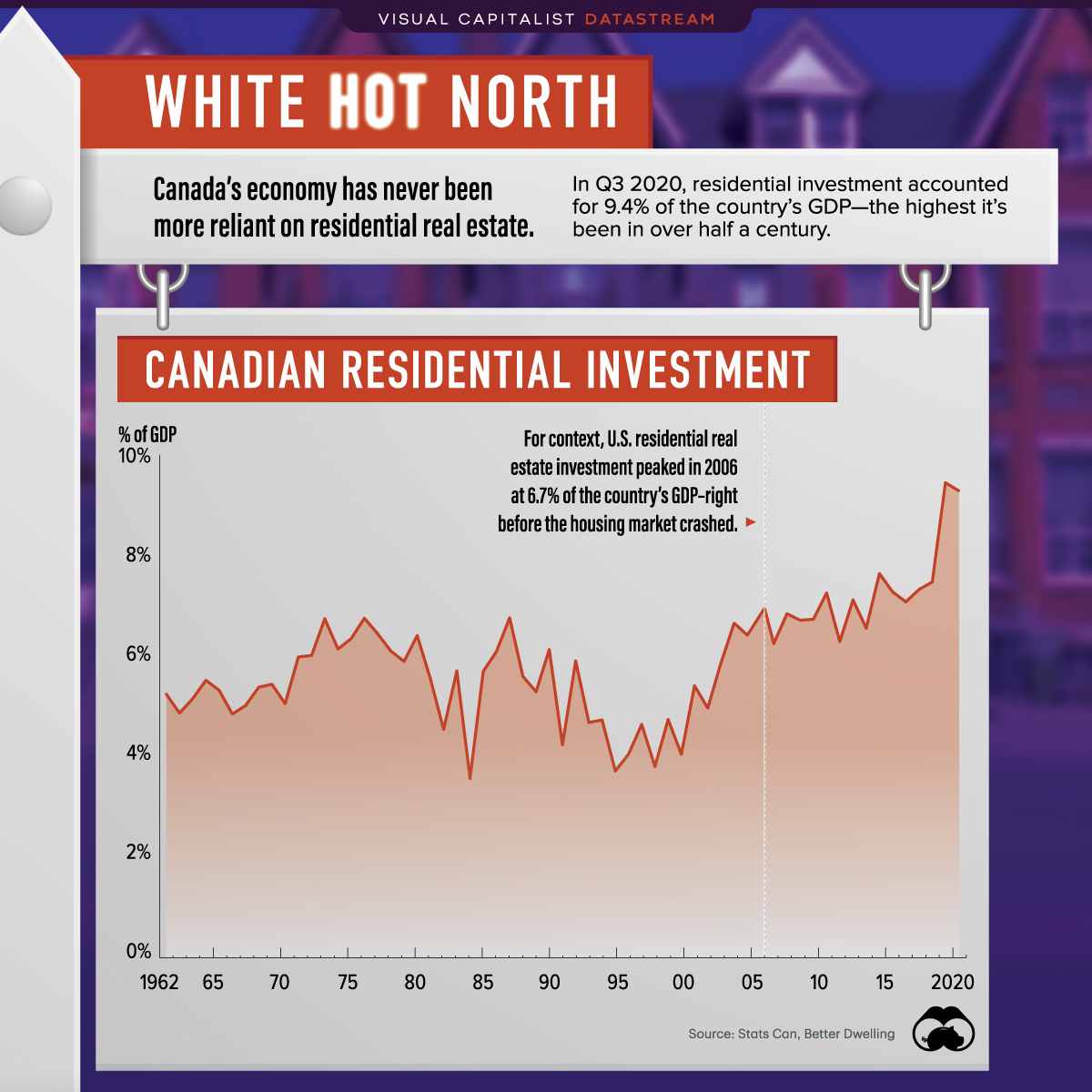

- Residential investment made up 9.3% of Canada’s GDP as of Q4’2020

- For context, U.S. residential real estate investment peaked in 2006 at 6.7% of the country’s GDP (just before the infamous housing crash) and it currently sits at 4.3%

White Hot North: Residential Real Estate Investment in Canada

Residential real estate is breaking records in Canada. As of Q4’2020, it accounted for 9.3% of the country’s GDP.

The purchase, sale, and construction of new homes in Canada currently makes up more of the country’s economy than it does in any other developed country.

There’s No Place Like Home

So why is there so much investment going into building residential structures? Here’s a look at just a few reasons:

- Increased immigration to Canada

- Falling mortgage rates

- Increased saving rates

The steady flow of immigration into Canada is a significant factor behind increased residential real estate investment. Prior to the pandemic, the country welcomed around 300,000 newcomers per year—increasing the demand for housing, particularly in urban hubs like Toronto and Vancouver.

Mortgage rates have also been steadily falling, making it easier to purchase a home. As of the latest 2020 data Canadian 5-year uninsured mortgage rates sat at 2.1%, compared to a steep peak in the beginning of 2019 at 3.7%.

Additionally, some individuals may have become more capable of affording a new home as increased saving rates have become a widespread trend during the pandemic, potentially adding to demand. This combined with increasingly flexible remote work options are increasing real estate activity around the country.

Higher Stress Tests

The increased demand has caused prices to skyrocket. As it stands now, if the housing bubble doesn’t burst, prices will continue to rise, and could become a major wedge separating those who can afford the increasing prices and those who cannot.

Two major Canadian cities—Vancouver and Toronto—are already among the least affordable cities in the world due to low vacancy rates and the immense demand.

According to CBC, the country’s top banking regulator is making a proposal to raise the mortgage stress test level. The idea is to raise it to 5.25% or 2 percentage points above the market rate, whichever is higher. This would be up from the current rate of 4.79% posted rate at Canada’s biggest lenders.

Borrowers will have to prove their ability to take out a loan at the higher rate, regardless of the lender’s ability to provide the loan at a lower one, in order to relieve some of the pressure on housing prices.