by Daniel Carter

After the sharp selloff in stocks in February, much has been said about a potential recession and stock market crash. Although these events are very difficult to predict, certain indicators are telling us that the next economic slowdown is very close. In this article, I will be focusing on one of the most widely used economic indicators, the yield curve. Let’s consider what the yield curve is telling us at the moment.

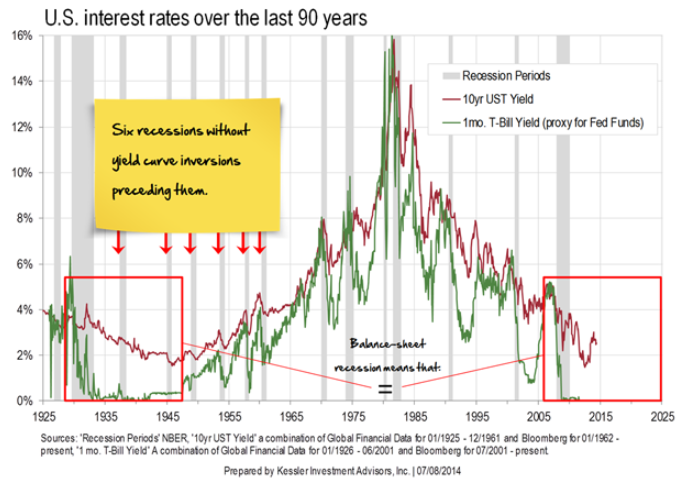

The yield curve can be measured many ways, but here I am referring to the 2s10s curve (I.e. 10-year yield minus 2-year yield). This is a particularly important economic metric because it usually shows us exactly when the next recession will occur. As you can see from the chart below, the 2s10s curve has inverted (gone below zero) before each of the last five recessions. You can also see that the yield curve seems like it might invert once again very soon.

Because of its reliability over the past several decades, investors have put a lot of faith in this metric. However, I believe the yield curve is currently more deceptive than people realize. To see why this might be the case, let’s look at the yield curve separated into its two variables (the 2-year yield and the 10-year yield).

Typically, before a recession, the 2-year yield rises so dramatically that it becomes greater than the 10-year yield. This is what causes the inversion on the yield curve chart. However, I don’t think that will occur this time. As you can see from the above chart, there was immense downward pressure on the 2-year yield after the Great Recession of 08-09. This was caused by the Federal Reserve’s Quantitative Easing program.

Because the Fed bought trillions of dollars of 2-year US Treasury bonds, the yield collapsed as the price of those bonds went up. Now, I believe, the 2-year yield won’t rise enough to cause the yield curve to invert. If the Fed had let natural market forces prevail, I believe the yield curve would have already inverted. This means that the time to worry about the next recession is now.

The yield curve failing to invert is nothing new. In fact, the last time we saw this phenomenon was during the last era of extremely slow economic growth, after the Great Depression. As you can see from the chart below, the last time the yield curve didn’t invert was when short-term yields were exceptionally low like they are today.

If I am correct, and the yield curve is already near its bottom, the next recession is only a matter of months away. Many investors talk about the falling yield curve as a bad sign, but it is actually worse once the yield curve bottoms and reverses to the upside. Look for a bottom in the yield curve soon and then a reversal to the upside for a sign that the recession is upon us.

The yield curve has been a very useful indicator for the last several decades, but it has become very complicated in recent years. I strongly believe that the 2s10s curve will not invert this time and that we are already very close to its bottom. Once the curve reverses direction, the recession is here.