by Martin Armstrong

QUESTION: Mr. Armstrong; You have repeatedly said that the USA was a lower dollar while Europe thinks a strong currency is better. You said the dollar would decline first into 2018. That seems to be spot on. After Treasury Secretary Steven Mnuchin statement that a weaker dollar is best for USA, the dollar sold off. Why is there is a huge difference between the USA and Europe with respect to currency values?

HD

ANSWER: First of all, you can bet that Mnuchin had a little help from his friend in NYC who piled on short positions before his speech. The USA had also wrongly believed that a strong currency meant a strong economy. During the Great Depression, Roosevelt’s Brains Trust were all against devaluing the dollar. Why? It is the bondholders. A devaluation of a currency means that you pay back with cheaper dollars.

Europe, on the other hand, went through two World Wars. Their currencies went to zero. Politicians used the value of the currency and proof they did a good job and should be reelected. No American politician could run and claim that the dollar is up against Mexico, Europe, and Japan so vote for them.

I became probably the largest FOREX adviser in the world because I was an American. When I was going to open up offices in Europe, I went to lunch with one of the heads of a major Swiss bank and ran a few names by him like European advisers etc. He asked me to name one European analyst. I was embarrassed for I could not back in 1985. He said there were none. Because currencies were used by politicians, it was unpatriotic to forecast any European currency would decline. He told me that was why everyone was using our firm – “You don’t care if the dollar goes up or down!”

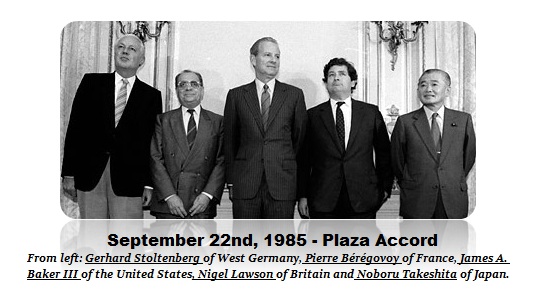

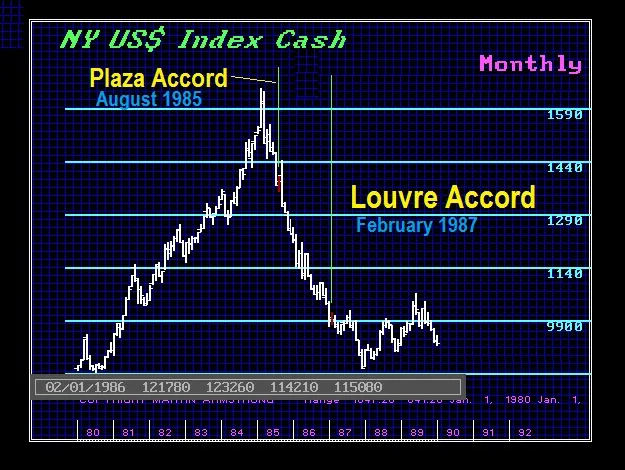

This is nothing new. The 1985 Plaza Accord was all about a coordinated effort to force the dollar down. That was the entire reason for forming G5 back then – now G7/G20. The New York Timeswrote: “Since 1985, the damage that accompanied the unfettered dollar has slowly started to be repaired. The Administration gambled that a big drop in the dollar, by making American goods cheaper and imports more expensive, would quickly translate into a large pickup in exports and a falloff in imports.”

Then the dollar fell like a stone and the G5 came out with the Louvre Accord and tried to stop the dollar decline. The markets did not comply.

The decline in the dollar was so significant that it then set in motion massive selling of US assets. The Japanese sold off debt and asset holding in dollars and took the money home, which then created the Japanese Bubble in 1989.

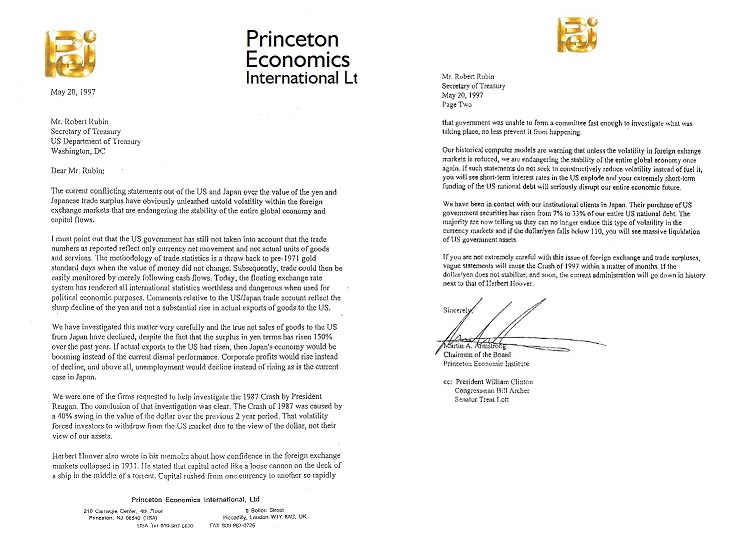

When Robert Rubin started the same nonsense trying to talk the dollar down again for trade, I wrote to him warning that he would create another crash.

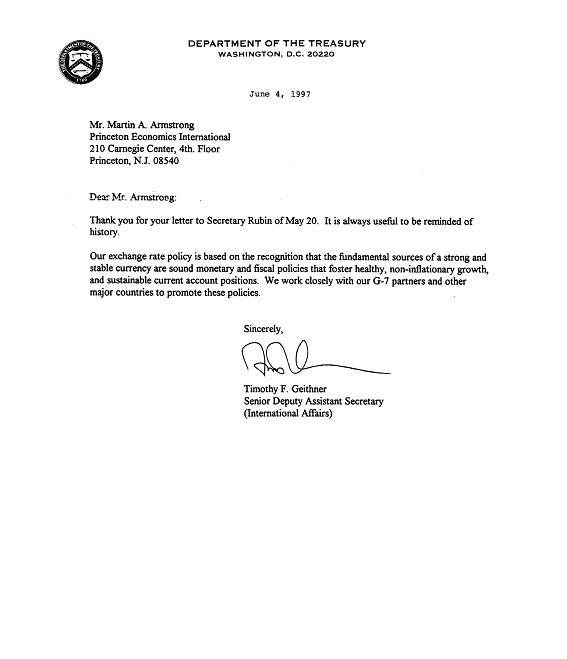

Tim Geithner replied saying they would never do that.

Trump is playing the same card. He wants a lower dollar to boost exports and create jobs. Yes, the dollar was scheduled to decline into 2018. However, only a dollar rally will create the massive collapse in the world monetary system. Make no mistake about this, they are not in charge. The dollar kept collapsing after the Louvre Accord. The dollar had peaked and was starting the decline before the Plaza Accord was announced.

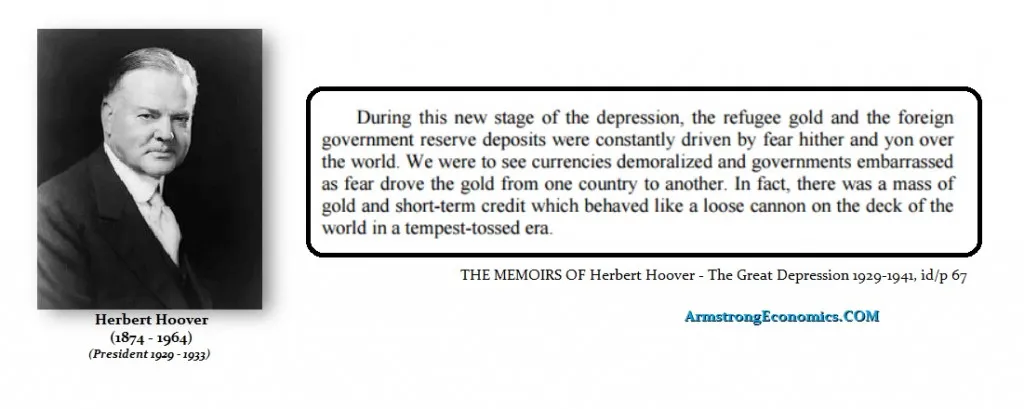

Central Banks and Governments may try to manipulate the currencies, but they too will be embarrassed. The words of Herbert Hoover should be read at every board meeting at the start of every Central Bank.