by John Mauldin

“T.S. Eliot once wrote, ‘Only those who risk going too far can possibly find out how far one can go.’ It seems the US financial system is bound and determined to find out.”

—John Hussman, July 29, 2021

“If I was Darth Vader and I wanted to destroy the US economy, I would do aggressive spending in the middle of an already hot economy… What are you going to get out of this? You’re going to get a sugar high, the higher inflation, then an economic bust.”

—Stanley Druckenmiller, July 23, 2021

“It’s not riding the tiger that is the problem, it’s the dismount.”

—John Mauldin, today

This week’s Fed statement was another non-story. They added a new line about continuing to “assess progress” which some interpret as a step toward tapering. If so, it was a baby step. They’re simply thinking about whether they should start discussing the possibility of making a plan to begin tightening when conditions are right.

This means the Jackson Hole speech in August will likely be a nonevent, and the earliest the Fed will even consider beginning to taper its massive quantitative easing is at the December meeting. Rate hikes are not even a discussion yet.

All this is as predicted in my Federal Reserve Folly letter last week. To reiterate, I believe the Federal Reserve has already made a policy mistake that will lead to great mischief if not a recession, depending on when they normalize. The problem is, they have created conditions that will cause normalization to have its own repercussions.

We are passengers in the Federal Reserve’s monetary policy plane. I fear the turbulence will be consequential. Will Jerome Powell be able to safely land in an airport of his choosing, or will he need to be Sully Sullenberger and find the nearest runway, even if it’s the Hudson?

I am worried the Fed will either let inflation become psychologically entrenched, or wait too long to stop it and spark crisis with a too-hasty response, but there are other possibilities. None are especially good.

Endgame Nearing

In a typical week I get dozens of responses to my letter. I read them all and appreciate the thought that goes into them—even those who think I’m wrong, and say so in not-always-gentle ways.

(Incidentally, you can comment by clicking the “Read Online” link at the top of your email. Our website has a comment thread after the letter. Or you can send an email to subscribers@mauldineconomics.com. Our team will forward it to me.)

A letter with distribution as wide as mine has a diverse and often quite opinionated audience. I appreciate the differences of opinion because they force me to think. Strangely, last week’s letter generated almost no disagreement. Some thought I hadn’t gone far enough. Others saw the Fed making different but still severe mistakes.

I may have stumbled on the one thing that unites all Americans: None of us like what the Fed is doing. I thought this response from reader “Sagelike” was well said.

[Fed Chair Jerome] Powell is no idiot and he knows what a complete mess things are so if I’m Powell I’d have to ask myself how I need to play this? I wouldn’t want to be the guy who presides over an economic implosion so I’d just keep the game going to avoid being tarred with that label for all time and, I’d retire in January with reputation more or less intact and leave the mess to someone else…

Debt monetization is the last and only option left on the table at this point. Interest rates can’t go low enough to spur growth as they are near zero anyways nor can they rise high enough to rebalance the system without leading to debt default and depression. QE forever doesn’t work so what’s left?

Debt monetization and real money printing are the only options left and it’s only a matter of when.

So, transitory inflation, then disinflation followed by deflation and another recession. The economy is still very weak and long yields are signaling slowing growth already. The reflation trade will be brief and I do not believe we’re going to get anything close to an economic boom. The current expansion looks more like a dead cat bounce.

Politicians panic at that point and introduce yet more massive stimulus and with debt spiraling and deflation taking hold, debt monetization becomes the only option to create inflation.

And that’s when we get real, sustained inflation… probably starting sometime next year.

So with my first statement in mind, good policy outcomes are a virtual impossibility and more bad policy almost a certainty and if bad policy is a certainty, the results must therefore be highly negative given our current debt position. How it unfolds is anyone’s guess but the broad outlines seem clear: The endgame is nearing.

I don’t know about the “next year” part. I think it is also an open question how severe any such inflation will be, given so many other variables. An economic slowdown could greatly diminish that particular threat. Recessions are by definition disinflationary/deflationary. But as I said, even “mild” inflation is a problem if it lasts long enough.

Other responses had different scenarios as far as how inflation and recession and monetization play out. Many of my readers are far more certain than I am as to the exact nature of future events. If nothing else, Powell is his own man. He resisted Trump’s call for lower interest rates and negative rates, up until the period of COVID when it was appropriate. The Fed is clearly data dependent. I believe that Powell can look at the data and change his mind, but right now markets want firm leadership and a clear path forward.

Powell is riding the tiger of extraordinarily easy monetary policy. It’s not riding the tiger that is the problem, it’s the dismount. That tiger can turn on you savagely.

It’s not like bull riding at the rodeo. There are no clowns to distract the tiger. You better have your exit planned perfectly.

Leadership Vacuum

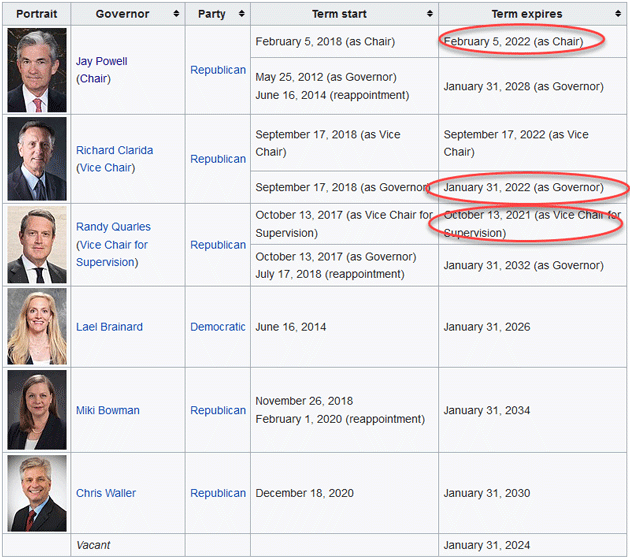

Powell’s term as Federal Reserve Board chair ends in February 2022. We don’t yet know if Biden will reappoint him. Ideally, this isn’t a partisan exercise. Powell is a Republican, originally named to the board by Obama (while Biden was VP), then elevated to chair by Trump. We shouldn’t assume Biden will replace him just for that reason, but he might have other reasons.

My friend Doug Kass has been pointing out the unusual situation of having a former Fed chair, Janet Yellen, in the political role of Treasury Secretary. She will of course be involved with Biden’s decision to reappoint Powell or pick someone else. She hasn’t disclosed her recommendation publicly.

If it’s not Powell, then what? The most likely candidate is Lael Brainard, who is currently the only Democrat on the board. But she would have to be confirmed by the closely divided Senate, which is not a sure thing. However, I doubt there would be that much of a fight over Powell or Brainard, although there would be some sharp questioning.

This could all get out of control, though. Here’s a handy scorecard to help you identify the players.

Source: Wikipedia

On February 5, Powell would stop being chair but still be on the board (the terms are separate) if he chose to stay, which I find doubtful. If a new chair isn’t approved by then, one of the two vice chairs would take charge in the interim… except there may not be one.

Vice Chair Richard Clarida’s term as governor expires on January 31, 2022, a few days before Powell’s chair term ends. So he will be gone unless he is reappointed and confirmed by then.

Vice Chair for Supervision Randy Quarles loses his vice chair title on October 13, 2021. His renomination is also uncertain, as is confirmation. Some Democratic senators regard him as too friendly to the banks and are actively lobbying to remove him.

Whatever the White House decides, it would help to do it soon. The Fed needs qualified, intelligent, known leadership. I realize some think Powell is trying to please Biden by keeping policy loose. But Powell is a wealthy man who doesn’t need this job or the headaches that go with it. As noted above, he seemed to have no trouble ignoring Trump’s demands. While I think he’s making big mistakes, he doesn’t strike me as someone who surrenders to political pressure.

Powell has at least acknowledged that at some point monetary policy needs to be normalized (whatever that means). The general consensus seems to be that Brainard would maintain easy policy for longer. Janet Yellen clearly leaned towards looser policy. Biden really needs to make a decision by October so the confirmation process can move forward, especially if he is going to appoint a new chair.

But all this uncertainty is the point. Business owners and investors need some idea of what the landscape will look like as they make the decisions that lead to economic growth. Making them fly blind isn’t helpful.

Borrower’s Paradise

These things matter because the breakdown, whenever it happens, will be as big as the bubbles it pops. They are huge and mostly trace back to monetary policy.

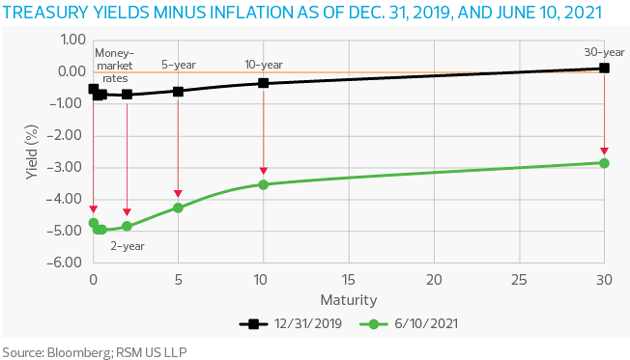

For instance, here’s a look at the “real” inflation-adjusted Treasury yield curve before (the black line, December 2019) the Fed’s assorted pandemic programs, and after (green line, June 2021). Note that subsequent CPI numbers make this chart slightly worse.

Source: RSM

Going into 2020, real rates were already negative out to 20 years and a little beyond, but just slightly so. Now, with nominal rates lower and inflation higher, short-term real rates are in the -5% area. Even 30-year T-bonds are almost -3%. Commercial lending rates aren’t quite as low, but in real terms are still zero or negative for top credit risks.

This situation is why we are in what my friend Mark Grant calls the “Borrower’s Paradise.” The Fed is incentivizing everyone to leverage up and everyone (especially corporations) is responding. The problem is some percentage of these borrowers are in good condition now, but won’t be when something goes wrong. Then what? Remember, when borrowers can’t repay it’s bad for the lenders, too.

Of course, real rates change. If inflation drops or nominal rates rise, real rates become less negative and eventually positive (a situation we used to call “normal”). But there is no reason to expect either of those in the near future. The Fed seems fine with 5% CPI inflation for an extended period and hasn’t indicated any rate hikes are coming soon. Current conditions could persist for a while, and the side effects will keep growing.

(I will note, however, that this kind of yield curve is exactly what the Fed would want if its real goal were to subsidize federal deficits and give Treasury time to refinance existing debt at lower rates. We don’t know if that’s their intent but this is what it would look like.)

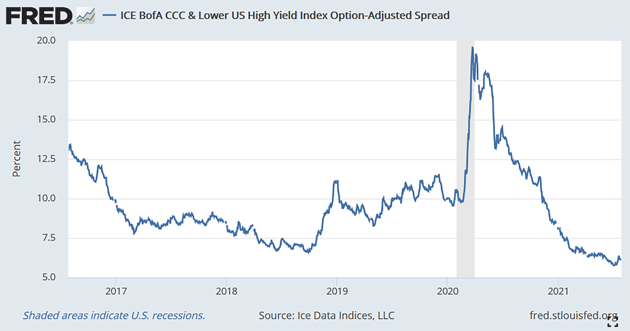

This “Borrower’s Paradise” extends to businesses as well, and not just blue chips. Here is the BofA “High Yield Spread” for the lowest-rated junk bonds. The spread is the amount by which these bonds yield more than Treasury debt of the same maturity. You can think of it as a measure of excess risk. How much riskier than Uncle Sam are these low-rated companies?

Source: FRED

Ahead of COVID-19, the answer was about 10 percentage points. It shot much higher, then gradually slid back and is now more like 6 percentage points. The riskiest companies can now borrow for about 400 basis points less than they could before the Fed launched all this craziness.

Are they really that much more creditworthy? Are their business prospects that much better? Doubtful. This is a serious twisting of incentives and it’s funding some companies that won’t make it, with great pain for all involved.

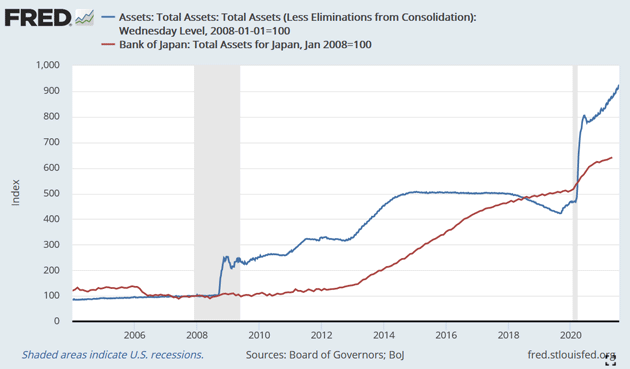

Finally, here is a variation of the Fed balance sheet graph I showed you last week. This time I’ve added the Bank of Japan’s assets. I spent years, and even wrote a book, saying Japan was a bug in search of a windshield because the BOJ was buying everything in sight. The Fed was, too, but not as much relative to GDP.

Source: FRED

In 2008 and following the Fed expanded its balance sheet well above the BOJ. The gap later shrank a bit, to the point that in 2018 BOJ assets exceeded Federal Reserve assets. In 2020 both central banks went on a buying spree but the Fed’s was much bigger—and faster. All of which should call to mind The Vapors Turning Japanese tune. It’s happening.

All these distortions and many more are going to be corrected at some point. Equity premiums and valuations are at extremes. The Fed seems to think it can engineer a gentle landing. Count me dubious.

The People Want a King

In a round-robin email conversation with friends about the Fed, David Bahnsen quipped that “the people wanted a king,” referring to the Old Testament Israelites in Samuel’s time who wanted a king. Samuel warned of all the problems a king would bring, but they wanted one anyway.

It seems the people want a king in the guise of the Federal Reserve. Well, not the people, but banks and the markets and the elites. They assume our wise philosopher-kings can sit around the table and decide the price of the world’s most important financial instrument—US dollar interest rates—better than the collective wisdom of the hoi polloi.

I am neither a prophet nor the son of a prophet, and frankly, it doesn’t really take a prophet to point out all the negative unintended consequences of well-intentioned attempts to manage the world’s largest economy. They really do think the wisdom in that boardroom where the FOMC meets is superior to the market. They have accepted the third mandate of keeping stock and real estate prices moving ever upward.

As Samuel warned, a king “will take the best of your fields and vineyards and olive orchards and give them to his courtiers.” Federal Reserve policy is significantly contributing to wealth disparity. The courtiers have done well indeed with their king. It is no wonder they aren’t grumbling.

The following analogy is not explicit, but it does have a rhyme. Fed Chairman Arthur Burns ignored warnings of inflation when he became chairman of the Fed in 1970 (appointed by Nixon), inheriting his position from William McChesney Martin. The brilliant Stephen Roach does an excellent job of explaining how Burns ignored the warnings of inflation (loose translation). He basically assumed that each of the various components of inflation were transitory, yet by the time he left office, inflation was already in double-digit territory.

Jerome Powell is making that same bet. I will be the first to say that the conditions causing the inflation we see today, 5.4% inflation as of two weeks ago and 6.2% for the last four months, are different. (PCE inflation, which the Fed uses, is up 4% year over year.) Burns interpreted both rising energy prices (OPEC) and rising food prices as due to an El Niño, rising fertilizer prices, etc. Then he ignored everything else, including rising housing prices. All of this, built on his personally created models, was transitory. (Roach pointed out that staff was arguing vigorously against it.)

Powell does have a point in that much of the inflation we see today is due to COVID-caused supply shocks. Since COVID is “transitory,” the cause of the inflation was transitory. Except that wages are sticky, house prices continue to rise as they buy $40 billion a month of mortgage-backed securities keeping mortgage rates low, semiconductor experts expect a shortfall for at least two more years, and I could go on and on.

With rates at zero and QE at an extraordinarily aggressive pace, they are doing the opposite of leaning into the inflation pulse that is quickening in the United States. And they are literally showing no concern, at least not in a policy change between now and the end of the year. They are talking about it while still adding fuel to the fire.

Perhaps Powell is right. Perhaps inflation will be transitory. But the longer they maintain this massively easy monetary policy, it will lengthen the time that uncomfortably high inflation is “transitory.”

I think Fed officials believe the economy is still very fragile, and that if they began to even modestly normalize monetary policy, it runs the risk of pushing the economy into a more fragile condition. The stimulus money is going to run out soon. Eviction notices will start coming out in August and September (unless the moratorium is somehow extended, but then how does that help a severely impacted real estate industry?).

Until we know how the economy is going to react to those events, changing policy today is very risky, at least in their eyes. Slowly, one regional Fed president after another is beginning to give speeches acknowledging the problem.

I readily acknowledge that the potential for market volatility when the Fed starts leaning into inflation and/or decides to normalize policy is quite high. That is the corner they have painted not just themselves into, but all of us with them.

Washington, DC, Maine, Colorado, and Family

As I’ve mentioned the last few weeks, I fly to Washington, DC, on August 10, then on to Grand Lake Streams, Maine, for the annual economic fishing trip, then to Steamboat, Colorado, for a private speaking event.

My son Trey and his girlfriend are here in Puerto Rico with us this week. Overlapping by one day will be Tiffani and her daughter Lively and the boyfriend. After they leave, Amanda and husband Allen will show up for the weekend. I am happy to have them near me once again, and may even take a little downtime to be with them.

I’m going to hit the send button as the letter is overly long. Don’t forget to follow me on Twitter. You have a great week and I hope you can have some time with family and friends. And please note that even though I do sound a little bearish in today’s letter, I really am quite the optimist that the world is going to turn out much better. We are going to have so much fun in the 2030s!

Your hoping I’m wrong about the Fed analyst,

John Mauldin