by Sven Carlin

We can’t time recessions, but we can look at fundamentals, dividends, risks, common sense, and our financial goals. It is enough.

The goal when it comes to investing is to maximise long-term returns. By speculating you might get lucky here and there, but you cut yourself short for the long term.

The S&P 500 index will return between 0 and 4% per year over the next 15 years. By using the CAPE ratio, you can do much better.

Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.

– Peter Lynch

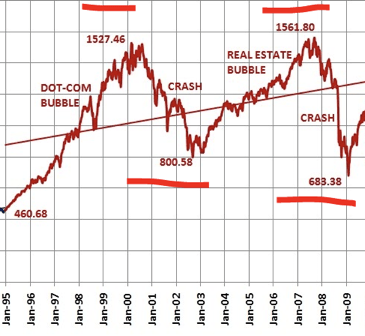

There is so much talk about the next, imminent, economic recession, and people are justifiably very concerned. The last two times there was a recession, stocks (SPY) fell 50%.

For those that prefer watching, here is the video; article continues below.

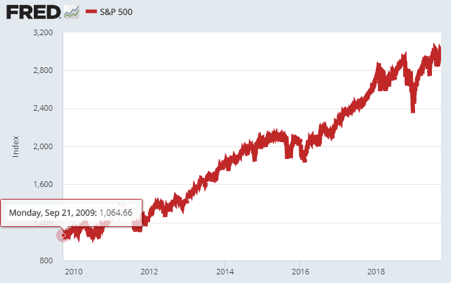

I don’t think anybody would like to see their holdings drop 50%, so it is natural to be scared. The easy thing to do would be to sell everything, but you can’t do that because, since the bottom of the last crash, the S&P 500 is up 4 times. Those who sold in 2010 (aftermath of Great recession), 2013 (European crisis), 2015 (commodity crisis, China slowing down), or 2018 (trade wars, etc.) have missed on huge gains.

Source: Fred S&P 500

Investing is and will always be about balancing the fear of losing and the fear of missing out. So, what is the best strategy? I think the best strategy is one that maximizes long-term investing returns. Timing the market is something that is based on luck, not statistical maximization of returns.

Peter Lynch, famous for making 28% per year over 13 years at Magellan, was always invested 100% in order to have one less thing to think about. Over the years, he managed his fund, the S&P 500 fell more than 10% a dozen times, and each time that happened, Lynch’s fund fell more. So, he wasn’t worried about protecting himself from a decline, he worried about owning great businesses. When investing for the long term, we have to apply a strategy that will bring to the largest rewards despite recessions and crashes, those are inevitable.

What is a strategy that maximizes investment returns over the long term, over your life-time?

Such a strategy comprises the following:

- It is time in the market, not timing the market.

- Taking advantage of dividends, business improvements, takeovers, and individual stock volatility over time is what puts you ahead.

- Focus on earnings over the long term and stay true to fundamentals. Peter Lynch understood that well as historically those are the factors that led to great returns.

- Asset ownership gives you protection against inflation (given the Fed’s and ECB’s loose monetary policies).

- Always analyze every investment opportunity from a personal perspective; how is this investment XYZ going to get me to my financial goals?

It is time in the market, not timing the market

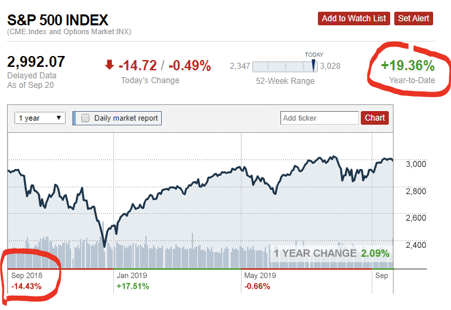

If you invest for the long term, trying to time the market is extremely costly. Just think of December 2018, the news was all bad; trade wars, recession, China slowing down, etc. Many sold during the December 2018 dip and they regret it now.

A similar situation was in 2015, oil prices were falling on the expectation that the Chinese economy will slow down and that global growth will slow too. Many sold in January 2016 and they surely regret it as the S&P 500 index is up 50% since.

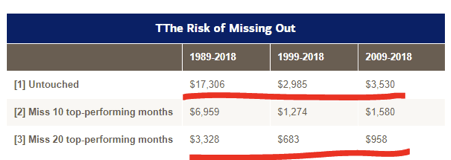

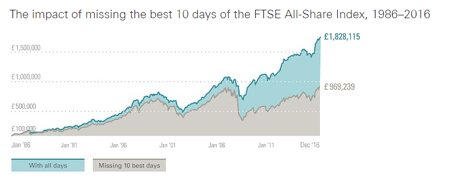

So, selling is not smart if the decision is not based on fundamentals or on your life goals which we will discuss in the following points. Let’s first show how timing the market pans out numerically. Merrill has calculated how much have investors lost by missing out on the top performing months, and those top performing days are usually when or just after most people have sold (think November 2008 or April 2009). The differences are staggering, an investor investing $1,000 in 1989 would have ended up with $17,000 if held through time, by missing the best 20 months, the portfolio would fall to $3,328. Investors missing the best months since 2009 have actually lost money.

The same principle applies to other indexes.

Source: Vanguard

Over the long term, it is smart to hold onto your investments, but that is just one pillar of successful long-term investing and being prepared for a crash. The second pillar actually involves timing, but the positive kind of timing the market; time in the market.

Taking advantage of dividends, takeovers, individual stock volatility over time

Nobody knows when the stock market will crash nor when the next recession will come. There are many ‘broken clocks’ that have made big businesses around such predictions, but it is impossible to predict. What is possible to predict are dividends, takeovers, and individual stock volatility.

Dividends

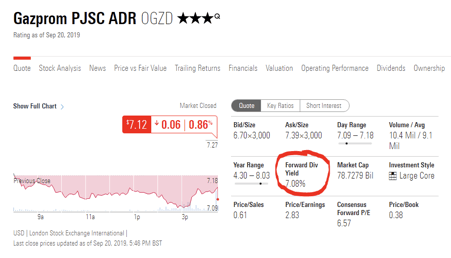

When it comes to good businesses, dividends are fairly predictable. Those will perhaps not grow in tough times, but will often be there. For example, one of my holdings is Gazprom that currently offers a dividend yield of 7.08%.

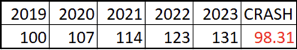

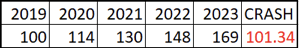

Now, let’s say that in three years, there is a crash of 25%. It would hurt, but how much would it hurt me? (example – start with a general 100 investment).

If a crash of 25% comes in 2023, I would break-even, a risk I am willing to take as it would allow me to reinvest the dividends at lower prices and thus increase my long-term returns. However, dividends are not all.

Business improvements

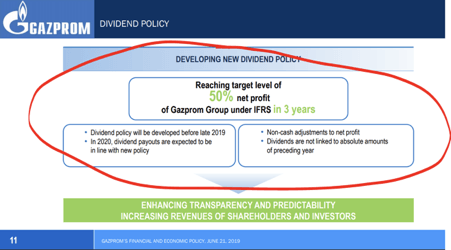

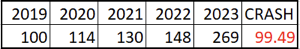

Sticking to Gazprom, the company has announced that it plans to payout 50% of net income in dividends. If that happens, my dividend yield will be 14% on the current price as they are paying-out only 25% of net income now.

In case of a 14% dividend, I would need a 40% crash to break-even in 2023.

But, if they double the dividend, which I consider a business improvement, the stock would probably double too. So, I would need a 73% crash to break even.

I think that it is better to focus on owning good businesses than to focus on a crash. In life, you get what you focus on, right?

Takeovers

Furthermore, in business, there are constant acquisitions that happen, so often see your stock as a takeover target, it spikes 30% to 50% on announcement and you get cash when the company is taken over. If you wait for a crash, without owning businesses, a takeover will not happen for sure. But stocks are volatile despite takeovers.

Individual stock volatility

Many ponder on whether there will be a crash or not but forget that each individual stock will probably see a drop of 30% and a spike of 50% over any period of 12 months. Such normal volatility allows you to buy quality businesses on the cheap and rebalance when those become overvalued. If a stock goes up 50% in 9 months, you don’t have to care much about crashes. An example that you don’t have to own penny stocks to see such moves is Apple (AAPL).

From the bottom in January of 2019 of $142, the stock spiked to $233 in September of 2019. That is 64%. That is also my focus in life, not crashes. This point is an excellent intro into the next pillar of my stock market crash strategy, fundamentals.

Stay true to fundamentals

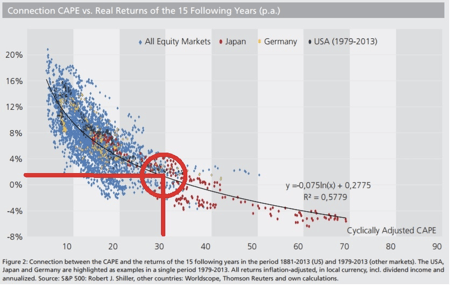

It is pretty simple; your long-term investing returns will be perfectly correlated with the underlying performance of the businesses you own. Business performance depends on cycles and, therefore, a good measure is the CAPE ratio (cyclically adjusted price to earnings ratio) that takes into account average 10-year earnings, not just the latest earnings. History shows, the higher the CAPE, the lower the return.

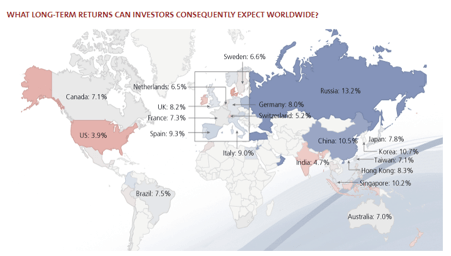

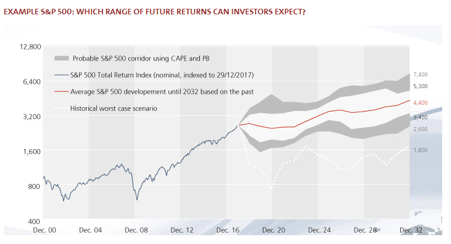

The current CAPE ratio of the S&P 500 is 30, and therefore, you should expect 15-year returns to be between 0% and 4% per year.

Source: Starcapital

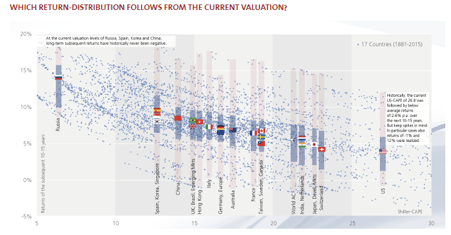

What you can do is to diversify and buy those businesses or sectors with lower CAPE ratios. Historically, you should expose yourself to higher returns and thus lower risk, another reason not to worry about crashes. The lowest global CAPE ratio is in Russia.

Source: Starcapital

Consequently, returns should be in double digits. China also is not that bad.

Source: Starcapital

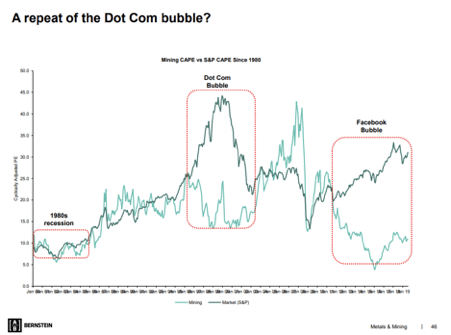

I am long some Russian stocks but also some commodity mining stocks as their CAPE ratios are low and around 10.

Source: S.I.A.

By buying strong fundamentals, you lower your investing risks and increase your long-term returns. When investing in businesses, you have nothing to worry about crashes. Businesses usually survive, adapt, and grow stronger.

The next crash might be different

Now, I know that by saying things might be different this time I will sound crazy, but don’t dismiss it as a possibility. The next crash might be different compared to the previous two crashes. In September of 2019, there was a liquidity crunch on the US overnight repo market, the Fed immediately intervened by pushing $75 billion into the system and continued to add during the week. This is a clear signal that central banks and politicians will do whatever it takes to prevent a crash or a recession. We live in a financially engineered world, so monetary policy and asset prices go hand in hand.

Therefore, this time, stocks might continue to go up like those did over the last 10 years, but due to inflation, you might not be happy about it. By printing money and lowering interest rates, financial institutions continue to pump up asset prices. With interest rates close to zero, stock valuations can go to infinity.

I think that probabilistically, there is the same chance for a 30% spike in the stock market as there is for a 30% drop over the next few years. Another reason to focus on businesses and not on crashes.

At the end, it is about you

The key to remember when it comes to investing is that it is not your banker’s money, not your neighbour’s money, it is your money. You have to see what kind of situations you can handle from a personal financial perspective. A person with $1 million in the S&P 500 and about to retire in 2 years is in a different situation than someone who just started contributing to one’s 401k. You have to think in scenarios and see how would possible scenarios impact your life.

Over the next 15 years, the S&P 500 will probably be in a range between 3,400 points and 7,400 points. In the next 2 years, it can be in a range between 1,800 points and 5,000 points with a maximal historical decline being 1,000 points, but that is one time in a century situation.

You have to see how you can handle such scenarios happening to your finances which include your mortgage, children’s college tuition, etc. Put your finances into your life’s perspective, your banker can’t do that and is not incentivized to do that.

Don’t worry about stock market crashes or recessions – worry about businesses and your life

I hope I have given you a rational approach to investing and have put things into a perspective that matters for your life-long investing journey. If you wish to have my input over than journey, see the investment I make based on the above concepts, check what I do on my Stock Market Research Platform, it is a good way to diversify away from bubbly assets like the current over-hyped indexes.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Consult your financial professional before making any investment decision.