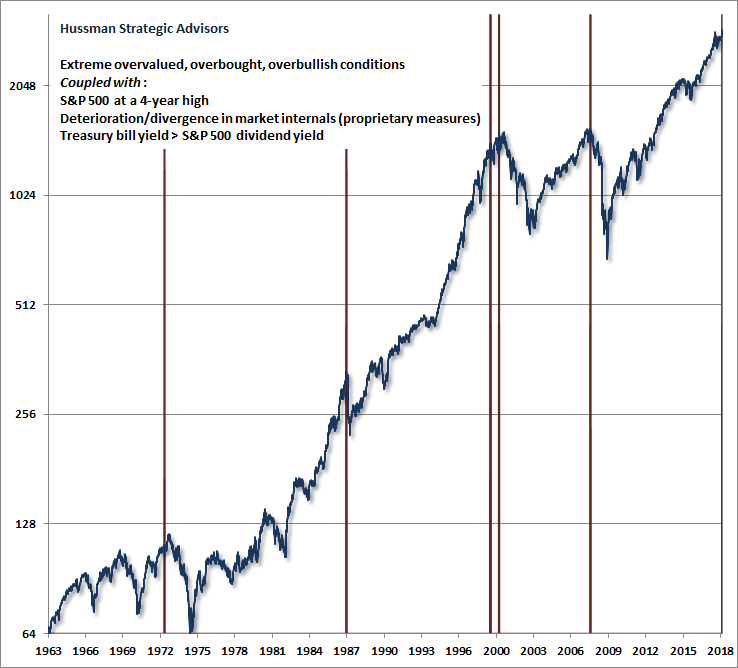

This is the largest systemic fraud of the century – dwarfing the mortgage crisis – the @federalreserve has deliberately induced it aswell as done nothing about it

thanks to @OccupyWisdom and @LanceRoberts for focusing on it!!! pic.twitter.com/7dJXcNxiVk

— mcm-ct.com (@mcm_ct) September 4, 2018

Everyone’s so euphoric rn. pic.twitter.com/SM8jRwneQo

— Señor Fudd (@Dyor_Fudd) September 4, 2018

ALEXA, WHAT IS A BLOW OFF TOP? pic.twitter.com/P6VcsFmkEC

— OW (@OccupyWisdom) September 4, 2018

FUNDAMENTALLY SPEAKING: With the markets closed yesterday we take a look at Q2-Earnings. While the tax-cut surge is evident, the question of sustainability of growth arises. $SPY https://t.co/Cdtc9KfEVq pic.twitter.com/u7cVVnZVYo

— Lance Roberts (@LanceRoberts) September 4, 2018

I sincerely believe that @hussmanjp will be exonerated. This profit-margin corrected CAPE includes provisions for overvaluation AND elevated (but normally mean-regressing) profit margins. A regression to and through the mean will be a widowmaker. It will not be just a correction. pic.twitter.com/FgNiRO79sK

— Dave Collum (@DavidBCollum) September 5, 2018

Hussman: “Few Possibilities Involve a Smaller Stock Market Loss Than 66%”

“I am aware of no plausible conditions under which current extremes are likely to work out well for investors. From current valuations, we expect that the total return from passive investment strategies will average less than 1% annually over the coming 12 years.”

Markets are 'greedy' in 2018 🙈🙉🙊 when they should be like Steve Carell's character in 'TheBigShort'= skeptical🤨 pic.twitter.com/osIuCU7vup

— M/I_Investments (@MI_Investments) August 8, 2018

@neelkashkari Connect the dots in the picture to attain enlightenment

chart: @SiliconValleyBank pic.twitter.com/WPyJ3r0LYg

— M/I_Investments (@MI_Investments) September 5, 2018

Global #QE is fast-fading, but its the non-US Central Banks that are reversing QE by most! Are we all looking at the US #Fed too much? pic.twitter.com/QWfs9F2JTV #CentralBanks

— CrossBorder Capital (@crossbordercap) September 5, 2018