by Daniel Carter

The yield curve is collapsing once again, and that has many investors talking about what it means for the US economy. Overwhelmingly, the sentiment is that a flattening yield curve is bad for the economy, and an inverted yield curve spells imminent danger for the stock market. Is this true? Sort of but, at this point, the truth is much murkier than the financial pundits would have you believe.

As you can see from the chart below, the yield curve usually flattens (falls) significantly before a recession. But that doesn’t mean a falling yield curve is bad for the economy. During an economic expansion, the yield curve spends most of its time flattening.

fred.stlouisfed.org/graph/fredgraph.png?g=lFt2

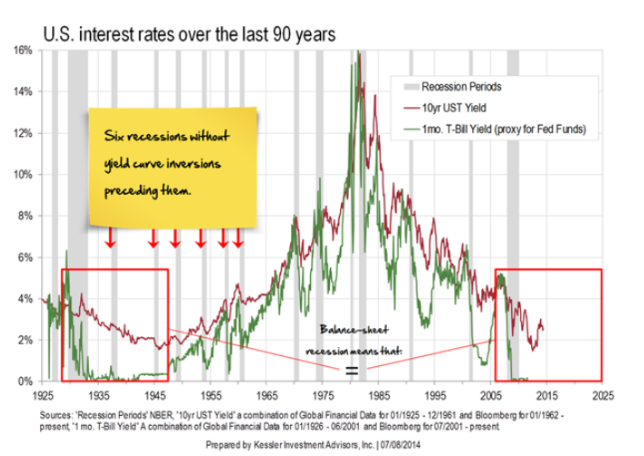

But what about the possibility of an inversion (a dip below zero) of the yield curve? An inversion is a bit more serious, but it still may not mean imminent danger for the stock market. The yield curve inverted in mid-1978, but the recession didn’t kick in until early 1980. The yield curve inverted again in September of 1980, but the recession didn’t kick in until mid-1981. The yield curve inverted in early 1989, but the recession arrived in mid-1990. The yield curve inverted in early 2000, but the recession didn’t arrive until March of 2001. And, finally, the yield curve inverted in early 2006, but the recession didn’t start until the end of 2007.

Point being, an inverted yield curve doesn’t really mean that a stock market crash will start immediately. And the yield curve still hasn’t inverted during this economic cycle. However, stock prices will usually peak about six months to a year before a recession.

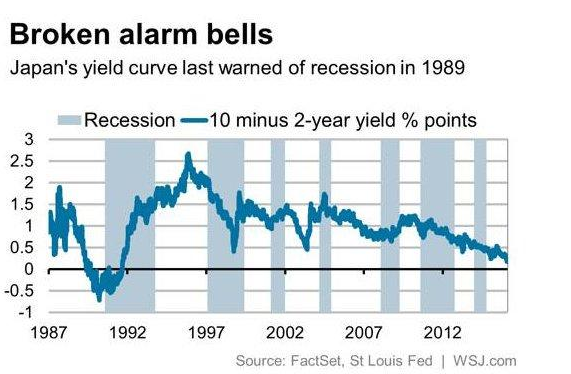

Maybe the yield curve has lost its predictive power altogether. This is something I almost never hear investors discuss. The Japanese yield curve last signaled a recession in 1989. Their yield curve lost its predictive power because the Bank of Japan suppressed short-term rates so much that they could never rise enough to cause an inversion. In the modern era, the Fed has also suppressed short-term rates significantly.

The US yield curve lose its predictive power after the Great Depression because short-term rates were suppressed. Today’s interest rate environment seems awfully similar.

So, it may be best to ignore the misinterpretations in the financial media about the yield curve. That’s not to say that you should ignore this metric completely. There still may be important information to be derived. Just know that the way people are talking about the yield curve doesn’t make much sense. A recession is near, but you won’t be able to time it successfully by listening to the standard interpretations of the yield curve.